I remember a real stock crash...

It was the worst day in Wall Street history.

The Dow Jones Industrial Average plunged 508 points on October 19, 1987. In percentage terms, stocks dropped 22% in one day. That's crazy. And when things get that crazy, clients panic...

During the 1987 "Black Monday" stock crash, I was working on the trading desk for Goldman Sachs.

For days, we worked, ate, and slept at the office... and helped our clients move assets around. It was a true global panic. There was no time to go home, so we simply "copied" our outfits and wore the same clothes from the day before. We called it "Xeroxing."

It was a nerve-racking experience, but it taught me one simple lesson: When extreme fear hits the market, it creates incredible opportunities.

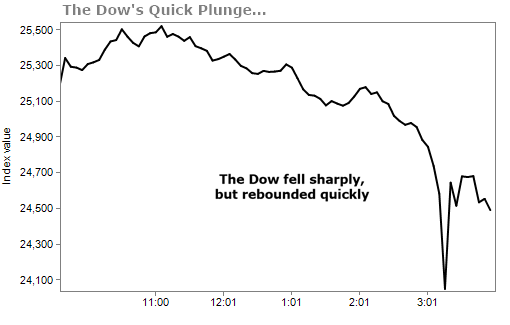

At its lowest point on Monday, the Dow lost nearly 1,600 points. It ended the day down nearly 1,200 points, about 4.6%. And Wall Street's "fear gauge" – the CBOE Volatility Index (or "VIX") – soared by more than 100%.

So while this crash isn't anywhere close to Black Monday, it's clear that there is real fear underlying the bull market. And lots of investors are wondering if we're headed for a correction – that is, a market drop of 10%-20%.

We might be... (In fact, I predicted as much during our Stansberry Portfolio Solutions webinar in late January.)

But the good news is that most corrections are insignificant. They're about as damaging to your portfolio as a cold is to your long-term health. You'll get over it... and pretty quickly.

If you set aside major events like the dot-com bust and the 2008-2009 financial crisis... over the last 12 corrections of 10% or greater, it typically only takes about five months to earn back losses.

Some of those markets bounce back in as little as 32 days, like they did in 1997 or 1999.

As long as a correction doesn't have a recession attached to it, the average decline is only about 19.4% according to numbers compiled by Ben Carlson of Ritholtz Wealth Management. And if you limit that to the modern era – 1970 onward – the average drops to 17.5%.

Additionally, after these drops, the market tended to return 79.4% over the next five years.

But what about those true bear markets... the most traumatic market upheavals of the last 70-plus years? The big declines get paired with recessions...

And right now, we don't see any signs that a recession is looming. The American consumer is stronger than he's ever been. GDP is growing at around a healthy 3% with more room to run.

The lesson here is simple... Ride out the recession-free declines in the markets like the bumps in the road that they are.

We are getting more cautious... And we do expect a correction to come sooner rather than later. But what we saw on Monday wasn't that correction.

You can see how quickly the Dow fell late in the day, but within minutes recovered much of those quick losses. Since Monday, the Dow is up around 25,000 again.

One of the problems with these kind of fast moves is that they can kick you out of a trade too early. Remember the "flash crash" in May 2010? In 36 minutes, the stock market fell 10%. The market had mostly rebounded by the end of the day.

In an unusual situation like that, you wouldn't want to have an automated stop set with your broker.

We've seen this sort of thing in the flash crashes we've had in the past few years. Don't show your cards to anyone but yourself.

Instead, you can use price alerts from your broker to send you an e-mail or phone message once prices get close to your sell or buy levels. This is a safer way to maximize your profits and limit your losses because your shares aren't automatically sold. That means you can decide when you sell.

And of course, you can also use our corporate affiliate TradeStops – a service that allows users to track their stops. Click here to learn more about TradeStops.

[optin_form id="73"]

- Something different: Team USA's Olympic clothing has gone hi-tech.

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

Baltimore, Maryland

February 7, 2018