You don't often hear advice to invest in boring businesses...

Investors have a desire to find new and exciting companies that could one day revolutionize the world. After all, these are the stocks you can use to impress your buddies.

But most great investors stick to boring. While they won't make front-page headlines from the stocks they buy, their returns will.

Investing legend Peter Lynch is the perfect example of this...

Lynch, the author of investing must-reads like One Up on Wall Street and Beating the Street, is the former manager of the Magellan Fund at Fidelity. Between 1977 and 1990, his fund outperformed the market by a staggering 29% per year annualized. That's unheard of.

How did he do it? By investing in what he knows... and investing in boring companies. As he put it:

The perfect company has to be engaged in a perfectly simple business, and the perfectly simple business ought to have a perfectly boring name. The more boring it is, the better.

Our very own Thomas Carroll, analyst for my Prosperity Investor newsletter, agrees. But he takes it a step further...

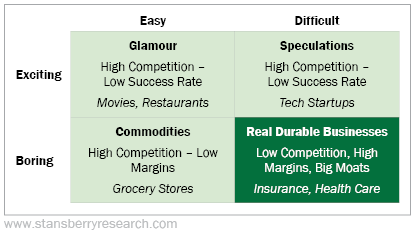

You want a boring business... but you also want that boring business that does something that is difficult. Thomas explained why in a November 2021 issue of Retirement Millionaire...

Let me tell you, the best companies to invest in are those that excel at something boring and difficult.

If you break down businesses by whether they are boring or exciting, and by whether they are easy or difficult, the best quadrant to be in is the boring, difficult sector.

The sexy sectors get tons of competition and are overloaded with capital. Try making money in fancy restaurants or by funding movie production. You'll get handed your shirt.

At the same time, doing easy things may work, but it's easy for your competitors as well. So you get low margins and a constant struggle for survival.

But boring and difficult means steady, profitable business.

Putting boring and difficult together you get – and you might have guessed it already – health care companies.

If you google "defensive sectors," it pulls up utilities, consumer staples, and health care. Defensive means boring in a lot of investors' minds.

For whatever reason, health care is lumped in the boring category – even though many companies in the space are coming up with new technologies and medicines that will change our lives.

Still, they are far less exciting than technology or consumer discretionary stocks.

Health care is also one of the most complex, difficult, and misunderstood industries you will find. No one quite knows what really goes on behind the scenes from the time you go see a doctor and end up receiving medication. There are a lot of moving parts.

Health care checks both the boxes of boring and difficult. And in case you haven't been reading Health & Wealth Bulletin over the past few weeks, I'm extremely bullish on the sector.

In fact, I haven't pounded the table on an investment this hard in some time.

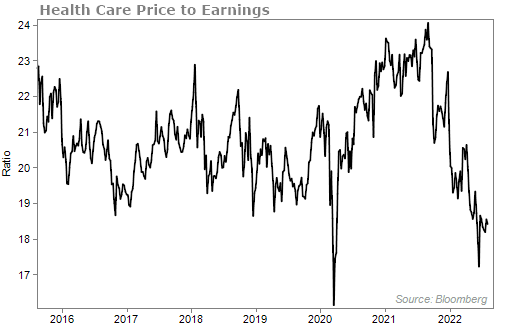

The time to buy is now... The sector is dirt cheap.

The chart below shows the price-to-earnings ratio of the entire health care sector. It's trading near its lowest valuation over the past few years. Take a look...

Thomas has teamed up with me in Prosperity Investor to recommend the best health care stocks in the industry. We both couldn't be more excited.

Our first official health care recommendation will come out tomorrow. And because we believe it's such a great opportunity, we are opening the window to become a Prosperity Investor subscriber for a short time.

If you haven't already, I encourage you to watch this presentation on why I believe you should invest in health care stocks.

What We're Reading...

- The Peter Lynch approach to investing in "understandable" stocks.

- Something different: People are turning back to cash as prices rise.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

August 10, 2022