For decades, we went on a credit binge...

While many of our parents taught us values like "only buy things that you can afford," low-interest-rate loans and credit cards make it too easy for folks to "buy now, pay later."

Unfortunately, over the past few decades, the U.S. has adopted a buy-now-pay-later mentality. And as you may know, taking on debt is a slippery slope.

You can quickly find yourself in over your head and in serious trouble. We've all heard the horror stories. Perhaps you've been a part of one yourself.

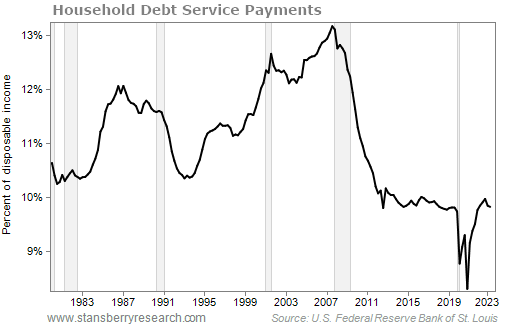

The chart below looks at the percentage of disposable income a household spends on debt. Household debt include the combined debt of all people in a household, such as mortgage loans and credit cards. Disposable income is the amount of money that a household has to spend or save after income taxes have been deducted.

Looking over the past 43 years, you can see that most years, folks have spent more of their disposable income on debt. That percentage only fell during recessions (the gray bars) and the years following them.

That credit binge was getting out of hand. You can see that the ratio rose to more than 13% right before the housing bust in 2007. Of course, the financial crisis devasted many families all throughout the country. Then the pandemic hit, and again, household finances were hit hard.

During the pandemic, folks were spending less and saving more. Net household liabilities as a percentage of disposable income had finally come down to reasonable levels.

It was refreshing to see Americans finally getting their debt levels in check.

The only problem? It didn't last long.

Americans have a love affair with their credit cards and low-interest-rate loans. Since the economy has reopened, it has prompted many to get out of their houses and spend. They went on vacation again and bought homes and cars while interest rates were low.

Now, as we've written recently, lots of folks are depending on their credit cards to pay for essentials like food, gas, and utilities.

And now, since it's already November, a lot of folks have Christmas spending on their mind.

The Conference Board Holiday Spending Survey found that folks will spend nearly $1,000 this year on holiday items, with more than $600 of that being spent on gifts. And Americans are estimated to spend $61 billion (or $708 per person on average) over the Thanksgiving holiday weekend.

Everyone deserves time with their loved ones to celebrate the holidays. But I worry folks are falling back into the habits of running up their credit cards on gifts and travel. That's why one of the best ways to avoid overspending is to avoid the cards and stick to cash.

We know most folks prefer to pay for everything electronically these days. But that makes it easy to overspend. If you're in that boat, I recommend a little trick called the envelope system. Here's how it works...

First, plan out a budget and decide how much you want to spend on each person or group of people. Next, grab enough envelopes for each group. Label each one with the name and the dollar amount. Then, put the cash you'll use for shopping into each envelope.

When you do your holiday shopping, only use the predetermined amount of cash from your envelope to pay. If you get to the checkout counter and don't have enough money, you put something back. This part is the key... This means you're practicing the discipline of sticking to your budget.

The envelope system works for more than just your holiday shopping. It also works well if you want to budget for things like throwing a dinner party, taking a special vacation, or simply saving more month to month.

Unlike using a credit card, you'll never pay interest when using cash. And if you must use a card to complete a purchase – if you're buying something online, for example – sticking to the envelope system means you already have the cash to pay off your card purchase right away.

An easy way to help you stay on track with your budget when using a credit card is to add another envelope that represents the money you've spent on the credit card. Move the money from your predetermined cash envelopes into this credit-card envelope. Then take the spent money to the bank right away, deposit it into your checking account, and pay off your card before the bank gets a chance to charge you any interest.

How are you planning to save on your holiday spending? Let us know your tips and tricks... [email protected].

What We're Reading...

- Something different: Disneyland's opening day was a 'Black Sunday.'

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

November 16, 2023