If you think the next 10 years in the market will be similar to the last 10... it's time to change your expectations.

That means if you're currently retired and living off your savings, or close to your retirement age, you should read today's issue closely. I (Jeff Havenstein) have already sent this message along to my retired parents and in-laws.

You see, 10 years ago, things weren't so great.

The housing bubble burst in 2007 and 2008, devastating the lives of many Americans for years. Millions lost their jobs. Many were forced to downsize or even move in with parents or children. Retirees across the country saw their nest eggs get cut in half, crushing their dreams of a stress-free retirement.

When comparing 2011 versus today, there are some similarities...

The COVID-19 pandemic and economic shutdowns that followed caused a rise in unemployment. The unemployment rate is 6.3% today, and it was just over 8% in 2011.

Retirees also saw their portfolios plunge in March 2020. The benchmark S&P 500 Index was down 34% from peak to trough.

The biggest difference between 2011 and today is how quickly the economy and stock market have recovered. After the Financial Crisis, the recovery was slow and brutal. It took a whole decade before the unemployment rate was at the same level as it was pre-crisis.

Stocks didn't hit a new all-time high until 2013... six years after they peaked in late 2007.

It was a scary time to trust your money in the market, but 2011 turned out to be a great time to buy. Since then, stocks have returned an average of 15.4% a year when you factor in dividends... a remarkable return.

On the other hand, the recovery has been much quicker and stronger following the COVID crash. Jobs are already coming back, consumer spending is at new highs, and stocks can't seem to do anything but go up.

This time around, it took less than 12 months.

A lot of this is due to trillions of dollars of government spending and the quick rollout of the COVID-19 vaccines.

With such a swift recovery in the stock market, stocks are not as cheap as they were in 2011... And that's what I want to focus on today.

Right now, stocks trade for a price-to-earnings (P/E) multiple of 31.5 and a price-to-sales (P/S) multiple of 2.9. In 2011, they traded for 13.5 times earnings and 1.2 times sales.

Stocks are expensive.

And it's true that stocks can get much more expensive... That's the point of my colleague Steve Sjuggerud's Melt Up thesis. Investor speculation and euphoria can keep driving up expensive stocks, making them even more expensive...

That is, until you know what happens. (Trust me, it's coming eventually.)

Another way to look at how expensive stocks are is by examining the cyclically adjusted price-to-earnings ("CAPE") ratio.

The CAPE ratio takes the regular P/E ratio and smooths out earnings over the business cycle. The idea is that earnings are too low when things are bad and too high when things are good. Smoothing out earnings – then comparing them to current prices – gives a better indication of whether stocks are cheap or expensive today.

The CAPE ratio is currently at 34. And that tells me that the next 10 years of investment returns are not going to be good...

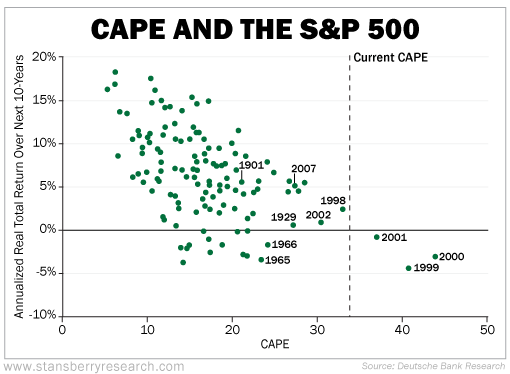

The chart below looks at the CAPE ratio in various years and the return of the market over the following decade.

If you can imagine an average line, it would be downward sloping. That means when the CAPE ratio is small, market returns over the following decade tend to be higher. The more expensive stocks get, the less they return over the next 10 years...

This chart should make you nervous. Based on history, we should expect to see low to even negative annualized real total returns over the next 10 years.

Last Wednesday, Dr. David "Doc" Eifrig explained how the stock market feels a lot like 1999. And the similarities are truly unmistakable. That means stocks can absolutely soar from here as more and more speculators jump into the market. It also means we could be a year, if not months, away from a crash.

As you can see in the chart, the 10-year annualized returns of the market after 1999 were abysmal. If today is truly like 1999, it's time to come to the realization that the market may have very poor returns over the next decade.

Now, on to the million-dollar question... What are you supposed to do?

First, it's important to still own stocks. That sounds a little backward since I just babbled on about how returns may stink from here... But we're not at peak dot-com-bubble status just yet.

There are likely life-changing gains still to come. You want to be along for the ride.

The key to navigating this euphoric market is to have an exit strategy in place. That way, you won't be wiped out when the market turns. (And if you ever feel the need to take out a second mortgage on your house to buy more bitcoin or shares of Tesla, give me a call and I'll talk some sense into you.)

You should own stocks today because stocks are the best game in town to generate wealth over the long-term. But they shouldn't be the only thing you own. You need to diversify...

You should consider precious metals like gold and silver, less expensive international stocks like emerging markets, cash, real estate, even things like timberland or farmland. And even though the outlook for bonds doesn't look great, given low interest rates and the possibility of inflation in the months to come... some safe bonds will also help diversify and stabilize your portfolio.

The U.S. stock market may have had negative returns in the years following 1999, but other assets did just fine. Emerging market stocks were up 11% a year, in the decade following 1999... Silver returned 12.8% a year... And gold was up nearly 300% or 14.7% a year.

The point is that you can still grow your portfolio over the next 10 years even if stocks lag.

All you have to do is diversify.

What We're Reading...

• Charlie Munger doesn't know what's worse: Tesla at $1 trillion or bitcoin at $50,000.

• Online Data – Robert Shiller's CAPE ratio.

• Something different: Mining magnets: Arctic island finds green power can be a curse.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein and Dr. David Eifrig

March 3, 2021