My boss, Doc Eifrig, likes to have a bit of fun at the expense of millennials... And I (Jeff Havenstein) will admit, it's often warranted.

But folks in their mid-twenties to early thirties haven't had it easy...

They paid a fortune to get educated, and now, when they finally establish their careers and start to settle down, the prices of homes are at record highs.

Already drowning in student debt, they have to take on even more debt to simply buy a house.

The median price of a home sold in the U.S. has increased from $322,600 in the second quarter of 2020 to $428,700 earlier this year. That's a 33% jump in roughly two years.

A few of my friends who have been house hunting lately can't find anything on the market at a reasonable price.

They ask me all the time if they should just take the plunge now and purchase at elevated prices... or wait until housing prices cool a bit.

A lot of Americans wonder the same thing. They see the growth in housing and think prices have to come back down to earth at some point. Asset prices can't go in a straight line up forever after all.

An article on Bloomberg sparked my interest the other day. The title was 'Coast to Coast' Housing Correction Is Coming.

In short, Mark Zandi, chief economist at Moody's Analytics, says that U.S. home prices will likely drop in the most overvalued markets. But this correction will fall short of a crash.

Zandi gives three reasons why we won't see a 2008-like crash. Here's his reasoning from the article...

- Housing vacancy rates are at an all-time low. Vacancy rates reached historic highs before the financial crisis more than a decade ago that led to the Great Recession.

- The quality of mortgage underwriting is high. Most loans are "plain vanilla" 30-year or 15-year fixed-rate products, with no sign of the subprime or negative amortization activity that precipitated the foreclosure crisis.

- While some markets are marked by speculation and flipping, nationwide the evidence for flipping is low.

If you've been a longtime Health & Wealth Bulletin subscriber, you'll know that we've covered housing for years.

Today, we're at an interesting moment. Inflation is tightening a lot of consumers' wallets, and mortgage rates are on the rise. It's easy to think housing is in trouble.

I agree with Zandi, however, that we won't see a collapse in the housing market.

Back in the mid-2000s, we saw folks getting approved for homes they couldn't afford. Today, people with actual jobs and credit history are the ones buying.

In a recent Fannie Mae report, first-time home buyers had an average credit score of 746. And the average score across all home buyers, not just first-timers, was 754. It takes a minimum credit score of 620 to qualify for a conventional mortgage... This tells us that quality buyers are the ones bidding on houses today.

Also, there was an abundance of house flipping back in the mid-2000s. People were trying to get rich quick, so they speculated on housing prices.

Today, the people who are buying houses aren't trying to make a profit. Instead, they are families looking for more space.

Last year, only 5.9% of home sales were flips. That's about the same percentage as 2017 and 2018.

I think it's unlikely we'll see a collapse in housing. The signs of a bubble and excessive greed just aren't there.

Besides, there's one factor that proves the point... And it's the reason I don't think we'll see housing prices come down much at all. Rather, we'll simply see the pace of growth slow...

The U.S. needs more homes.

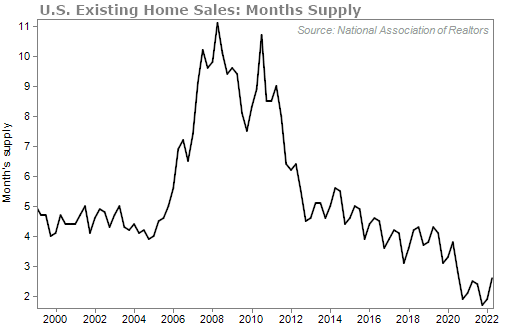

Doc has pointed this out since 2017. We have a severe scarcity of homes for sale. Take a look...

We've been talking about this for years. And even though a lot more homes have been built over the past 12 months, we're still in need of more.

A tight supply should help keep prices high – even if the pace of growth does slow a touch.

As I've told my friends who have been house hunting, it's unlikely you'll see prices come down in any significant way.

What We're Reading...

- A 'coast to coast' housing correction is coming.

- Fannie Mae's report on the cost of housing.

- Something different: ARK Invest's Cathie Wood says the U.S. is already in a recession.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein with Dr. David Eifrig

June 29, 2022