For investors, a lot of crazy – and painful – things happened in 2022... but likely nothing was more surprising than the performance of bonds.

Let me give you an example...

In 2021, Apple (AAPL) decided to borrow $1.75 billion for 40 years. It didn't need the money. It had $190 billion in cash on hand and generated another more than $90 billion each year. But interest rates were low and money was cheap. So borrowing from the bond market made sense.

Investors who bought the bond signed up to lend Apple the money at 2.8% per year. That's not a huge yield, but it's more than you'd get from most stock dividends. And Apple is a rock-solid company that will have no trouble repaying its investment.

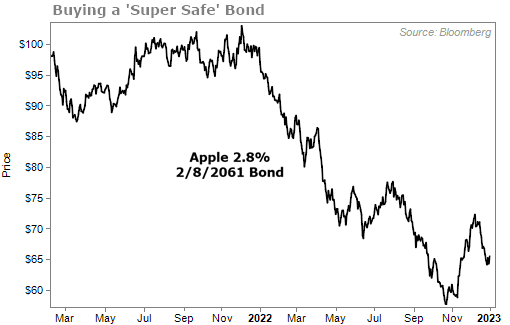

Here's what's happened to this "super safe" investment...

An investor who lent money to the safest company in the world is down nearly 35% in about two years.

Of course, nothing has gone wrong at Apple. The company still has more cash than debt. It's still a highly profitable business.

This move down is entirely due to interest rates.

Let's take a look at the math on bonds...

That Apple bond was issued at $100 (meaning $1,000 per bond) and paid a coupon of 2.8%. That wasn't far off from the standard rate at the time. So, as you can see in the chart above, the price of the bond stayed pretty close to $100.

Then, the prevailing rate for investment-grade bonds changed to roughly 5%, which led to the AAPL bond price falling.

Active bond investors won't pay full price for a bond yielding 2.8% when they can buy more recently issued corporate bonds, or even Treasury bonds, with higher yields. So the Apple bond's price fell until the yield to maturity reached its current 5.1%.

The move here is so drastic because it's a long-term bond. But even a similar bond with a seven-year maturity is down nearly 20%.

Buying Apple bonds seemed like a can't-miss prospect. And it was. Apple is going to pay all its interest payments and principal back to investors. But that only happens after you hold for 40 years.

In between, prices fluctuate.

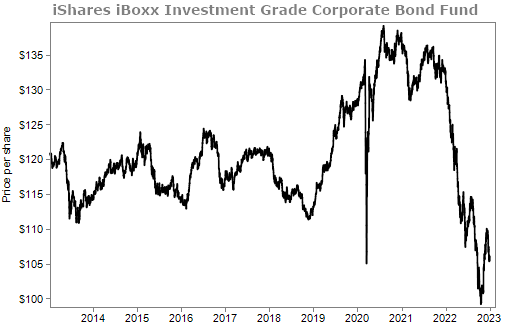

Corporate bonds have come down to a level that hasn't been seen in years. Take the iShares iBoxx Investment Grade Corporate Bond Fund (LQD)... This is a good proxy for the safest, most liquid bonds in the market, and it has been running since 2002.

Normally, investment-grade corporate bonds provide a nice, ongoing return. Not this year...

Again, this is almost entirely due to interest rates.

As a result, prices have gone down. But yields have gone up.

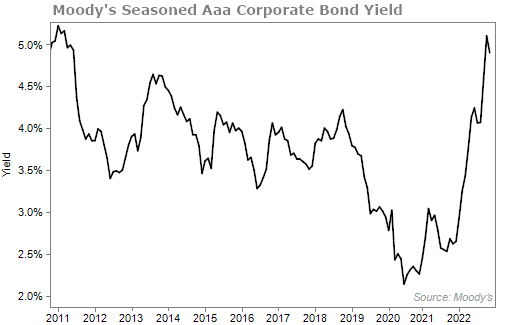

The yields on safe corporate bonds are currently 4.9%. That's the highest in over 10 years. Take a look...

Bond investors were crushed in 2022. But bonds are starting to look attractive again because of their high yields.

My colleague Mike DiBiase agrees... Specifically, he thinks we're on the verge of an incredible opportunity in distressed corporate debt.

To help explain the opportunity, let's back up a little and talk about what a bond really is...

Bondholders, unlike stock investors, have a legal right to be paid by the company. If a company's balance sheet collapses, its share price collapses with it (and any dividend it pays will end).

Shareholders have no guarantees... but bondholders have much more safety.

Those interest payments are legal obligations. So if a company gets in trouble, bondholders stand at the head of the line when it comes to paying bills and creditors.

Even in the event of a bankruptcy liquidation, the proceeds go to the secured creditors and bondholders. Shareholders get squat.

Not only that, but the capital gain potential of bonds is widely underrated. If you can purchase corporate bonds at a discount – when they trade for less than face value – and hold to maturity, you receive the full face value when the bond principal is paid off. That can be an incredible, overlooked built-in capital gain... regardless of what the market or an individual company's stock has done.

As long as the company doesn't go bankrupt, bondholders get paid... it's that black and white.

When the credit cycle eventually rolls over – something that Mike believes will happen very soon – there will be tremendous deals available. You'll also be able to buy what's called "distressed debt."

Purchased at the right price, debt can make a fortune for investors.

Remember: All that has to happen for you to be right is for the company to not go bankrupt.

This occurs because you're dealing with safe, legally binding contracts that have less risk than stocks and can pay you no matter what happens in the stock market.

Buying distressed corporate debt is an incredible moneymaking strategy when the credit cycle turns. And according to Mike, that may be closer than you think.

The outlook for bonds is much brighter in 2023.

You can click here to learn more about the strategy of buying distressed corporate debt... and how it helped one of our own subscribers retire at age 52.

What We're Reading...

- Something different: Snow shortage threatens Alps with wet winter season.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

January 4, 2023