We've all felt the heartbreak of the "one that got away."

Few things are more intoxicating than a new love. The feeling when every facet of your object of interest inspires deeper affection. Everything seems just perfect.

But sometimes, it just doesn't last. Maybe you were in different stages of life. Maybe the cost to get together was too high. Or maybe you were just too stubborn to take a risk.

And you'll spend the rest of your days wondering what may have been.

Sure, you may be happy with what you've got now and where you ended up... but there was always the possibility of a different result if your paths had crossed differently.

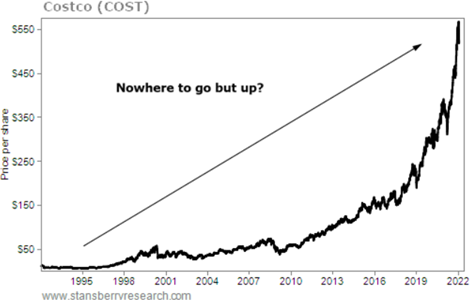

For me, that was Costco Wholesale (COST).

Since its early days, the discount retailer has been a near-perfect business. Customers and employees loved it. It offered low prices and a pleasant experience. I even wrote about its "Treasure Hunt" program and recommended becoming a Costco member back in 2008.

And Costco managed all this with reasonable profit margins and very little debt.

It looked like an investment no-brainer. But I was too stubborn. For nearly the entire time Costco has traded, its shares have been expensive. Costco has nearly always traded for 20 times earnings or more – except for a dip after the financial crisis.

That's expensive for a discount retailer. And every time we review Costco's business, we're put off by its priced-for-perfection valuation.

Even now, it trades for a price-to-earnings ratio of 45. That means if you bought the whole company today and collected all its earnings, it would take you 45 years to break even.

But here's the thing...

Buying at almost any time would have been highly profitable.

Perhaps you have a "stock that got away" that nags at you. Maybe it's Amazon (AMZN) after the dot-com boom or Home Depot (HD) before the start of the pandemic...

Whatever it is, it's heartbreaking.

But that's the challenge of investing. If you want to buy a perfect stock – the one that's profitable, growing, destroying its competition, and delighting customers – you've got to pay a premium price.

And almost everything seems expensive today...

With markets at all-time highs, valuations stretched, and fears of rising inflation, it's tough to know what's worth investing in now.

If stocks crash this year, you don't want to be stuck paying a premium. But you also don't want to miss out on potential moneymaking opportunities.

Last night, my colleague Greg Diamond issued a serious warning... A massive event in 2022 could wipe out all of your gains from the last two years... Or it could help you potentially double your money 10 different times.

According to Greg, the coming months could make or break your retirement.

Greg's strategy has nothing to do with buying stocks, bonds, or any other conventional investments. You only need 10 stocks to pull it off, without touching a single share along the way.

If you want to be prepared for whatever comes next, click here for all the details.

What topics do you want to see us cover this year? Send your suggestions to [email protected]. Now, on to this week's Q&A...

Q: What's the difference between a hard stop and a trailing stop? How do I know which to use? – S.N.

A: Hard stops use a set price or percentage below the purchase price. If the stock falls to that amount at any time, you sell.

Let's say you purchase Stock X at $10 and set a 25% hard stop at $7.50. No matter how high Stock X's stock price rose, you would sell once it fell to $7.50 and not before.

Trailing stops use a percentage below the purchase price, but they don't stay the same. As the share price rises, the trailing stop follows.

Let's say you chose a 25% trailing stop... For Stock X, you'd start out at $7.50, the same as a hard stop. But if Stock X rose to, say, $12, your trailing stop would rise to $9.

Using a hard stop means that if the stock does move higher and you have big gains, you can ride through some volatility without getting stopped out. On the other hand, you can give back all your gains on a big winner before triggering your stop.

If you follow a trailing stop, you'd have to sell your winners much sooner – a hard stop means we hardly ever sell winners early. And if a stock does fall 25% from our entry price, it either means we were wrong about the stock or we had horrendous timing.

Picking the right kind of stop can be tricky. Generally, we recommend hard stops for income-generating investments (stocks we plan on holding for the long term) and trailing stops for growth investing.

Q: Instead of having six months of bills stashed in a money market, any suggestions for a safe place to stash that money with a better return? – R.T.

A: It's true that your emergency fund won't make much in the accounts like money-market funds or certificates of deposit. But that's not the point of setting aside savings...

Your emergency cash fund is there to provide a safety cushion in the event of unforeseen emergencies, especially the loss of your source of income. An emergency fund needs to be liquid since you won't know when you'll need it. And you don't want to pay taxes or fees to get to it.

Let's look at municipal bonds as an example... One of the problems with keeping your emergency fund in munis is that you could pay some tax, depending on the muni fund and where you live. Many municipal bond funds are exempt from federal taxes, but not always. And you might have to pay state and local taxes, and maybe even capital gains tax.

And, after all that, you might have to wait a few days to get your money.

If you're looking for a place to push cash (after you've put your emergency fund aside), and you're looking for something safer than individual stocks, a good gold fund is a great place to start. (Something I've recommended for years in my monthly advisories – Retirement Millionaire.)

Your emergency fund and your portfolio are essential pieces of wealth planning... but keep them separate.

Editor's note: Our offices are closed for Martin Luther King Jr. Day next Monday. Expect your next Health & Wealth Bulletin issue on Tuesday, January 18.

What We're Reading...

- Did you miss it? Six investing lessons we can learn from poker.

- Something different: Americans are choosing work over college.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

January 14, 2022