I'd bet that you're smarter than 92% of Americans. Here's why...

As a reader of Health & Wealth Bulletin, you're serious about being in control of your own finances. If you've been following me for any significant amount of time, you'll know I've covered everything in the investing world from options to asset allocation to fixed-income investing.

And that's why you're likely smarter than the vast majority of your peers.

According to a 2019 survey by BNY Mellon Investment Management, a staggering 92% of Americans don't know what fixed-income investing actually is. And this survey didn't factor in younger Americans who are still trying to learn the alphabet... This was a survey of a couple thousand adults.

The results were scary...

The survey revealed that Americans have little to no knowledge about fixed-income markets and ways to invest in them.

Fewer than 1 out of 10 respondents could correctly define fixed-income investing. About 30% believe fixed-income investing is intended only for your retirement. And nearly half have no clue about the right time to have exposure to fixed-income investments in their portfolios.

Maybe these folks got it right... 2022 was one of the worst years ever for U.S. bonds. The Total Bond Index, which tracks investment-grade bonds – corporate and government debt that credit-rating agencies deem to have a low risk of default – lost more than 13% in 2022. Before then, the index had suffered its worst 12-month return in March 1980, when it lost 9.2% in nominal terms.

While bonds lost 13% in 2022, stocks lost more than 18%. The bonds held up better.

I've long said that fixed income should be a staple in any investor's portfolio. And that's because diversification among asset classes is essential...

Fixed-income securities are designed to pay a regular stream of income over a fixed period of time. You lend money to a corporation or a government, and at the end of the bond's duration (at maturity), you get back most of your initial investment (called principal), depending on what price you paid at the start.

Depending on your age and tolerance for risk, bonds sit somewhere between boring and a godsend. The promise of interest payments and an almost-certain return of capital – at a certain fixed rate for a long period of time – will let you sleep well at night.

Including safe fixed-income securities in your portfolio is a simple way to stabilize and balance your investment returns over time, too. For people with enough capital, locking up extra cash (after you've saved six to 12 months of your expenses) in fixed income is a great way to generate much more cash flow than the nearly nonpaying money-market or savings accounts.

In my Retirement Millionaire newsletter, I've talked about many different fixed-income investments... from municipal-bond funds to preferred stock (a sort of half-bond, half-stock security) to corporate bonds.

One of the main reasons to have some money in safe bonds is to offset volatility from the stocks you own.

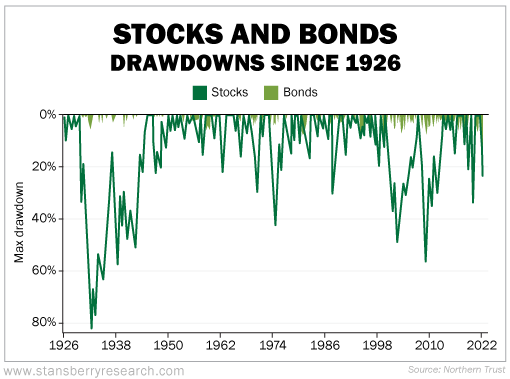

Over time, you're likely to make money in stocks. But it's not always a smooth ride. There are many up years – but there are some big down years, too. The chart below shows the drawdowns of both stocks and bonds dating back roughly a century...

In other words, bonds also fall... But if you are used to stocks, you'll never lose a moment's sleep over your bond portfolio.

Now, a question I'm sure a lot of folks struggle with is: How much of my portfolio should be in bonds?

This answer depends on your tolerance for risk – and your age.

When you're younger, you can afford to take more risk and try to earn higher returns with your money. This may lead you to having more money in stocks (even though you should have at least 10% in fixed income as a baseline). And as you get older and become more focused on capital preservation – versus appreciation – more money in bonds makes sense.

Still, everyone needs some exposure to fixed income.

If you don't have any of your portfolio in fixed income, I suggest you do it now... especially with concerns in the economy today.

The returns from bonds aren't going to blow you away, but consistently getting a check from the government or a company is a great feeling. You don't lose any sleep at night.

And my friend Joel Litman is sounding an alarm on stocks – that makes getting steady income even more essential.

According to Joel, there's a crisis coming for U.S. stocks. And on September 27, he'll walk you through every warning sign he's seeing... and most importantly, what you need to do to avoid the worst financial damages you've sustained in your investing life to date.

Sign up here to make sure you don't miss Joel's urgent market warning.

What We're Reading...

- 2022 was the worst-ever year for U.S. bonds.

- Something different: MLS sacks player after fake name and ban claims.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

September 20, 2023