Doc's note: Longtime readers know I'm a contrarian... When I see that lots of investors have turned bearish, I know that it's nearly time to start thinking bullish. And today, my colleague Greg Diamond explains where he's seeing too many bears and why that means it's a good time to be bullish...

***

Over the fall, a young black bear wandered into my backyard several times over a few weeks... And, on one occasion, it made itself at home on our playground for quite some time.

According to my neighbor who has lived in this community for 44 years, it was the first time he had even seen a bear.

While it was clearly a young bear, it was still very strong and quite destructive...

It decimated some of our Halloween decorations, shredded my daughter's soccer ball, snapped three of my steel tiki torches like toothpicks, and punctured my neighbor's car tire.

After a few days, I called the Virginia Department of Wildlife Resources to remove the bear safely and transport it to a less-populated area.

The department official I spoke to was great. I asked if I could shoot the bear with my BB gun, and he said, "Sure, but it won't even penetrate the skin."

And we both started laughing.

While a BB gun can seriously injure a human, shooting a bear with that type of gun is like trying to chop down an oak tree with a spoon.

I just wanted to scare off the bear, not hurt it. I have two little kids and a dog. My neighbors have a little one as well. The chances are slim that a juvenile black bear would cause harm, but there was still a possibility.

I don't know if the bear was caught and released into the western part of Virginia or if it just wandered off... but it hasn't been back since my call.

I guess it doesn't like me anymore. It's OK, though. I hope it has moved on and is doing fun "bear" things.

But what I found funny was that, for the first time in four decades, a bear happens to turn up in my backyard... right around the time I turned bullish on the stock market.

Could it be a sign? Or maybe there's some kind of connection?

No... It's just funny.

As for the markets, it seems I'm mostly alone in my bullish sentiment. Very few analysts agree with me.

But that just makes me more bullish.

Today, I want to highlight a couple of charts that support my claim...

If you attended or watched the Stansberry Research Conference from home in October, you might have seen the "Bull, Bear, or B.S." segment... In it, a panel of analysts received statements and questions about the market and had to decide whether the viewpoints were bullish, bearish, or B.S.

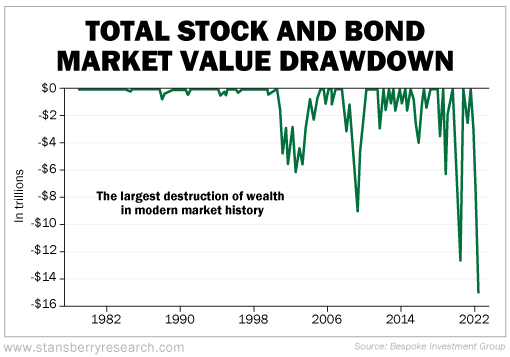

I'm going to share two charts that we need to look at in this context. Let's start with the chart below, adapted from the Bespoke Investment Group...

The chart label says it all... This year, we've seen the largest destruction of wealth in modern market history.

Now look at where the big bottoms occurred on this chart...

2002 – There's capitulation and a major low in stocks. (Capitulation means investors have given up trying to recapture lost gains due to falling stock prices.)

2009 – We see capitulation and a major low in stocks.

2020 – Again, there's capitulation and a major low in stocks.

2022 – We see a new low.

But maybe you'd rather take the other side of this trade and be aggressively bearish? Is this B.S.? I've heard a lot of analysts say there's no capitulation yet. But this chart says otherwise...

Capitulation is here, right now.

The phrase "It's different this time" may come to mind in this scenario. But I'm sticking with this historical chart and the lessons it has taught us each time it marks a new low...

Namely, it's time to buy.

So, my view is that this chart is unquestionably bullish.

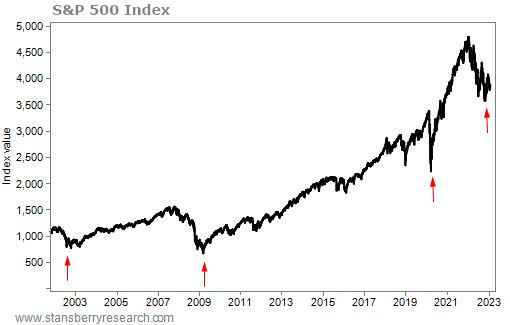

Now let's compare this chart with some simple technical observations. Here's the S&P 500 Index going back about 30 years...

The red arrows above correspond to the capitulation lows that we saw in the first chart... in 2002, 2009, 2020, and 2022.

My Stansberry Research colleague Dr. Steve Sjuggerud likes to buy things that are "hated and in an uptrend."

I think we're seeing a market that's hated and in an uptrend.

As I mentioned earlier, the Bespoke Investment Group chart illustrates the largest destruction of wealth in modern market history...

And yet one of the major indexes, which almost all investors track, can't make a new low. In fact, the S&P 500 isn't even close to making a new low. The dip we're seeing in 2022 barely registers as a meaningful drop on this 30-year chart.

When comparing these two charts, my first thought was, "That's it? The largest destruction of wealth on record, and that's what the S&P 500 does?"

So, ask yourself this question...

Is this a destructive bear market or simply a large (larger than normal, certainly) correction within a much bigger bull market?

The answer is: This is nothing more than a correction within a long-term bull market.

So am I bullish, bearish, or inclined to think this is B.S.?

I'm bullish.

As Warren Buffett famously said, "Never bet against America."

Well, if the largest destruction of wealth in modern market history can't even break an uptrend, I'm not betting against America or the long-term bull market either.

Bears may not like this issue, but as I always say... I call it like I see it.

So get ready to buy stocks.

Best,

Greg Diamond, CMT

Editor's note: This Thursday, January 12, Greg will air his newest prediction for 2023... how a rare market event that's occurred just three times in 25 years could soon ripple through stocks this year. Click here to learn more.