Doc's note: Lots of people have heard that there's good debt and bad debt. In today's continuation of our series on the essential things you need to know to build your wealth, I explain why no debt is actually good, plus the one loan you should never take out...

***

You've probably had someone tell you that there's "good debt" and there's "bad debt."

Good debt is usually on something like education, real estate, or a business. Interest rates are low, and you're typically earning a solid return on your money. (Your house may appreciate in value, or your business will produce income.)

I don't consider any debt to be necessarily "good" because, well, it's still money that you are obligated to pay back. But if you leverage it and use it to increase your wealth, then it's debt you feel OK having.

Bad debt, on the other hand, can crush you. I'd consider debt to be bad if it has a super-high interest rate like a credit card or if it's on a fast-depreciation asset like a car.

You've probably been told time and time again how credit-card debt can cripple your finances. They're generally used to buy things like clothes or electronics, which are depreciating assets. And with interest rates around 16%, it can take years to pay them off if you're simply making the minimum payments.

As for cars, we all need them. So we have to buy them. For most folks, the decision comes down to buying a new car or a used car...

New cars, as you may know, depreciate anywhere from 5% to 20% the moment you roll them off the lot. That's why I think folks should consider buying a two- or three-year-old car coming off a lease.

I'd go as far as to say that one of the cardinal sins in personal finance is borrowing a large sum of money to buy a new car.

When you think about it, how much different is a 2018 Honda CR-V than a 2021 Honda CR-V? Probably not much. Maybe one or two more features.

But the amount you'll save by going the used route is substantial. And I say that even though the interest rate on a new car is much lower than a used one.

I'll give you an example...

Let's say a new car costs $21,195. If you financed it at 1% for 48 monthly payments of $451, you would spend $21,648 on the car.

If you bought a 2019 version of that same car (with only 18,000 miles) for $14,000 and financed it at 5.40%, you'd spend $324 a month. That's $15,552 over four years.

In total, you'd save $6,096 in cash flow if you buy the used car.

|

|

Monthly Payments |

Total Cost Over Four Years |

|---|---|---|

|

New Car |

$451 |

$21,648 |

|

Used Car |

$324 |

$15,552 |

But to know how much you truly save, let's look at the ending value of the cars...

Due to depreciation, the new car loses about $10,608, while the used car only loses $6,496 over the four years. At the end of four years, the new car is worth $11,040, and the used car is worth $9,056.

Essentially, you spent $21,648 to get $11,040 – a loss of $10,608. For the used car, you spent $15,552 to get $9,056 – a loss of $6,496. So, you lose $4,112 more by driving a new car.

|

|

Total Cost Over Four Years |

Value After Four Years |

Loss |

|---|---|---|---|

|

New Car |

$21,648 |

$11,040 |

-$10,608 |

|

Used Car |

$15,552 |

$9,056 |

-$6,496 |

The math works out to $86 a month. And I'm sure you'd much rather put that $86 a month to better use than by driving a car with a heated steering wheel.

The next thing I want to talk about today is paying off debt. That's also a question I often get... specifically about paying student loans off early.

While some Health & Wealth Bulletin readers may not have any student debt, I'm sure you know someone who does... your children, your grandchildren, or family friends.

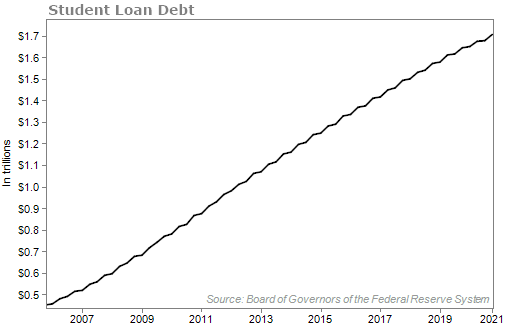

The truth is that folks have been overrun with student debt in recent years. Education costs have become sky-high.

You can see in the chart below how student loan debt has more than tripled since 2006. It now nearly stands at a whopping $1.7 trillion...

New graduates (and parents of new graduates) often ask me if they should try and pay off their student loans early or just pay their minimums.

In general, it's a good idea to pay off student loans early. But I won't say every person should do that. I'll explain...

The good thing about paying off student loans early is that it's really the only way to earn 4% to 7% completely risk free.

For one, as you sit on your student debt, the interest keeps running at rates typically around 4% or 6%. If you pay an extra $1 today, that's $1.04 you don't have to pay next year. Or $1.08 the year after.

By paying early, you "earn" 4% on your money.

And since student debt can't be discharged in bankruptcy, paying it off is a completely riskless return on your money. As of now, you have to pay that money back, no matter what. So paying it off early is risk free.

Paying off other debts early – though often a wise choice – comes with some risk. For example, you could pay extra on your mortgage and earn maybe 5%. But there's at least a chance your home will decline in value and steal your equity. Or maybe down the line you need to declare bankruptcy. Debts other than student loans at least have a "risk" that you'd have been better off not paying them.

So paying off student loan debt is risk free. It will "earn" you about 4% to 7% a year, depending on your rate.

The only time you wouldn't want to pay off student loans early is if you can earn a higher return elsewhere.

Over the long term, investing in the stock market will earn you between 7% to 10% a year. So, if you're deciding between paying off your 5% student loan early or investing that money and earning 10% a year in the market, you're better off throwing money into buying an S&P 500 fund.

It comes down to opportunity cost.

But of course, nothing in the market is guaranteed. Earning 7% to 10% is what you should expect over the long term. Results will likely vary drastically from year to year. Being in the market is definitely not risk free... and if you have a poor outlook on the next few years in the market like I do, that plays a role in your decision.

You also have to consider liquidity.

If you buy an S&P 500 fund, you can access that money any time by selling your fund. That makes it valuable in case of an emergency when you really need to come up with more cash.

But when you make a big student loan payment, that money is gone. You can't use it for an emergency or even another investment opportunity. So there are a few things you'll need to consider when deciding whether to pay off student loans early or not.

In general, though, you can't go wrong with paying off student debt early. It's one of the best risk-adjusted returns you can get.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

December 22, 2021