Everybody hates "The Greeks"...

The vast majority of individual investors – perhaps 90% of them – will never trade options. And the No. 1 excuse is "it's too complicated." They think the required math is too complex and intimidating.

That fear is epitomized by the Greek letters that professional traders use to measure how options will react to factors that influence options prices. Many folks just shut down when they hear the pros bandy about terms like "delta," "theta," "vega," and "rho" – aka "The Greeks."

Resist that impulse...

As I said, the Greeks are simply a set of statistics that measure how an option price will react to different factors. They get their names from the Greek symbols they represent in math formulas.

Full-time option experts on Wall Street's trading floors use Greeks to make all sorts of trades, using three-dimensional charts on multiple screens to find anomalies in the market. New option traders see all these complex calculations and start to think they won't be able to understand options.

But that's not true. If you remember, I already introduced you to one of the Greeks a few weeks ago... delta. Delta represents how much a change in the stock price changes the option price.

In addition to delta, there's another Greek term everyone understands intuitively. It's the measurement of the passage of time... something called "theta."

Options are worth more the further they are from their expiration date. As time passes, the price of an option falls. That's "time decay."

Let's look at an example of a put buyer (remember, buying a put is a bet that the stock will go down within a certain period).

The social-media service Facebook (FB) currently trades for about $128 a share. But let's say a trader thought shares were going to collapse to less than $100 in the next six months.

To make that bet, the trader buys a $100 (the strike price) put option for $1 (the option premium).

Over the course of six months, a lot could happen. The company will announce a couple of earnings reports. The numbers could be bad. New social networks could get started, creating competition. Or economic growth could slow, putting pressure on its revenue streams...

But let's say nothing really bad happens... Imagine the next three months pass, and Facebook stock is still at $128.

The option trader still needs Facebook to drop all the way to $100. But it only has three months to do it rather than the original six. That's a lot less time for "something bad" to happen to Facebook.

It's much harder for a stock to move that much in three months than it would be in six. There's simply not enough time for the stock to make such a big move.

For that reason, the price of the option is much lower... probably as low as $0.10.

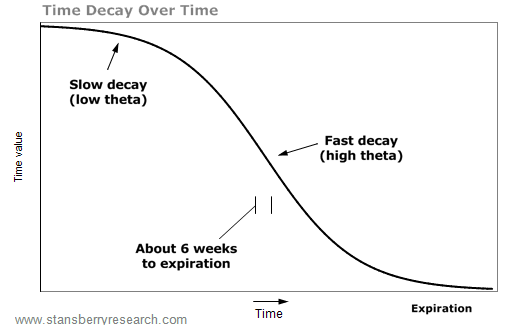

You can see as time passes, the price of an option declines (if all the other things like share price stay the same).

This "time decay" is measured by the Greek letter theta (Θ). Easy, right? "T" for time, "T" for theta.

You may have noticed that time decay is bad for the option buyer, but time decay works to the advantage of an option seller, like us.

Time decay makes us money. And just how much money is a simple calculation...

How We Profit From Theta

Consider the value of a single day. Look at a scenario where the prices are closer, say, with a strike of $100 and a stock price of $99.

This option has a chance of paying out. It depends on what happens between now and expiration. With the one-week option, as each day ticks off the clock, it makes a big difference. But if you have a five-year option with 1,825 days left, and the next day you've got 1,824 days left, the single day doesn't matter much at all.

The value of time is different at different stages in the option's life. This is the concept of "theta."

We can use this to our advantage by focusing on the period in which an option loses time value the quickest. Remember, as option sellers, we like to sell high and watch the price decline. As time value erodes away, it works in our favor.

You can use this reasoning to figure out why we sell options that are usually two months to expiration.

Ideally, we want to have sold an option while the time value erodes away at maximum pace. An option with a long time to expiration will only lose a little value each day. And if an option is far in the money or out of the money, the last few days don't erode much time value either.

For example, if a stock is at $50 and a $40 call ($10 in the money) has five days left to expiration, the option won't have much time value left. What's the value of an extra day when the outcome is clear?

In other words, time value erodes away slowly, then speeds up, then slows down again as the option gets close to expiration. We've found around six weeks to be the period of fastest time-value erosion.

By focusing on that period, we maximize theta and get the most option income for each trade we make.

Learning this simple calculation of theta should give you a better appreciation of how Retirement Trader put-sellers make money with each tick of the clock.

If you want to learn more about how to successfully trade options and make steady income, try out my Retirement Trader newsletter today. You'll receive issues, special reports, and updates on the best options trades on the market. Get started today by clicking here.

What We're Reading...

- Investopedia put together a visual guide to the Greeks.

- Something different: It's never too late to keep learning.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Retirement Millionaire Daily Research Team

Las Vegas, Nevada

September 21, 2016