We've all heard the horror stories...

The thought of outliving your money has probably kept you up at night... Maybe you're wondering if you'll be able to retire. Or, maybe years after you've retired, you find you've run out of money and are forced back to work...

This nightmare happened to Jerry...

Jerry thought he had everything figured out for his retirement. He retired in 2000 with a nest egg of $1.5 million – and most folks would agree that's a sizeable portfolio and could very well last during his retirement.

His plan was to take out 4% at a time and live off that. The only problem is that 4% was not enough. He still had $240,000 on his mortgage and two car payments. And his daughter got married shortly after he retired, so he had to reach into his account once again to make sure she had her dream wedding and a nice honeymoon.

In fact, it's quite common to spend more in retirement than you did working. One study from JPMorgan Asset Management found that median spending by its credit-card customers one to two years before retirement was $43,000. That figure rose to about $45,000 in the first year or two of retirement.

Free from work, retirees want to get out and enjoy themselves. They spend on things like travel and home renovation.

Getting back to Jerry... He also made a big purchase in his early retirement years. He bought a beach condo in Florida (as a lot of retirees do).

Underestimating just how much he would spend while in retirement, his $1.5 million nest egg quickly evaporated. Just a few years after retirement, he only had $238,000 and a lot of years left to live.

You probably know how this story ends... Jerry was forced back to work. Just to afford his bills, he worked as a door greeter at Walmart.

Jerry's story isn't uncommon. You likely know someone in your life who felt prepared for retirement only to be struggling just a few years later.

Maybe it was a relative who saw their portfolio get cut in half back in 2008. And unlike the market crash of 2020, the recovery from the housing bubble was long... and painful. Many retirees didn't recoup their capital fast enough to avoid reentering the workforce.

It's a sad truth, but many Americans underestimate how much they'll need for retirement. Relying on Social Security won't cut it.

According to the World Economic Forum, the average American is expected to run out of savings at some point during retirement. The report also states that most retirees in the U.S. will likely outlive their savings by around eight to 10 years – assuming a life expectancy of age 85. And we know that many of us are going to live past 85.

During your retirement, you want your money to be working for you and growing. That's why it needs to be invested. But the threats to your nest egg today are real.

First, there's the possibility of a market crash.

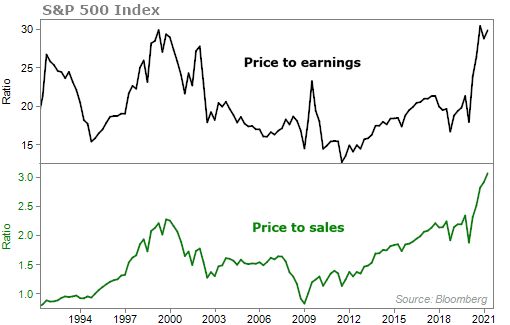

Stocks are trading at all-time-high valuations. The S&P 500 Index is currently trading for 30 times earnings and 3 times sales. The last time stocks were this expensive was right before the dot-com bubble burst in 2000...

Given how expensive stocks are today, some retirees might be too afraid to put their money into the market. But where else can you put your money?

There's no yield to be found in bonds. A certificate of deposit ("CD") is paying less than 1%.

Also, fixed-income investors might be crushed if there is high inflation over the next few years, which I expect there will be.

Inflation erodes the purchasing power of a bond's future cash flows. Goods and services become more expensive, but your income stays the same.

Inflation is a real concern for retirees, and it's something that many Health & Wealth Bulletin subscribers have been writing in about.

It's a troubling time to be retired or getting close to your retirement. There's a lot that can go wrong.

Fortunately, there are ways to protect yourself.

That's why, next week, I am sitting down with my right-hand man and senior analyst Matt Weinschenk for our first-ever (free) retirement event.

We'll reveal how the first domino just fell in what may be the greatest retirement crisis in modern history. And your money may already be in jeopardy.

We'll also discuss:

- The safest places to put your money now

- What to do with your 401(k)

- How to protect yourself against soaring inflation

- And much more...

And if you sign up for this retirement wake-up call, I'll send you a free report on how to protect your wealth from Big Government, Big Banks, Big Pharma, Big Everything. It's just the first of many free bonuses I've prepared for you.

Click here to reserve your spot and get your free report.

What We're Reading...

- Did you miss it? The biggest concerns retirees face today.

- Something different: The death of retail continues.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

June 15, 2021