Editor's note: What should you do when the stock market isn't growing?

There's a type of investment that pays you more income than bonds and is safer than stocks. We're sharing an issue we originally published in May that details how this investment pays you even when stocks aren't rising.

***

Investors are having trouble figuring out where the market is going...

It trades up a bit... then back down... only to repeat the process a few months later with fears of a new crisis: new worries about a global slowdown... when the Fed is going to raise interest rates... or what might happen with the presidential election.

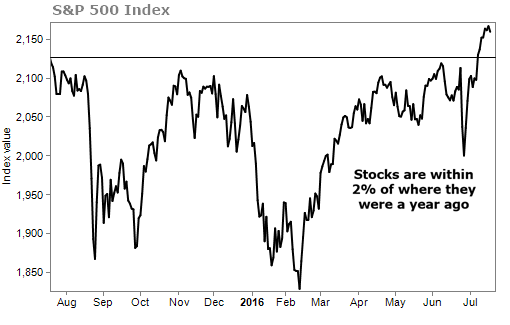

Take a look at this chart of the S&P 500 stock market index. Despite all the "sky is falling" headlines, the market is within 2% of where it was a year ago:

But there's a weird investment that lets you ignore this lack of stock market growth and still get paid... often double or even triple what you might get paid if you simply bought a stock.

Even better, you won't have to worry about that regular payment changing. And buying this investment gives your portfolio a margin of safety that stocks can never provide.

This hybrid investment is a preferred share, or "preferred."

Like a common stockholder, you are a partial owner of the business. But rather than hoping for increasing dividends, you receive an agreed-upon dividend rate with preferred shares that can be two or three times as high as a typical stock dividend.

You give up any price appreciation there may be in the stock, but you can earn a 5%-6% yield with a preferred... compared with 2%-3% for regular shares.

Now, if you were a bondholder, the company would pay you each interest payment or risk default. Preferreds don't have the same guarantee. A company can suspend its preferred dividends. This rarely happens... And the company is barred from paying any dividends on common stock until it meets its preferred dividend obligations.

As a rule of thumb: If you find a stock with a safe dividend, you can bet that the preferreds are even safer.

This arrangement is why preferreds are described as a cross between a stock and a bond.

The great thing is that even in worst-case scenarios, preferred shares are safe. They tend to hold their value... and quickly bounce back.

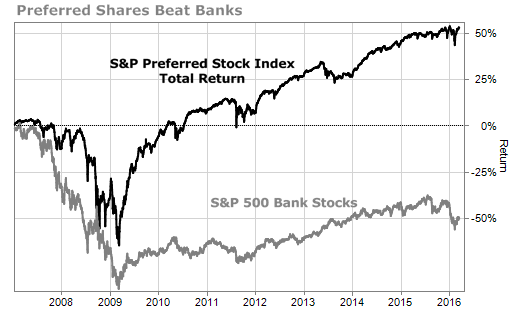

During the financial crisis, a diversified portfolio of preferreds did drop... but quickly regained its value. Thanks to the income, preferred shares rallied back, while bank stocks lagged far behind. (Most preferred shares are issued by banks and other financial companies.)

Over the long term, regular stocks generally beat preferred shares for total return. But if you're looking for safety and income, it's a fair trade to make.

If you need to generate income today... at yields that are higher than what a bond pays and still have a measure of safety... then preferreds are a great investment.

If you want to get started, there's one last thing to note... When you go to purchase a preferred share, they aren't always easy to find on your broker's platform. Each brokerage has a different format for the ticker. If you have trouble finding the one you want, call your broker and ask for the symbol – then place your order online (to avoid the fees of ordering over the phone).

This extra step might put some folks off... And that's a good thing. If people don't want to make the effort, fewer will buy preferreds and that keeps prices down.

Preferreds offer a higher interest rate, long-term security, and steady payouts.

If you are interested in adding preferreds to your portfolio, we've recently recommended several individual preferred shares in my newsletter Income Intelligence... plus an investment that gives a diversified portfolio of preferreds with one click... It's currently paying a yield of nearly 8%.

Learn how to access our three preferred-shares recommendations... our "one click" fund... and all of our issues, special reports, and income portfolio with more than a dozen open "buy" recommendations by clicking here.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Retirement Millionaire Daily Research Team

August 3, 2016