One of the top analysts at Morgan Stanley is ringing the caution bell on the market.

Specifically, Morgan Stanley's Mike Wilson said the third quarter is "going to be choppy." And there is good reason for investors to brace for the next few months.

There's the upcoming presidential election... uncertainty from the Federal Reserve about when it will cut interest rates... and another round of corporate earnings, where margins will be a focus.

Wilson has become cautious on the market. Here's what he said in an interview with Bloomberg Television:

I think the chance of a 10% correction is highly likely sometime between now and the election… Your likelihood of upside from now until year end is very low, much lower than normal.

Wilson puts the odds of stocks finishing the year higher than today at only about 20% to 25%.

This is by far not a consensus view on the market...

When you look at the derivatives market, you can get a sense of how investors are positioning themselves and what they expect stocks to do. Right now, very few traders are betting on a correction.

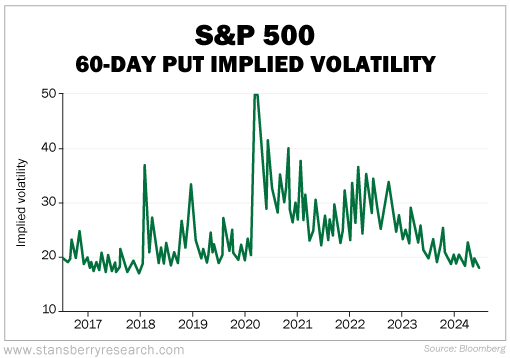

The chart below looks at the 60-day put implied volatility for the S&P 500 Index. Without diving too much into option jargon and boring anyone, this basically tells us not many people are interested in paying for put protection from a 10% correction over the next 60 days.

In fact, this is the lowest level since early 2018. Take a look...

Doc Eifrig has talked before about how markets tend to do what hurts the majority of investors the most.

When everyone is all in on the market, it typically drops... as there aren't many new buyers left to prop up prices. And when everyone has given up on stocks, they rip higher... Think back to March 2020.

Today, there aren't many who are thinking about a correction. There's Mike Wilson from Morgan Stanley. But now, Doc and I (Jeff Havenstein) are becoming more concerned about a correction as well.

Of course, if you're a long-time reader of Health & Wealth Bulletin, you'll know corrections are nothing to be afraid of. They are just part of the game.

In fact, corrections are healthy in long bull runs. During the bull market from 2009 to 2020, there were six 10% to 20% market corrections. Every time, it was just another buying opportunity.

My advice for you today is to prepare for more volatility. Complacency is at a high today, and I don't see it lasting much longer.

To take advantage, my suggestion is to turn to the options market and try out option selling. You see, option sellers make a ton of profit when folks are afraid and more willing to pay for options protection.

But in general, make sure you're not getting sucked into the hype of the market continuously hitting new all-time highs. Don't extend yourself too much.

Now is not the time to get greedy. Volatility is coming... So be sure to follow Doc's advice for position sizing and asset allocation.

What We're Reading...

- Something different: Boeing's future CEO has same mess, different day.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

July 10, 2024