During his 12 years in office, President Franklin D. Roosevelt became famous for his fireside chats.

These chats were a way for Roosevelt to directly address the American people's fears and ease their worries. In his first one on March 12, 1933, Roosevelt went on the radio and discussed the U.S. banking system, why banks collapsed, and how the country was pushing through the Great Depression.

The fireside chat was an instant success – so much so that Roosevelt would go on to do 30 more of them. The only problem was that the conversation was completely one-sided...

Then in 1942, a radio program called "Dear Mr. President" finally changed that. It gave average Americans a chance to respond to Roosevelt. Through audio recordings taken from around the country, people asked questions regarding issues like the safety of Alaska or shared their personal struggles of living during wartime. Roosevelt could listen in and later address his constituents' concerns in his next fireside chat.

The radio provided a way for the president and American citizens to interact that had never been done before.

In the nearly two decades I've been in the publishing business, I've always loved hearing from folks. Over the years, some of you have said your favorite issues are the Friday Q&As. So today, we're doing our own Dear Mr. President and getting straight into some of the questions we've gotten recently...

As always, keep sending your comments, questions, and topic suggestions to [email protected]. My team and I read every e-mail.

Q: I believe I have my emotions out of the picture by using adviser-recommended trailing stops to avoid holding onto anything I'm attached to or like too much to sell when I should. Is this the best strategy in your opinion? Thanks. – M.T.

A: Thanks for your question, M.T. If you're following any stop, you're already a step ahead of most folks. It's the best way to protect yourself against huge losses because it removes your emotions from the equation and keeps you from clinging to a loser.

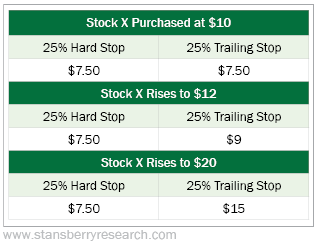

Stops come in two varieties: hard and trailing. Here's a look at how the stop types differ:

As stock X's price rises, the trailing stop follows it up, but the hard stop stays the same... no matter how high the share price rises. (Of course, the trailing stop doesn't follow the stock down. So if shares fall to $8 right after you buy them, your hard stop and your trailing stop both remain at $7.50.)

The kind of stop you should use depends on what you're investing in and what your goals are. Here at Stansberry Research, our editors will recommend different stops for different portfolio holdings – based on a given strategy or risk profile.

For example, I often recommend a 25% hard stop in my Retirement Millionaire newsletter, because our strategy is to let our winners ride for the long term, without needing to sell during a period of ordinary market volatility.

However, I recently switched some of my long-held winners to trailing stops to protect our gains. And sometimes I'll recommend a wider 35% stop to give a volatile stock more room to bounce around.

Meanwhile, our corporate affiliate TradeSmith goes even further and calculates a custom trailing stop for each stock based on its own volatility.

The further your stop loss is from the stock's current price or your entry point, the less likely you are to stop out... but the more you'll lose if the stock does reach that point. This all comes down to your own risk profile.

Now, I'm not entirely sure what you mean by an "adviser-recommended trailing stop"... But whether you're listening to a Stansberry editor, TradeSmith, or someone else's stop-loss recommendation, the most important thing is to stand by your choice.

Whichever stop you pick, sell when your stop is triggered... no questions asked.

Q: That was a good article you wrote about tomatoes. There is a tremendous difference in taste of tomatoes grown in a greenhouse and those grown outside in the hot open air (homegrown tomatoes). Is there a difference in data you quote for the two? Why do the homegrown tomatoes taste better to most people? – E.W.

A: We're glad you enjoyed that issue, E.W. As a tomato lover, I agree that the best ones always seem to come straight off the farm (or from your own backyard) in summer – the peak season for a flavorful harvest.

As for why tomatoes grown outside taste better, the leading theory has to do with money. Because greenhouses are more expensive to maintain, farmers might sacrifice flavor somewhat to concentrate on higher yields.

Of course, other factors may be at play, depending on which supplier you're getting the greenhouse tomatoes from...

For one, tomatoes that travel a long distance to reach you may get picked before they're ripe so they don't spoil in transit... meaning they wouldn't hit their flavor peak. And second, growing conditions can vary wildly and make a big difference. This includes everything from soil quality to how much water the tomatoes get (overwatering can dilute the flavor).

However, based on the studies we've seen, outdoor-grown and greenhouse tomatoes seem to be mostly evenly matched when it comes to nutritional value... So greenhouse tomatoes are just as good for you, even if they may not taste as good.

Overall, I like to grow my own and recommend you do the same if possible. By controlling the environment and picking my tomatoes at the ideal time, I ensure I get the best-tasting results.

What We're Reading...

- Listen to the Dear Mr. President broadcast.

- Something different: The answer to how often you should wash your towels.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

January 17, 2025

Editor's note: Our offices are closed Monday, January 20, for Martin Luther King Jr. Day. You'll receive your next issue of the Health & Wealth Bulletin on Tuesday, January 21.