$5 billion...

That's how much retail investors lost from November 2019 to June 2021 by trading options.

That tally is staggering considering that the broader market was up 40% over that time frame... And that includes the 34% COVID-induced decline in the first quarter of 2020.

While the numbers are staggering, they are not surprising... at least to me.

Options get a bad reputation for good reason. If you don't know what you are doing when you trade options, you can lose money fast. It's an expensive education.

A new study, "Retail Trading in Options and the Rise of the Big Three Wholesalers," proves it. From a recent Bloomberg article, "Mom and Pop Investors Took a Billion-Dollar Bath Trading Options During the Pandemic"...

Spurred by Reddit posts and urged on by Twitter and TikTok influencers, daily volume in bullish contracts set record after record as stuck-at-home tinkerers flocked to the contracts in an effort to juice up returns.

Researchers Svetlana Bryzgalova, Anna Pavlova and Taisiya Sikorskaya estimated that retail investors lost $1.14 billion trading options from November 2019 to June 2021, assuming a 10-day holding period. Trading costs ate up an additional $4.13 billion. To measure the performance of nonprofessional traders, the authors tracked options orders coded as originating with retail brokerages and sent to high-volume market makers known as wholesalers.

During the pandemic, with everyone bored at home, many investors turned into options traders overnight. They wanted to gamble, and they wanted fast gains... Options provide that.

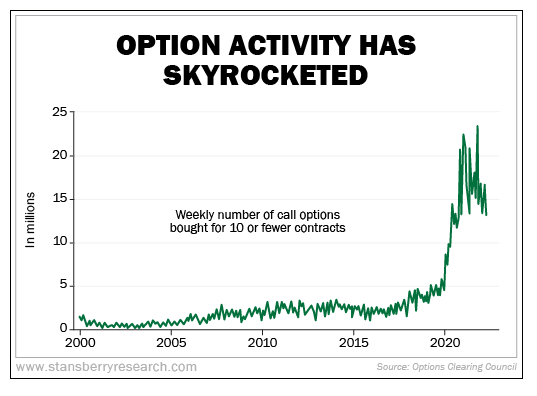

The chart below looks at the number of call options (a bullish bet) that were bought for 10 contracts or fewer.

We know these folks were mom-and-pop investors because it's rare you'll see a big bank or hedge fund trade in such low amounts. These massive institutions trade hundreds of contracts per trade. When you see 10 or fewer contracts, it's usually by an individual investor hoping to score big.

In an era of zero-commission trading, options activity has skyrocketed...

The reason many of these bullish bets didn't pay off was because they were far too speculative.

You see, if you buy a call option and the underlying stock shoots up in a short period of time, it's easy to double or triple your money. The more you bet the stock will go up, the more your potential return will be.

For this reason, greed blinds a lot of new traders. They get sucked into the lure of life-changing gains... All without realizing these are ultra-low probability bets.

Here's more from Bloomberg giving an example of how foolish some of these new option traders were...

But at the peak of the frenzy in 2021, small-time traders were buying more than 23 million call options a week, according to Options Clearing Council data compiled by Jason Goepfert at Sundial Capital Research. That's way above any other period going back to 2000. Sundial defines small-time as a trader who buy or sells 10 or fewer contracts at a time.

The derring-do of newcomers was frequently called out by Wall Street. One tactic in particular – buying out-of-the-money calls days or hours before they were likely to expire – was pilloried as a newbie gambler's mistake. In one celebrated instance, more than 50,000 contracts effectively betting that GameStop would surge sevenfold changed hands on Feb. 25, 2021. The option expired the next day.

Think about that for a second... There was real money being bet that GameStop (GME) would move up 600% in just one day.

Absolutely absurd.

As I've said many times before, options are only dangerous if you want them to be. The way my team and I use options is ultra-safe... In fact, you'll have less risk than a normal buy-and-hold investor.

That's why my options selling portfolio has held up much better during this market correction than many all-stock portfolios. (You can learn more about my strategy here.)

The way I use options is for income.

But they can also be used as a form of insurance – returning you big gains if markets do fall.

Last Wednesday, I talked about how my colleagues Greg Diamond and Jeff Havenstein wrote about two specific options strategies to profit from a falling market.

Greg uses the first strategy in his Ten Stock Trader newsletter. And today, Greg is warning about an "aftershock" that's coming on May 25.

If you read Greg's work in Stansberry's Financial Survival Program, you'll know Greg thinks there are four phases to a bear market... the initial decline, the relief rally, panic, and finally, the bottom.

According to Greg, we are in the panic phase. And that means stocks can still fall from here.

To learn more about Greg's specific prediction, click here.

What We're Reading...

- Something different: U.S. FDA authorizes Pfizer's COVID booster shot for young children.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

May 18, 2022