You can learn a lot from office "water cooler" talk...

Water cooler talk is when employees take a break from work and hang around the water cooler talking about various things on their minds.

We don't have a water cooler in our Baltimore headquarters, but the kitchens are where you get to hear all of the latest office gossip.

Over the years, I've made it a habit to visit the "water cooler" in the Stansberry office often. I like to know what's going on in the company... stuff that I won't be able to read in company memos. I've even been known to hold the impromptu meeting in the kitchen.

I've taught my research staff members to pay attention to water cooler talk. I want them to know what's going on in the marketing department, in the technology department, in the customer service department, you name it. I always tell them, "You can't make the company better if you're stuck in your own little bubble."

So I like when one of my team members tells me something they overheard at the water cooler. And just the other day, the conversation was about me...

You see, I just spent a week in China at the Stansberry Spring Summit with my friend and business partner Steve Sjuggerud, along with several dozen Stansberry members.

I was fortunate enough to attend last year's summit, and my experience this time was just as memorable. The cleanliness of the cities and the much lower pollution blew me away. (Although it might be a while before I eat roasted duck again... I ate duck for eight days straight.)

And again, we heard from lots of experts on investments in China, and I gave some perspectives on the U.S. During my presentation, I talked about everything from inflation to bitcoin to China.

My colleagues back in Baltimore were able to watch each of the presentations and, it turns out, one point I discussed became a hot topic at the office...

Right now, there's a lot of focus on America's trade war with China, the country's slowing growth, and how much of a beating Chinese stocks have taken recently.

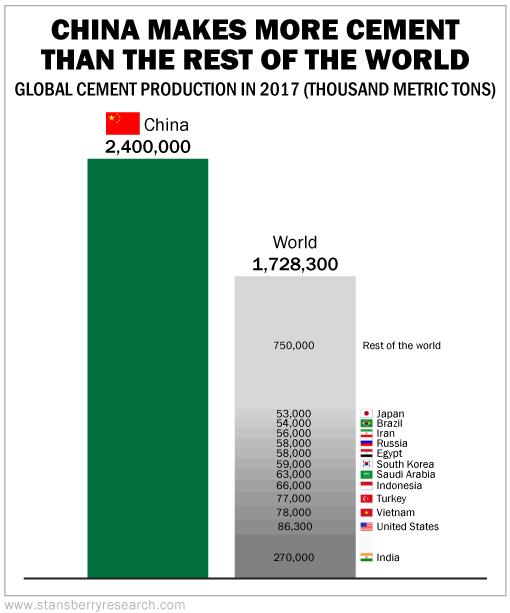

But I wanted people to focus on the stories more Americans are missing. Like cement...

The next day, the above chart was the source of water cooler talk.

My researcher overheard an employee say how this one fact amazed him... "Wow, I can't believe that China makes more concrete than the entire world combined. That's insane."

I work for one of the largest independent publishers of financial research in the world. And we employ some of the brightest minds in finance. But even we can get stuck in our own U.S.-centric bubble. We don't see the real story...

Too many folks are focusing on the sensational headlines the mainstream media keeps pumping out. The reality is, everything you're seeing about China right now probably makes you nervous.

After spending a week in China for the second straight year, my opinion on China is completely different than it was five years ago. And that week let me see what's really going on in China, not what the headlines back home were telling me.

Most people have the wrong impression about investing in China right now... and they're about to miss a tremendous moneymaking opportunity by letting the mainstream press scare them away.

And that's why, tomorrow night at 8 p.m. Eastern time, Steve is holding an Emergency Briefing. He's not spooked by what he sees on the news. Instead, he's using his "boots on the ground" experience to give hundreds of readers the chance to make hundreds of thousands of dollars in China.

Tomorrow night, Steve will discuss the crucial events currently taking shape in the Chinese markets. He'll also give away one trade he sees setting up for a big potential rally...

If you have any money in Chinese investments, you need to tune in. If you have any money in companies that sell in China, you need to tune in. And if you like to make money by betting against the crowd, then you certainly need to tune in.

I know I will be.

Click here to reserve your spot.

What We're Reading...

- The next flood of cash hits China tonight.

- Something different: Inside the relationship that unleashed Steph Curry's greatness.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

May 29, 2019