Doc's note: Too many investors ignore the important role cash plays in their portfolio. It can give you a leg up when there's an opportunity for big gains, or it can protect your wealth when things go wrong in the markets.

Right now, Porter Stansberry is seeing major cracks in our financial system. So today, we're sharing an excerpt from his October 20 newsletter at Porter & Co. that tells you everything you should do with your cash to avoid catastrophe...

Everyone remembers the losses.

Between October 2007 and March 2009, the S&P 500 Index fell 58%, representing one of the worst declines in U.S. markets ever.

Yet even this figure doesn't fully describe the pain most investors experienced. Many individual stocks plunged much more – including those of some of the highest-quality, capital-efficient companies we love at Porter & Co.

Notable examples include Microsoft (which fell 60%), Apple (62%), Google (67%), Adobe (68%), and Starbucks (which fell a gut-wrenching 83% peak to trough).

These declines scarred a generation of investors, leading many to swear off stocks for years afterward.

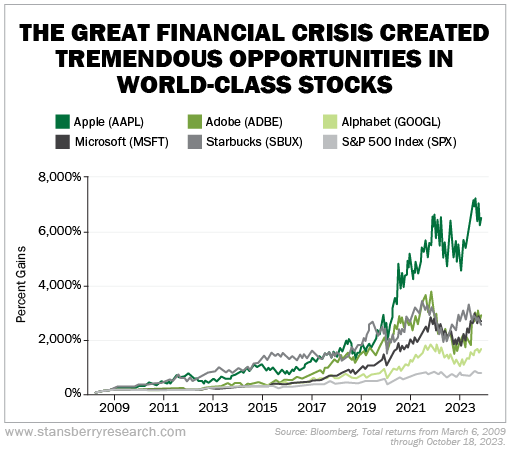

However, like other notorious bear markets, the great financial crisis also created generational opportunities in these very same companies. Each of them briefly traded at historically low valuations far below their long-term average price-to-earnings (P/E) multiples.

For example, in early 2009, investors had the opportunity to buy shares of Microsoft for as little as 8 times earnings, versus its long-term average valuation well above 20.

Those who did could've earned total returns of 2,800% – or more than 27 times their money – to date. That represents an annualized return of 26% on Microsoft, even after accounting for the big decline in tech stocks last year.

Similarly, investors could've purchased shares of Google for 16 times earnings (which are now up 1,600% to date, or 22% annualized), Starbucks for 11 times earnings (now up 2,700%, or 26% annualized), Adobe for 10 times earnings (now up 3,100%, or 27% annualized), and Apple for 11 times earnings (now up 6,700%, or 33% annualized).

For comparison, the S&P 500 returned 740%, or 16% annualized, over the same period – well above its long-term annualized return of around 10%.

These are life-changing rates of return on par with the greatest investors in history.

Of course, taking advantage of these kinds of opportunities is easier said than done.

It requires more than just the discipline to buy when most investors are selling – to "be greedy when others are fearful," as Warren Buffett famously said. You must also have the cash available to do so.

Unfortunately, most folks tend to remain fully invested until a crisis is already underway... and only begin to raise cash in earnest after stocks have suffered significant declines.

This behavior is doubly harmful... It locks in big losses on the stocks you sell too late. And it leaves you with relatively little capital to take advantage of new opportunities (assuming you aren't too traumatized to get back in).

The key to avoiding this fate is to raise cash before the real trouble begins.

With ominous economic "storm clouds" gathering on the horizon, we believe now is the time to do so.

For investors who don't already hold a meaningful portion of your portfolio in cash – somewhere between 25% and 50% generally makes sense for most folks right now – we urge you to consider raising some soon.

Like during the great financial crisis, we expect the coming downturn will give investors the rare opportunity to buy world-class businesses at fire-sale prices. And the cash investors hold today is what is needed to earn Buffett-like returns of 20% to 30% annually, with very little risk, for years, even decades, to come.

How to Raise Cash

The first step for investors is to take a close look at every position they own and ask one simple question: "Am I comfortable holding this asset through a financial panic?"

If the answer is not a resounding "yes," the decision is easy: Sell and raise cash now.

We recommend paying particular attention to speculative companies, those with significant exposure to cyclical areas of the economy – like housing, commercial real estate, and industrial commodities – and those with significant debt burdens or interest-rate risks that are likely to struggle under higher financing costs.

These kinds of companies are likely to decline the most in value during any crisis and in some cases may not survive at all.

For many investors, simply ridding their portfolio of riskier companies may be sufficient. However, those with a large percentage of their portfolios in equities may need to do more.

In this case, investors might also consider selling lower-risk stocks that have underperformed in their portfolios. These stocks are likely to continue to underperform in a crisis. Selling them now could allow you to harvest tax losses that can be used to offset gains in other investments.

As a general rule, we don't recommend selling "forever stocks" – particularly those previously purchased at bargain prices or those with significant unrealized gains.

We've told our readers before that when you've invested in a high-quality business capable of producing a good return on your capital, selling is almost always a mistake. Doing so is likely to trigger taxable gains, and you aren't certain to get the chance to buy back in at a better price.

That said, if investors must sell these stocks, we would recommend focusing on those trading at inflated valuations.

For example, while Nvidia (NVDA) is a world-beating, capital-efficient stock, it reached nosebleed prices during the AI mania this year. And even after a pullback this summer, the stock is still trading at a P/E multiple above 100.

Even the best businesses can be terrible investments if you buy them at the wrong time. And at these elevated prices, Nvidia is likely to produce dismal returns for investors over the next several years, even if its underlying business does well.

How to Hold Cash

Here in the U.S., "cash" generally refers to the U.S. dollar, either held as physical bills or as deposits at a bank or other financial institution.

However, it can also refer to "cash equivalents" like money-market funds and short-term debt like U.S. Treasury bills.

For years, these various forms of cash were basically interchangeable. When the Federal Reserve slashed interest rates to nearly zero following the great financial crisis, the yields in traditional bank accounts, money-market funds, and Treasury bills dropped to virtually nothing.

But that began to change last year as the Fed aggressively hiked interest rates.

Today, U.S. Treasury bills offer real yields above inflation (and nominal yields of around 5% or more). For the first time in 15 years, investors placing funds in these vehicles are no longer penalized for holding cash.

This makes T-bills – particularly those maturing in 90 days or less – an ideal place to hold cash today.

The best way to buy T-bills is from the government itself, through its TreasuryDirect website. While the website is a bit clunky, this is the safest way to own T-bills, especially if you're holding a substantial amount of cash.

If you'd rather not deal with the hassle of buying T-bills through TreasuryDirect – or you want to hold them in an IRA or other tax-advantaged account – there are a couple of next-best alternatives.

One option is purchasing T-bills through your brokerage account. Most major brokers – including Fidelity, Vanguard, Charles Schwab, and TD Ameritrade – allow you to buy newly issued T-bills with no fees.

However, it's worth noting that the minimum purchase through a brokerage is typically $1,000, versus a $100 minimum through TreasuryDirect. This option also carries a small degree of counterparty risk (via your brokerage), so it's a good idea to keep balances below the $500,000 Securities Investor Protection Corporation ("SIPC") limit per account. (The SIPC guards against the loss of securities and cash at troubled financial institutions.)

A second option is gaining exposure to T-bills through an exchange-traded fund ("ETF"), such as the iShares 0-3 Month Treasury Bond Fund (SGOV) or the SPDR Bloomberg 1-3 Month T-Bill Fund (BIL).

These funds are the most convenient way to own T-bills. However, they currently offer slightly lower yields (5.20% and 5.25% annualized, respectively) than the 5.40%-plus you'd earn holding short-term T-bills directly. And they also charge a small annual fee (currently 0.07% and 0.135%, respectively) for this convenience.

Like all ETFs, these funds technically carry a small risk of capital loss. So it would be wise not to hold all your cash in a single fund if you choose this path.

Money-market funds are also an option. Many funds are currently paying yields at or near those of T-bills.

However, like ETFs, money-market funds often charge annual fees and carry some risk of capital loss. In addition, some of these funds may invest in riskier debt obligations outside of the Treasury market.

In this case, investors should be sure to look for lower-cost funds that are invested primarily in short-term U.S. Treasurys, such as the Vanguard Treasury Money Market Fund (VUSXX).

And again, it's never wise to put all your eggs in this one basket.

Finally, a handful of online banks and financial companies – such as SoFi, Discover, and Marcus by Goldman Sachs – offer savings accounts yielding 4% or more. While these yields still lag T-bills, they're well above those available at most other banks.

Given the current risks to the banking system, we prefer T-bills to these accounts. But for those who do decide to hold cash in one of these banks, they should be sure to keep balances within the $250,000 U.S. Federal Deposit Insurance Corporation's account limit.

How to Protect Your Cash

While we're thrilled to earn a real yield on our cash for the first time in years, we also recognize that the U.S. dollar – like all fiat currencies – is inherently unstable and doomed to collapse. And it's possible that collapse is already underway.

To guard against this risk, we recommend holding a small portion of your cash in physical gold bullion and bitcoin.

You don't need a lot... Putting 5% to 10% of your cash in gold and 1% to 5% in bitcoin is plenty to protect you from the loss of value in your cash over time, while allowing you to patiently wait for the generational opportunities in stocks that are likely in the months ahead.

Good investing,

Porter Stansberry

Founder, Stansberry Research

Editor's note: Last week, Porter went on camera to issue one of the most important warnings of his career. He also shared the straightforward money move he believes you need to make immediately.