There's a massive boom happening that no one is talking about. And the COVID-19 vaccine is just the start...

I'm talking about the boom in "life sciences."

When I talk about life sciences, I'm talking about companies related to the research side of medical care... pharmaceutical and biotech companies that develop new treatments, and the supply chain they rely on. That's different from "health care services," meaning doctors, hospitals, insurance companies, and other businesses that deliver the treatments to patients.

My team and I see incredible change and growth in the pharmaceutical and biotech space...

When you try to tell the story of a growing industry, it always feels better when you have that one trigger that explains everything... For example, a shortage of oil sends other commodity prices soaring.

Life sciences doesn't have that right now. Instead, it has multiple factors working together at once to grow this industry.

Changes are going to happen fast. And there's a lot of money to be made as an investor.

Just consider these developments...

Immunotherapy has changed cancer treatment. This innovation holds so much promise that we wrote an entire book about it in 2017 called "The Living Cure."

Immunotherapy redirects a body's own immune system to combat disease. Ipilimumab, the first "immune checkpoint inhibitor," was only approved in 2011. Now, cancer immunotherapy is a $100 billion industry and is forming a new standard of care for the disease. As the field progresses, therapies will get more targeted and personalized, and more effective.

Artificial intelligence ("AI") and machine learning are responsible for one of the biggest breakthroughs in biology, and it just arrived in December... from Google.

Its artificial intelligence offshoot, DeepMind, figured out how to determine the shape of a protein from reading its amino-acid sequence. The shape of a protein determines how it interacts with other molecules and can be extremely complicated. Modeling the shape will allow scientists to rapidly prototype and test new proteins as disease treatments. Scientists told the journal Nature that the technology will be transformational and it's "a big deal."

Machine learning and AI have been much-touted and often overhyped. But much of biology is trial and error. Testing thousands or millions of potential molecules is still only a tiny fraction of those possible. If AI can help target that search even a small amount, it can lead to huge innovations.

This technology will underpin research across a wide swath of the life sciences and accelerate the pace of change.

Even with "basic" technology, computers make everyone's work easier, and that goes for health innovations as well. Cloud computing makes it easier and cheaper to set up databases and health records. Complex data like images and body scans can be shared instantly. Patients in trials can be "visited" more quickly with telehealth appointments. It's just plain easier to get things done and run a massive study than it was even 10 years ago.

If these advances can make medical science even 5% or 10% faster, that will have a large compounding effect on how fast discoveries are made.

That's not all... Breakthroughs are happening in areas like personalized medicine and genomics and gene therapy.

These areas are working together, feeding on one another, and making for big changes in the science behind health.

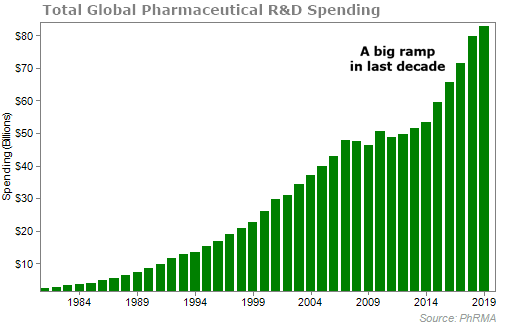

Spending on pharmaceutical research and development (R&D) flattened after the 2009 recession. But it has ramped up quickly over the past decade...

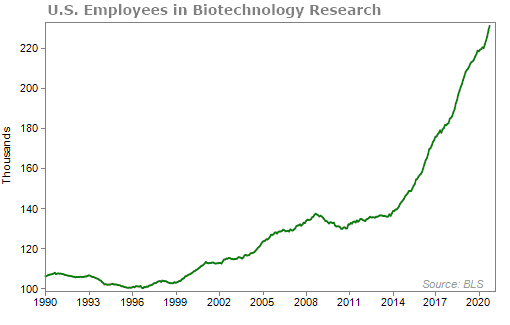

The number of people employed in the U.S. in life sciences has tacked on 60,000 employees in the last 10 years alone...

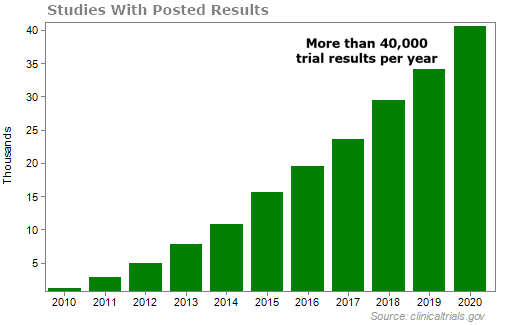

It is paying off in a major way. Medicine is always improving. We're always learning more and developing new treatments. And the number of trials in development has exploded.

In 2010, the U.S. Food and Drug Administration ("FDA") received results for a total of 1,139 trials. For 2020, that number hit 40,675, an increase of 35 times over...

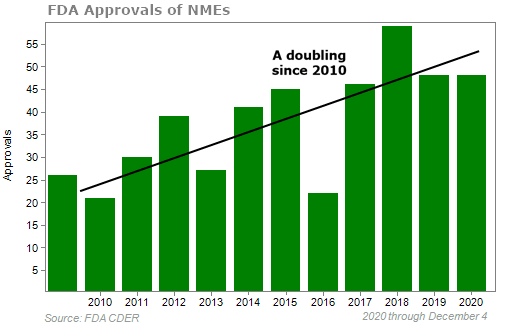

And FDA approvals of "new molecular entities" ("NMEs") have just about doubled in the last decade.

This is not growth – this is a rapid scale-up of an industry seeing amazing promise and potential for the breakthroughs it's creating every day.

Now, there are a few ways to play this boom in life sciences...

You could buy shares of a biotech company and bet that one of its early-stage drugs gets approval and saves millions of lives – leading to billions in profits. If you can do this, you'll get rich quick.

But that's a tough game to play. You'll quickly find you'll end with more losers than winners. Drug approvals rarely go the way you expect.

My favorite way to play the boom in life sciences is by buying the "picks and shovels" companies. Pick-and-shovel investing involves owning the companies that provide the services or tools needed to create a certain product... rather than in the companies that sell the final product itself.

In particular, there is one picks-and-shovels company in the life sciences industry that's set up for billions in profits, thanks to COVID-19...

First, this company makes a lot of money from COVID-19 testing, as it sells millions of test kits per week. And even though countries are rolling out vaccines, the demand for more testing isn't going anywhere soon. Americans are still taking over 1 million tests every day.

Second, this company makes a lot of money from the vaccine, as it is involved with its development and transportation. And there are still millions of Americans who need to be vaccinated...

This business will thrive, whether COVID-19 remains a big problem over the next 12 months and positive tests continue to surge... or a vaccine gets things quickly back to normal.

It's in a rare win-win situation.

The company I am referring to is a long-term capital compounder, and it has many years left of market-beating returns. I'm so bullish on this stock that I recently called it my No. 1 stock pick for 2021.

(My No. 1 stock pick for 2020 ended up earning 32% for the year... handily crushing the S&P 500.)

You can get the name and ticker of this stock by watching a presentation that I was recently a part of. You'll also get my colleague Steve Sjuggerud's No. 1 stock pick for 2021... as well as former hedge fund manager Austin Root's top idea.

You can click here to watch the presentation.

What We're Reading...

- Progress reported on one-dose J&J vaccine; COVID-19 reinfections seen as rare.

- Something different: Short sellers are down $91 billion in January as GameStop leads squeeze in stocks they bet against.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

January 27, 2021