People love to procrastinate. It's human nature.

And it's never more apparent than this time of year... tax season.

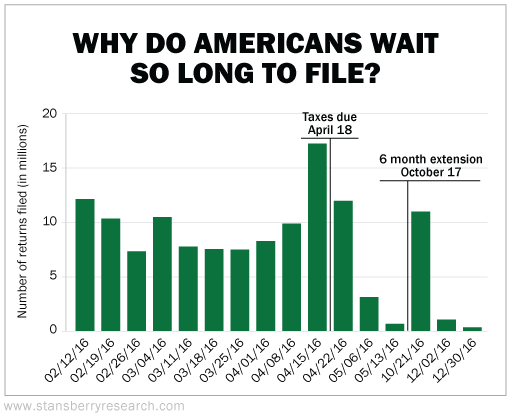

The IRS documents when it receives tax returns. And each year, the procrastination spikes within two weeks of the due date. Just take a look at the spike in returns filed the week of April 18 last year.

If you put off doing your taxes, you aren't alone.

The reason for delay has to do with psychology. Some folks work better under the pressure of a tight deadline... Others might procrastinate because they don't want to make mistakes, and think that doing nothing is "safer." They might also be worried about how much they'll owe... They think the longer they remain ignorant, the better.

In addition to the rush to file within those last two weeks, about 10 million Americans file for extensions each year. That gives them an extra six months to file.

And although this might sound tempting, you need to understand this one rule: You must pay any owed taxes by the April Tax Day even if you have an extension.

If you don't pay your estimated taxes by the April date (Tax Day is April 18 this year), you'll face penalty fees and interest on top of what you owe.

I love doing my taxes and always encourage my readers to do them sooner rather than later. That's because the longer you wait, the more vulnerable you are to tax fraud.

Filing early helps beat would-be tax-refund thieves. (It also means getting your refund faster.) These are folks who submit fraudulent tax forms to the IRS in your name and collect your refund check. The good news is that the number of these scams fell last year, but still hit 787,000 by September 2016.

Unfortunately, there's no way to know if someone has filed a fraudulent tax return in your name. If the IRS contacts you about filing multiple returns, immediately contact the IRS Identity Protection Specialized Unit at 1-800-908-4490.

If you haven't filed yet, know that there are plenty of options for free filing. For instance, the IRS provides free filing services for folks whose income is less than $64,000 a year. It's a program called Free File.

You don't have to buy or download any software. You just file through the IRS' website. And the site protects your personal information. Free File even allows you to track your refund status or pay your taxes electronically. Visit the site to learn more. And if you earn more than $64,000, you can still download the federal forms and file them online for free. You do have to do the taxes yourself, however, and the math can get tricky. But it's a good option if you have that background.

If you'd rather have in-person help, the IRS also offers assistance through the Volunteer Income Tax Assistance program. If you earn $54,000 a year or less or are disabled, you can get free help from its tax preparers. In addition, the Tax Counseling for the Elderly program also offers free tax help for people 60 and older. It specializes in pensions and retirement questions. Check here to find the closest locations for both services.

And don't forget, veterans get benefits too. In addition to the Volunteer Income Tax Assistance Program, active-duty servicemen and women can use programs like TaxSlayer Military or TurboTax Military Edition. There's also MilTax, which offers free tax software for military service members and their families. You can find all of these programs right here.

If you make more than these income limits or do not qualify for any of these programs, I suggest using a software program like TurboTax.

If you already have all of your forms and receipts, it should take three hours or less to do your return. Give it a shot for about 15 minutes to see if it's right for you. One thing to note – it is conservative... So it doesn't play fast and loose with tax laws. That's how you avoid making mistakes.

If your income situation is complex, an accountant might be better. But on the other hand, I have found many errors over the years in friends' tax returns done by accountants. So make sure you go to a reputable accountant and get a price quote up front.

Whatever you do, don't put it off any longer. Get those taxes filed and start enjoying the rest of your year worry-free.

[optin_form id="73"]

- More insight into free help for military members.

- Here's why Tax Day isn't on April 15 this year...

- NerdWallet ranks the best tax software on the market.

- Something different: Can we grow a heart out of spinach leaves?

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Retirement Millionaire Daily Research Team

April 3, 2017