Today's market is a lot different than it used to be...

For one, we've got information overload. I remember not too long ago when we couldn't get enough...

When I first started investing in college, getting a copy of a company's annual report was tricky. You had to hope your local library carried a couple of reports from the biggest companies. And if you were searching for a smaller company's annual report, you were usually out of luck.

Shareholders could request one through the mail and the postman would bring it to your door. But you'd have to wait a few weeks until it was delivered.

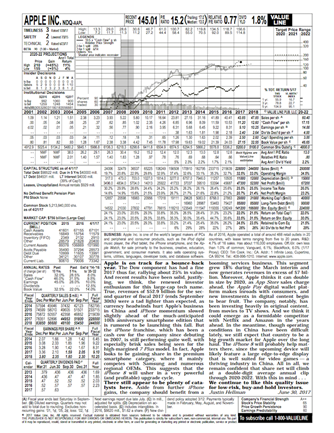

I treated a company's annual report like gold. Early in my investing days, I'd go to a broker's office to peruse single sheet Value Line newsprint on each company. The page was crammed with years of data plus the latest quarterly data and analytics. Today, I need reading glasses to see the material stuffed on these sheets...

This was how investors got their information before the Internet exploded in popularity. Today, just about everyone can get thousands of pages of company documents within minutes.

But how we get information is not the only thing that has changed...

Even the way companies are going public has changed.

Today, many companies are sidestepping the old route of going public through an initial public offering ("IPO"). IPOs have been around a long time. In fact, in 1602, the Dutch East India Company was the first to offer shares of its business to public investors.

Lately, IPOs have come under pressure. There have been regulatory changes and many believe that recent IPOs are leaving a lot of money on the table with listings being underpriced (and that's not good for the issuing company's founders and other early investors).

One mega-trend for 2020 is the growth of capital flowing to special purpose acquisition companies ("SPACs"). SPACs have raised over $30 billion through September compared to only $13.6 billion throughout the entirety of 2019.

They've become so popular lately that you've probably heard the term SPAC being thrown around at a few of your dinner parties lately (even virtually). There have been some big names launching SPACs this year...

For example, Paul Ryan, the former speaker of the House of Representatives... Gary Cohn, the former director of the National Economic Council... and even Bill Beane of the book Moneyball, have launched SPACs.

Despite their current popularity, plenty of folks don't really understand SPACs.

SPAC's, also known as "blank check companies," are just that. They're companies with no commercial operations that are formed to raise money through an IPO, and then go out and find an acquisition target.

Folks who launch a SPAC raise money based on their credentials and expertise. You can think of it as betting on the jockey rather than the horse. They can specify plans for the area they want to invest in, such as a financial services company.

Once the SPAC is funded, it looks for a company to buy at some point within the next couple years. The funds it raises sit on the company's balance sheet collecting interest, and once the SPAC finds a potential acquisition, it shares the details with the people who invested in the SPAC. The shareholders then get to vote on whether they want to approve the deal and invest in it... or ask for their money back. Even though it's called a blank check company, investors in SPACs do have some protections.

There are some risks to investing in SPACs. The first is the opportunity cost if the SPAC does not find a company to buy. Sure, the shareholders will get their money back. But their money will have earned very little when it could have been invested elsewhere making a higher return.

Also, SPACs don't have the greatest track record. They've been around for many years now and have often underperformed the broader market. But this could easily change with more money and more attention being devoted to SPACs.

Popular companies like DraftKings, Virgin Galactic, and Nikola have all chosen to go public through the SPAC route. And all three stocks are doing well so far.

SPACs have become a new way of doing merger & acquisition deals. They've exploded in popularity and are likely not going away anytime soon.

SPACs can also make you a lot of money... if you know what you are doing.

If you want to learn more about SPACS and whether investing in them is right for you, I encourage you to watch tomorrow night's SPAC Investment Summit at 8 p.m. Eastern time.

During this free event, you'll get all the details about a new SPAC deal that could give you a chance to make up to 25 times your money. It's a chance to invest in what could soon become the most exciting new company in America... BEFORE it goes public.

What We're Reading...

- IPOs are popping like it's 1999, and executives are fed up.

- Why SPACs are the new IPO.

- Something different: U.S. trade deficit jumps to largest in 14 years in August.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

October 7, 2020