Don't get caught up in the "reach for yield."

It's hard to earn much from your savings today in the typical "safe" investments... The S&P 500 yields about 2%... the 10-year Treasury security is about the same... and you're lucky to collect a few tenths of a percent in a savings account or certificate of deposit.

So some investors look further out in the high-yield space... often "reaching" for too much risk in the search for higher income.

Now, I have found a few high-yielding assets that are less known to investors... In fact, a few of the model portfolio positions in Income Intelligence deliver income of more than 7% a year and are incredibly safe. But if you don't know what's in the underlying portfolio, you might be loading up on risk – not just on yield.

I aim to build a portfolio that works in all markets with minimal risk to capital. If you want to do the same, you must set reasonable goals to keep your risk tolerable. For example, a good goal in today's low-yield world is to have a diversified portfolio that returns a consistent 5% per year. And in addition to that payout, you can also collect capital gains as asset prices rise.

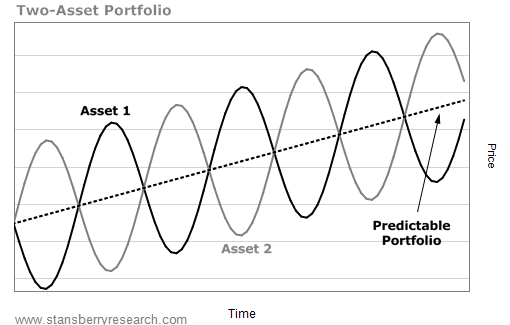

The key to finding the right mix comes from thinking a bit about diversification and portfolio theory. You can design a portfolio by maximizing the return you generate per unit of risk...

The easy way to do this is to add assets that aren't correlated.

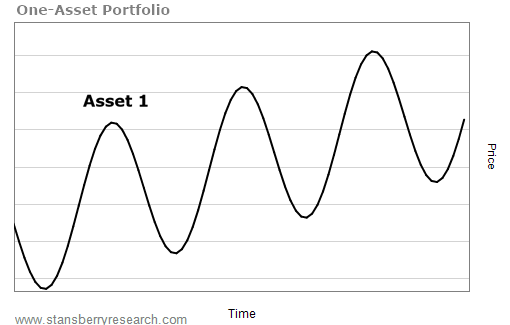

Think about this scenario... Take an asset that returns 5% a year but may vary widely in price in any given month.

By adding an asset that returns the same 5% yield but moves opposite the original asset, you can combine them in a portfolio. Now you can get the same 5%, with less risk...

This is the power of diversification... and why it's called one of the few "free lunches" in finance. By combining uncorrelated assets, you can get safer returns without sacrificing anything.

In the real world, it's not this simple. We don't have assets that are guaranteed to return given amounts or that move exactly opposite each other, but we can still get close...

Let's look at a historical example to see the power of this theory with real investments.

How to Measure Risk

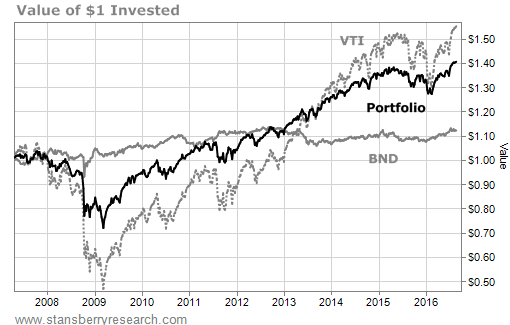

I'll use two broad index funds as a simple example of how stocks and bonds can work together in a portfolio...

You could have invested in the Vanguard Total Stock Market Fund (VTI) or the Vanguard Total Bond Market Fund (BND) when it launched in April 2007.

Had you invested in stocks, you would have earned annualized returns of 4.8% for the last nine years. In bonds, you'd have made 1.2%.

But that doesn't mean stocks are necessarily the better investment... Using standard deviation as a measure of risk, stocks had a standard deviation of 19%, while bonds varied 4.9%.

To compare these on equal footing, you could divide the return by the standard deviation to get what's called the "Sharpe ratio."

The Sharpe ratio measures how much return you get for each "unit" of risk you take on – higher is better. In stocks, the Sharpe ratio comes to 0.24. In bonds, it's 0.25. By this measure, bonds would have treated you better for the risk you were taking on.

And we can use simple diversification for even stronger performance... If you put half of your portfolio into each fund and rebalanced each year, you'd have earned 3.7% annualized returns with a standard deviation of 9.7%. And the Sharpe ratio would jump to 0.38, much higher than it was for either investment alone.

In the chart below, you can see that the combined portfolio has smaller declines than stocks, but higher returns than bonds...

You've just earned "free money" by diversifying... and boosted your risk-adjusted return by buying two investments instead of one.

Of course, you can't know exactly what your returns will be. But this mathematical analysis can still help you build a better portfolio...

In a recent issue of Income Intelligence, I recommended six funds using this strategy that can help you double your income. Current subscribers can get to this valuable issue by clicking right here.

And if you're not already an Income Intelligence subscriber, it's an ideal time to join...

This six-fund portfolio (that pays income of more than double the market) is ideal for anyone who is contemplating starting out investing. I would pass it on to your grandkids... pass it on to your kids... show it to your spouses. It's a great way of thinking about risk.

These six funds are what I'd show to new employees at our company or family members who are starting to invest and wondering where to start. To learn more about a no-risk trial membership to Income Intelligence, click here.

What We're Reading...

- The stock market is hitting new highs. Is it time to sell?

- Something different: Using cash instead of credit can save you big on holiday shopping.