Wall Street's earnings slump may be behind us...

If you pay attention to the financial media, you likely get a lot of conflicting reports about the economy.

Take Starbucks (SBUX), for instance. Shares of the coffee chain recently plummeted after it reported earnings for its most recent quarter. Net income dropped 15% compared with a year ago, while sales fell 2%. Starbucks reported a sharp slowdown in folks visiting its stores and investors punished the stock.

Many analysts look at a company like Starbucks and base consumer spending off it. After all, when times are good, folks are more likely to go into a Starbucks and pay for a premium coffee.

But you could also look at a company like Alphabet (GOOGL), which had a monster quarter. The company blew past expectations for both earnings and sales. Flush with cash, Alphabet will start paying its first ever cash dividend. The board also authorized a stock-repurchase plan up to $70 billion.

I (Jeff Havenstein) could go on and on with conflicting reports from different businesses. It's tough to figure out how our economy is doing by cherry-picking the results from any one company.

Overall, though, corporate profits are projected to be strong in the coming quarters. Analysts have liked what they have seen in recent months...

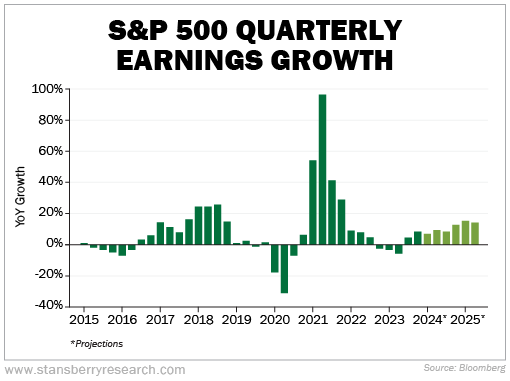

The chart below looks at the S&P 500 Index's quarterly earnings growth since 2015. You'll see that profits did fall for three consecutive quarters starting at the end of 2022. But projections going out to 2025 are optimistic. Take a look at its year-over-year growth...

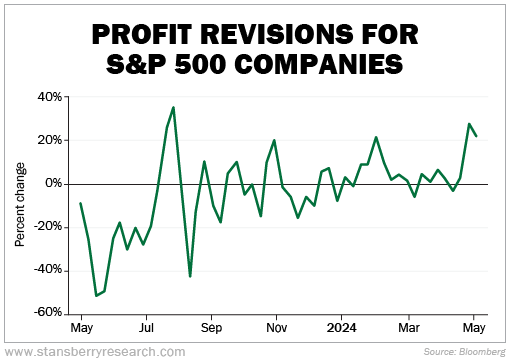

Analysts drove up earnings projections at the fastest pace in the past two years. Bloomberg reports that the cyclical sectors like energy and materials have helped lead this optimism.

For the most recent quarter – January through March – expectations called for 3.8% earnings growth. But with the majority of companies already showcasing their results, the actual growth rate will be around 7.1%.

Bloomberg also highlighted an indicator known as earnings-revision momentum. This looks at the direction of changes to expected per-share earnings over the next 12 months. And the indicator is near its highest level in nearly a year...

This is no doubt a bullish sign for the market going forward. Either previous forecasts were too low or we're seeing companies being able to post better margins.

We'll get an even better picture of how accurate these forecasts are soon...

Walmart (WMT) reports its quarterly results tomorrow... and I will be paying close attention.

Consumer spending makes up about 70% of our economy. If you want to know how the consumer is doing, check to see if folks are out spending at their local Walmart.

After Walmart reports its first-quarter earnings, we'll also hear from Target (TGT) the following week. That will also give us another signal of how the consumer is faring with inflation and higher interest rates.

My own experience tells me that these two stores always seem to have crowded lines. But we'll get the full story over the next week.

While analysts are getting more optimistic about corporate America, our colleague Joel Litman is telling a different story... In short, more than 3,000 stocks will be impacted in just the next six weeks – including many of the Magnificent Seven stocks.

If you haven't heard Joel's latest presentation, click here to learn more.

What We're Reading...

- Something different: Clinical trial for AI depression treatment.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

May 15, 2024