It's a simple question... and it has a simple answer...

What sort of return do you need from your portfolio to earn to pay your bills or enjoy your retirement? $2,000 per month? $4,000? $8,000?

That's the focus of nearly every investor. No matter whether you're interested in spending wealth in your retirement, or building wealth for future use... Investors focus on returns above all else.

Most people think that to generate eye-popping returns, you have to pump lots of money into small, "risky" stocks. Isn't that what we're always taught... that risk equals reward? The more risk you take, the greater your potential returns?

It's true that owning volatile stocks can result in big gains (as well as big losses, if you're not careful).

The problem is, most individual investors don't understand risk at all...

This year, we've seen volatility spiking in stocks. Many folks equate volatility with risk. But the secret to generating big returns lies in managing risk and harnessing volatility.

So today, I want to talk about some ways to clarify your understanding of risk today.

Rather than develop a complex, but flawed, analysis of risk... it's more helpful for an investor to think of "risk" in a simpler form: How much could I possibly lose?

So first... what is risk? It's impossible for most people to quantify all the potential challenges that could cause a stock to fall – new competition, regulatory changes, and macroeconomic trends, to name a few.

It's more useful to simply think of risk as the money you could lose on any one investment.

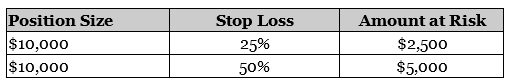

If you normally invest $10,000 on a position with a 25% stop loss, then your usual level of risk is $2,500 per position.

Longtime readers know I typically recommend using a 25% stop for an exit strategy. (Recall that a stop loss is a set price or percentage you use to know exactly when to sell an investment.)

But readers often wonder if there are times when you should use a different size stop loss.

Let's say you're interested in a stock that has the potential to make a big move in a short period of time. We want to buy that stock to capture the next big swing upward... That's what we'd call "harnessing the volatility."

Holding that stock with your typical 25% stop could force you out of the position before you capture those gains... Remember, because that stock is volatile the shares move around a lot. So instead, you want to hold it with a 50% stop.

But look at what that does to your risk...

With that $10,000 position, you're now risking $5,000. You've doubled your risk.

But there's a simple way to reduce that extra risk...

If you want to keep your risk level to $2,500, you would reduce your initial investment to $5,000. You could also go even smaller to have less risk in this kind of high-variance position.

We tend to recommend a wide 25%-35% stop for more volatile positions, like oil and gas stocks. This will allow for the cyclical swings in share price that the commodity industry is known for without kicking you out too early.

Similarly, we tend to recommend a narrow 15%-25% stop for less volatile positions, like well-established companies that dominate their industries. Companies like Johnson & Johnson (JNJ) and McDonald's (MCD) are so large and liquid that their share prices don't tend to move much.

As an investor, having an exit strategy is vital to your success.

If you stick to your exit strategy, it can serve as a near-foolproof way to methodically cut your losses and let your winners ride.

[optin_form id="73"]

What We're Reading...

- Something different: Why is everyone buying up America's least-liked candies?

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

April 11, 2018