It's no secret that Social Security is living on borrowed time...

Without congressional action (or some sort of miracle), the money is going to run out. That means the roughly 20% of U.S. adults on Social Security will stop getting government checks.

It's a scary thought, especially for younger folks.

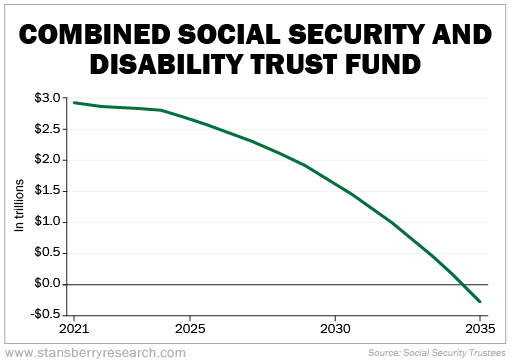

Even worse, in March, the program's trustees came out with new projections that the combined retirement and disability fund's reserves will run dry in 2034. That's a year earlier than previously projected.

Of course, this is mainly due to one big reason: People are living longer.

Average life expectancy for folks in 1900 was only 47 years.

Think about that... I don't know about you, but I'm glad I wasn't around then. I hadn't come close to living a full life at 47.

Not so long ago, in the 1960s, the idea that everyday folks would regularly live deep into their 70s was new and outrageous.

Folks used to retire at 65 and live for five to 10 more years. For that reason, they didn't have to have much savings.

Today, the Centers for Disease Control and Prevention pegs average life expectancy at 76 years... This is one of the greatest achievements in human history. Advances in medicine have come a long way in recent decades. And I do believe they will take an even bigger leap in the years to come.

With life expectancy expected to rise further in the future, we have to deal with the reality that the Social Security Administration's trust fund could and most likely will be empty.

Now, many analysts are betting that legislators will eventually move to shore up the program. But we've long preached that you can't rely on the government. You've got to take control of your own finances if you want to live a comfortable retirement.

You need to have your own nest egg and be confident that it could get you through retirement.

Throughout the year, I've written to you about the importance of dividend-paying stocks, selling options to generate monthly income, diversification, and even the qualities to look for in winning stocks.

You should think about all of these as you prepare for your own retirement.

The good news for folks already in retirement is that my colleagues Brett Eversole and Matt McCall are calling for higher equity prices in the near future. They believe this current bull market is just getting started... and you can create your own Social Security income from gains in the market.

Brett and Matt think this new bull market can last. And if you didn't hear their arguments yet, I suggest you do so by clicking here.

What We're Reading...

- Will Social Security run out of money? Here's what could happen to your benefits if Congress doesn't act.

- Something different: Libya floods wipe out quarter of a city.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

September 13, 2023