Two of the best investors in recorded history agree on one thing...

You can make a lot of money by going small.

I've talked about Peter Lynch and Warren Buffett many times before. While Lynch may be less known than Buffett, he was a rock star in the mutual-fund world. His Magellan Fund posted average annual returns of 29% between 1976 and 1991.

Both investors have given timeless pieces of investing advice that my team and I adhere to.

One thing both giants wished they could have done is to remain small enough to invest in smaller companies.

That's how Lynch earned much of his returns throughout the years before the mainstream finally caught on. As he puts it, "Big companies have small moves; small companies have big moves."

Here's Lynch from his book, Learn to Earn...

Over time, it's been more profitable to invest in small companies than in large companies. The successful small companies of today will become the Wal-Marts, Home Depots, and Microsofts of tomorrow. It's no wonder then that funds that invest in small companies (the so-called small caps) have beaten out the "large cap" funds by a substantial margin.

After Lynch's Magellan Fund grew considerably, he had to somewhat turn away from smaller-cap companies – valued at a few billion dollars or less – because of liquidity issues. Making a big investment in a small company will push up its stock price.

Buffett had the same problem.

He has stated on multiple occasions that managing large sums of money can be a performance disadvantage... Even if an investment in a small company goes well, it won't meaningfully improve a massive portfolio's overall performance.

Today, given Berkshire's size, Buffett keeps his eyes on giants like Apple (AAPL) and Visa (V) – two stocks that the whole world is glued on.

In 1999, he famously said that if he were managing only a million dollars instead of billions, he could guarantee a 50% return annually. And that's because there are simply more stocks to choose from that don't get much analyst attention. There's also less worry about broader market impact when investing.

Then again, a 50% return on $1 million is $500,000. Buffett can't waste his time on $500,000...

But you can.

And the data proves that smaller companies will produce better returns than larger ones over time.

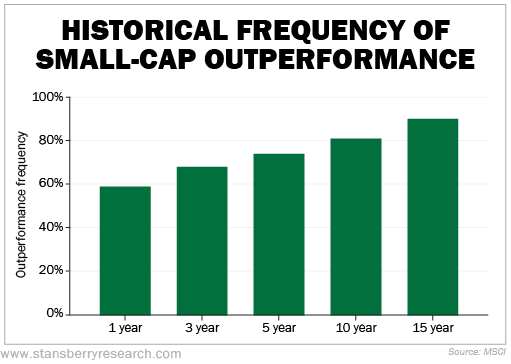

The chart below looks at the number of times when small-cap stocks (represented by the MSCI World Small Cap Index) outperformed large-cap stocks (represented by the MSCI World Index) in a rolling-window analysis from 1975 to June 2023.

Over a one-year period, it's usually a toss-up, with small caps having a slight edge. And that makes sense... The typical knock on small-cap stocks is that while they do provide higher returns, their volatility makes them scary investments.

But that's only true if you have the wrong time frame.

As you move your investment horizon out, you can become more certain about how they will perform. When you look over a 15-year time period, for example, small caps outperform 90% of the time...

Economists Eugene Fama and Kenneth French also provide a quality data set to show this. They have proved that since 1927, U.S. small caps have outperformed large caps by roughly two percentage points on an annualized basis.

For a long-term buy-and-hold investor, small caps make sense.

Today, I see a tremendous opportunity in small-cap stocks.

No one is paying attention to them... all eyes are glued to Nvidia (NVDA) and other mega caps... As a result, small caps trade for incredible value.

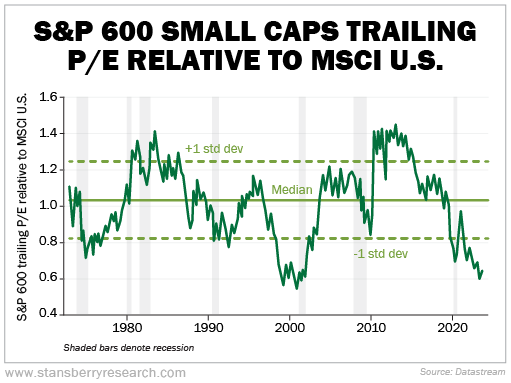

U.S. small-cap stocks are trading at their widest discount to the overall market since coming out of the tech bubble back in 2000. Take a look at the S&P 600 Index – a collection of 602 U.S. companies with market caps between $350 million and roughly $6 billion – and the MSCI USA Index, which tracks stocks with an average market cap of about $60 billion...

Today, small-cap stocks trade for just 1 times sales while the S&P 500 trades for 2.9 times sales.

The truth is that small-cap stocks have been forgotten about. They haven't been this hated in decades... And that means every investor needs to get some exposure today.

While you could just buy a small-cap ETF, the biggest gains come from handpicking the most promising small-cap names.

Fortunately, my colleague Marc Chaikin is using his decades of experience on Wall Street to help subscribers profit from small-cap names. If you haven't seen Marc's latest presentation on why you need to own small-cap stocks today, I suggest you do so.

Today is the last day his presentation will be online. Be sure to check it out here.

What We're Reading...

- Small caps have been a big story after recessions.

- Something different: Tesla shares rise on better-than-expected second-quarter deliveries report.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

July 3, 2024