You've worked hard your whole life. You've saved and invested and now you're ready to retire on a nice nest egg. You've always wanted to live by the beach, so you pack up and move to a great seaside town a few states away.

But imagine that you trip on the stairs down to the beach and break your hip. Suddenly, instead of sipping Mai Tais and relaxing in the sand, you're facing months in a nursing-home recovery unit... And Medicare stops paying while you're still there. The high-price home siphons off most of your hard-earned retirement savings.

One small accident ruins your retirement paradise.

Unfortunately, this reality hits more retirees than you might think.

According to the U.S. Department of Health and Human Services ("HHS"), about 70% of Americans turning 65 today will need at least some sort of long-term care in the future. And about a third of folks will need nursing care.

Remember, Medicare won't cover the costs of long-term care or assisted-living facilities. So pay attention to things like the average cost of nursing-home rooms, in-home nursing services, and assisted-living care. Knowing roughly what you'd pay in your city and state will help you better form your financial plan.

And according to HHS, those who will have out-of-pocket payments will face an average of about $140,000 in costs. What's more, Medicare stops paying for rehab services (which you would need after an event like a fractured hip or a stroke) after 100 days... But the clock starts from your first day at the hospital. And after the initial 20 days of that 100-day period, you're responsible for a daily copayment.

With more folks turning 65 every day, we're facing a boom in long-term care needs.

Now, when you're planning on where to live in retirement, the last thing you want to think about is spending it cooped up in a nursing home or rehab center. But this reality is one we must all face.

That's why you want to consider such costs when you plan your retirement move. And we've made it easy for you to do so...

Recently, my team and I released a new 55-page special report – "Dr. David Eifrig's Best States for Your Retirement." We looked at several separate factors you should consider when choosing the best place to spend your retirement.

One of those factors: Health Care Costs.

About 69% of folks 65 and older will develop a disability before they die, according to the Urban Institute policy-research group. And 35% of folks will need to enter a nursing home.

We looked at the average monthly cost per state for five data points:

- Home health aide

- Adult day-care services

- Assisted living

- Nursing-home room (semi-private)

- Nursing-home room (private)

The data came from the Genworth 2021 Cost of Care Survey, a leading insurance firm.

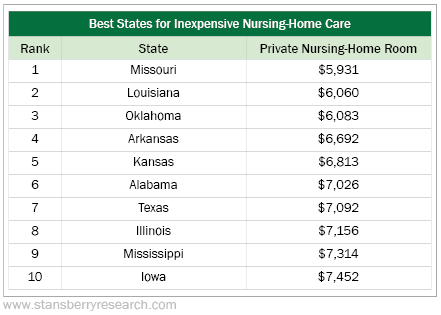

Right now, the national average for a private nursing-home room monthly cost is $9,034. So we're sharing the 10 states that scored the best for cost of care, including the average monthly cost of a private nursing-home room. (We included all the above costs while creating our ranking, but we found this number to be a simple and useful way to compare.)

Of course, this is just a fraction of the data we looked at when determining the best states for retirement.

You can see the full list with all 50 states in our report and find our top ten best states for retirement. You'll also see our data for housing costs, livability, crime, taxes, and more. It's the most comprehensive state-by-state retirement report out there. We want to empower you with this information to make the best decision to secure your dream home in retirement.

If you're already a Retirement Millionaire subscriber, you can access the new report right here. And if not, you can purchase your own copy of "Dr. David Eifrig's Best States for Retirement" here.

What We're Reading...

- Genworth's cost comparison tool.

- Something different: Peloton partners with Amazon as it struggles to regain investor confidence.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

August 25, 2022