Higher interest rates have effectively frozen the U.S. housing market...

Even after falling from a multidecade high of 8.5% back in October, the rate on a 30-year mortgage is still about 7.4% today.

That's making it nearly impossible for folks to buy a new home, especially considering housing prices are still sky-high...

In the months leading up to the pandemic, the average sales price for a home in the U.S. was $383,000. It climbed to as high as $553,000 in the fourth quarter of 2022 and has only come down slightly to about $513,000 today.

Right now, the housing market is stuck...

It's bad enough that folks are struggling to buy homes. Now, nobody wants to sell them, either.

As I (Joel Litman) will explain today, this setup is threatening to upend the U.S. housing market... and it's yet another warning for the coming recession.

Good luck buying a house...

Home prices are still elevated today. However, as we mentioned earlier, they are starting to come down.

That being said, folks who just bought their house within the past few years won't want to sell at a loss unless they absolutely have to.

And longtime homeowners are in no rush to sell their homes, either... Between the Great Recession in 2010 and early 2022, mortgage rates averaged less than 4%. That means there was more than a decade for folks to lock in a low mortgage rate.

Indeed, 69% of mortgaged U.S. homeowners have an interest rate less than 4% today. On the flip side, only 2.5% are paying the current mortgage rate or higher.

So not only are folks hesitant to buy homes... those who locked in cheap mortgages aren't looking to sell.

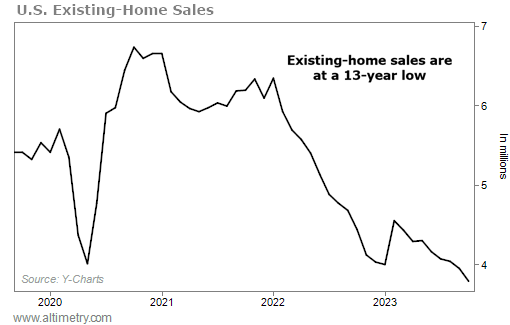

That's completely drying up the existing-home market...

In October, existing-home sales reached their lowest level since 2010.

They slowed to 3.79 million, which is down about 15% from the prior year.

Take a look...

It doesn't look like the situation in the housing market will turn around anytime soon, either... Pending home sales just dropped to a 20-year low.

The housing market is critical to the health of our economy. Studies have shown that affordable housing helps grow employment. And home equity is one of the most important assets a household has.

If people are unable to buy a home – and unwilling to sell their home – it actually hurts folks' ability to get or switch jobs... and to access one of their largest sources of capital.

Today, banks are far less willing to lend than they were early in the pandemic. So this is the worst possible time for people to not have housing liquidity.

Financially strapped consumers could speed along a recession...

A deteriorating real estate market will make consumers less financially secure.

And when consumers aren't secure, that means they are going to spend less...

This this could trigger a "consumer feedback loop." Folks spend less money, which hurts businesses, which then causes unemployment to rise... And pretty soon, we're in a recession.

Regards,

Joel Litman

Editor's note: Joel famously called the financial meltdown in 2008 – months in advance. He recently went on camera to explain the extreme déjà vu he's feeling today... and share an untold story from the Great Recession that could decide if you see big potential gains (or suffer big losses) in the early days of 2024. If you missed it, click here for all the details.