Nobody in the banking business compares...

Over the past several days, we've gotten more hints about the economy and markets as the biggest banks in the industry have reported their fourth quarter earnings for 2023. We've learned just how profitable the quarter was, or wasn't... And we also learned how the banks are positioning themselves for 2024.

Results have been mixed so far...

Consider Citigroup (C). Citigroup is the fourth largest bank in the U.S., just behind Wells Fargo (WFC). This past Friday, the bank posted a $1.8 billion fourth-quarter loss. The reasons... several charges tied to overseas risks, a company reorganization, and the early 2023 "banking crisis." Citigroup also expects to reduce its headcount by 20,000. That should cost up to roughly $1 billion more in severance costs.

On the other end of the spectrum is JPMorgan Chase (JPM).

Today's opening line is a loose quote from one of JPMorgan's longtime board members. And we've been saying the same thing for years.

You see, JPMorgan is the ultimate megabank.

Banks can be a lot of things. They can work with consumers, underwrite public stock offerings, trade for profits, or lend money. Most banks focus on a few key areas and dabble in others.

Not JPMorgan... It dominates the finance industry. It does everything from investment banking to wealth management to retail banking and trading.

In JPMorgan's most recent quarter, it posted quarterly profits of $9.3 billion. For the year, it made $49.6 billion in net income, up 32% from 2022.

This was the largest annual profit in the history of banking.

Now, let's find out why... (The reason might surprise you.)

In its most basic form, a bank takes deposits and pays out interest to depositors. Then it lends out its cash at a higher interest rate. The difference between the interest a bank pays and the interest it receives is called its "net interest margin." The higher the net interest margin, the more profits for the bank.

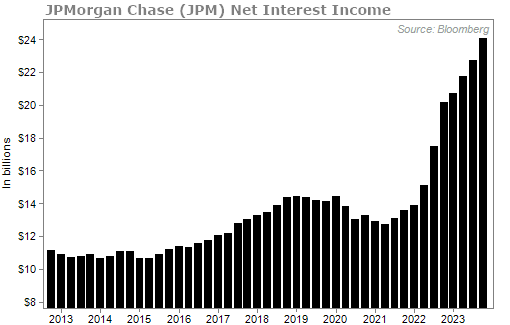

Thanks to high interest rates, JPMorgan's net interest income has surged. Take a look...

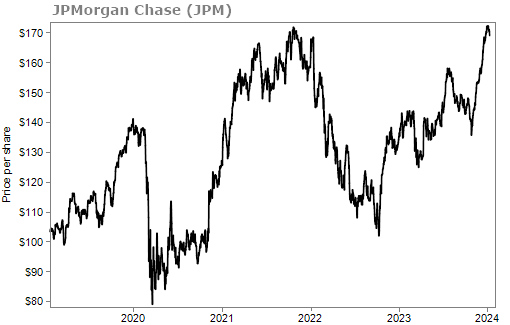

Higher interest rates practically shovel profits into banks. JPMorgan is showing just how profitable it can be. And as a result, the stock is trading near an all-time high.

Still, some folks are worried about the outlook for banks. There is some consensus that the Federal Reserve will cut interest rates in 2024. This will hurt net interest margins. Though the timing of these rate cuts is all over the place... Some analysts think it could start in the next couple months while others put the first cut in September.

The other worry is a recession. We don't need to explain this one. In times of economic turmoil, companies and households can't pay back their loans and banks are forced to eat some losses.

We're not worried about either of these concerns for JPMorgan.

We're not expecting the Fed to rush into a rate cut. It made that mistake in the past... We expect the Fed to be very patient and cautious before beginning a rate-cutting cycle. And that means JPMorgan should continue to earn record profits, letting it buy back stock, increase its dividend, and invest in its business.

We're also not in the camp of calling for an economic collapse over the next year or so. Even so, JPMorgan is well capitalized. If a recession does strike, JPMorgan could profit from the chaos by taking even more market share from smaller competitors.

In our first Retirement Millionaire issue of 2024, we went through every holding in our portfolio. If we did not rate the stock a "buy" today, then we wouldn't continue to hold it... This was an exercise that led us to say goodbye to and sell many of our long-held positions.

We did not have to part ways with JPMorgan, though, even at all-time highs. Our conclusion was the stock is a "Strong Buy."

This is a megabank that any investor should consider adding to their portfolios today. Since 1980, JPM shares would have returned 12.3% a year to investors.

JPMorgan is a stock you can own for many years and expect it to produce market-beating returns.

If you want to see which stocks that we're telling readers to buy (and which ones to cut loose), make sure you're a Retirement Millionaire subscriber, and read our January issue. If you're not, click here to get started today.

What We're Reading...

- For Retirement Millionaire subscribers only: "Don't Invest Like a Chimpanzee."

- JPMorgan's annual profit surges to record even as quarterly net income dips.

- Something different: Another ship comes under fire in Red Sea, disruption seen pushing up prices.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

January 17, 2024