Doc's Note: The panic surrounding the coronavirus and the crash in the economy sent billions in assets to "safe" vehicles. But all that money could pour back into the market soon... In today's issue, Stansberry NewsWire editor Scott Garliss explains why that will happen and what we've learned from the last market crisis.

A lot of money is coming off the sidelines... And it will fuel more gains for the markets.

There's an old saying I learned early in my career on Wall Street: "The market tends to do whatever hurts the most people the most."

It means that whenever everyone is piled into the same side of an idea, they're typically going to end up on the losing side of that trade. That's not just superstition, of course. It's fundamental economics. Every transaction needs a buyer and a seller. If everyone is on the same side of an idea, who's left to take the other side?

Think about it this way... If everyone has invested all of their money in stocks, where are the additional funds coming from that would push stocks even higher? It's likely there isn't any more capital coming. It has all been invested already. That means the next wave of activity is going to be selling, aka stocks dropping.

Today, we're dealing with the other side of that equation. The coronavirus-related shelter-in-place orders shut down economies everywhere. Nothing was happening. Investors got scared. They sold stock and bonds, seeking the safety of cash instead.

And since then, the media has continued to scare many of these people into staying in cash. It's hard to turn on a television channel or open a website without hearing dire news of a pending second wave of infections or economic restarts that are destined to sputter out. The media realizes individuals are more interested in hearing about all that could hurt them.

So, these investors have stayed in cash, missing out on much of the rebound.

But now, that is starting to change...

According to the Financial Times, a record $22.5 billion in assets went into U.S. bond funds last week. Investment-grade corporate bond funds saw $5.5 billion of inflows. Investment-grade corporate bonds and government debt saw $7.5 billion of inflows. And junk bond funds saw $8.5 billion of inflows.

That's a lot of money not in equities.

But, that's also money starting to come out of money-market mutual funds. If you're invested in money market mutual funds, you're safe because it's essentially cash. However, when the market is rallying, that safe money isn't doing anything.

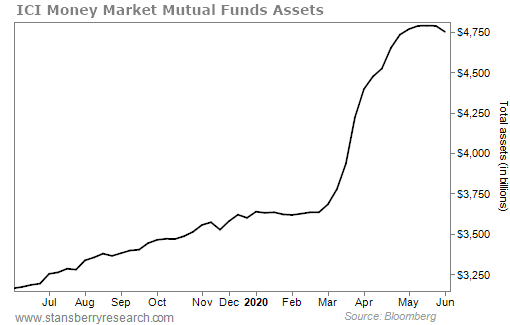

According to the Investment Company Institute ("ICI"), roughly $1.2 trillion had gone into money markets since early March. Take a look at this chart:

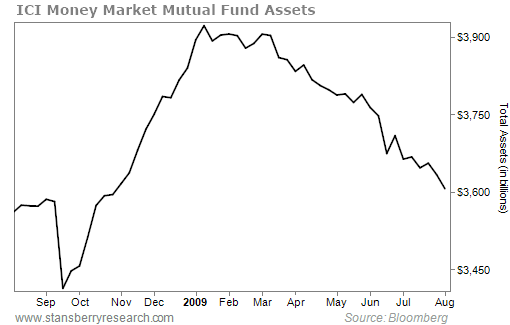

That's more than during the 2008 financial crisis. As you can see in the following chart, a total of $509 billion went into money-market mutual funds between September 2008 and March 2009:

As a testament to the amount of money not participating in the current rally, Bank of America reports that global fund managers' cash levels sit at roughly 5.7% of assets. Considering many of them have charters that say they need to be 95% invested, they can't sit in high levels of cash forever.

But now, $36 billion of those money market mutual funds has come off the sidelines.

At some point, investors will get tired of watching their money do nothing. They'll want to get back in. And it looks like that's finally starting to happen. Take a look at what happened in the wake of the financial crisis...

On March 13, 2009, the cash began to flow out of money market mutual funds. That was right around the beginning of the last bull market run. The S&P 500 Index added 349% (in total returns) from March 13, 2009, until February 19, 2020.

As of this morning, the S&P 500 is up about 35% from its bottom in late March. And with money starting to leave these money-market accounts, we expect this to be a tailwind for a continued rally. That's why we're staying bullish on stocks right now.

Good investing,

C. Scott Garliss