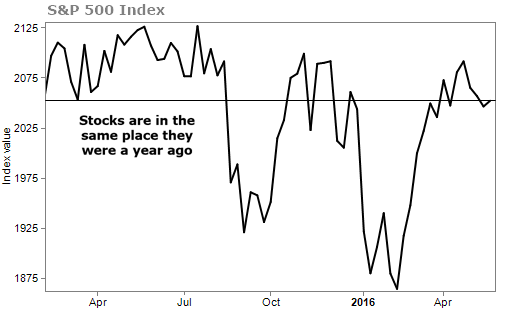

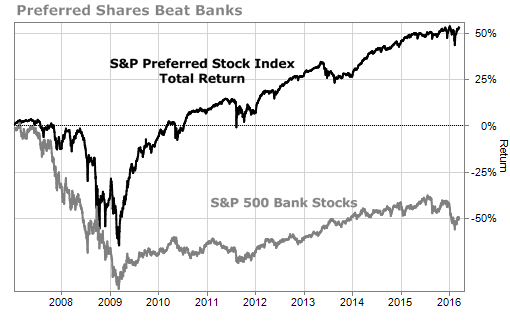

The market is going nowhere this year... It trades up a bit... then back down... only to repeat the process a few months later with fears of a new crisis: new worries about a global slowdown... when the Fed is going to raise interest rates... or what might happen with the presidential election. Take a look at this chart of the S&P 500 stock market index:  But there's a weird investment that lets you ignore this lack of stock market growth and still get paid... often double or even triple what you might get paid if you simply bought a stock. Even better, you won't have to worry about that regular payment changing. And buying this investment gives your portfolio a margin of safety that stocks can never provide. This hybrid investment is a preferred share, or "preferred." Like a common stockholder, you are a partial owner of the business. But rather than hoping for increasing dividends, preferred shares have an agreed-upon dividend rate that can be two or three times as high as a typical stock dividend. You give up any price appreciation there may be in the stock, but you can earn a 5%-6% yield with a preferred... compared to 2%-3% for regular shares. Now, if you were a bondholder the company would pay you each interest payment or risk default. Preferreds don't have the same guarantee. A company can suspend its preferred dividends. This rarely happens... and the company is barred from paying any dividends on common stock until it meets its preferred dividend obligations. As a rule of thumb: If you find a stock with a safe dividend, you can bet that the preferreds are even safer. This arrangement is why preferreds are described as a cross between a stock and a bond. The great thing is that even in worst-case scenarios, preferred shares are safe. They tend to hold their value... and quickly bounce back. During the financial crisis, a diversified portfolio of preferreds did drop... but quickly regained its value. Thanks to the income, preferred shares rallied back while bank stocks lagged far behind. (Most preferred shares are issued by banks and other financial companies.)

But there's a weird investment that lets you ignore this lack of stock market growth and still get paid... often double or even triple what you might get paid if you simply bought a stock. Even better, you won't have to worry about that regular payment changing. And buying this investment gives your portfolio a margin of safety that stocks can never provide. This hybrid investment is a preferred share, or "preferred." Like a common stockholder, you are a partial owner of the business. But rather than hoping for increasing dividends, preferred shares have an agreed-upon dividend rate that can be two or three times as high as a typical stock dividend. You give up any price appreciation there may be in the stock, but you can earn a 5%-6% yield with a preferred... compared to 2%-3% for regular shares. Now, if you were a bondholder the company would pay you each interest payment or risk default. Preferreds don't have the same guarantee. A company can suspend its preferred dividends. This rarely happens... and the company is barred from paying any dividends on common stock until it meets its preferred dividend obligations. As a rule of thumb: If you find a stock with a safe dividend, you can bet that the preferreds are even safer. This arrangement is why preferreds are described as a cross between a stock and a bond. The great thing is that even in worst-case scenarios, preferred shares are safe. They tend to hold their value... and quickly bounce back. During the financial crisis, a diversified portfolio of preferreds did drop... but quickly regained its value. Thanks to the income, preferred shares rallied back while bank stocks lagged far behind. (Most preferred shares are issued by banks and other financial companies.)

- BlackRock explains how rising interest rates will affect preferreds.

- Something different: The National Weather Service finally stopped yelling at us.