Even if they didn't smoke, the prisoners should have held onto those cigarettes...

It was 1942. The British soldiers had been captured in Libya, then shipped off to an Italian transit camp as prisoners of war (POWs).

When the POWs received their first weekly Red Cross food parcels, they immediately began swapping items. Everyone wanted to trade some of their rations for someone else's... but no one had established their true value.

For example, if a soldier didn't smoke, he was happy to give up his cigarettes for a bit more food. And the Sikh prisoners – whose faith promotes vegetarian diets – were eager to accept anything in exchange for their tins of beef.

Before long, though, each soldier had a better idea of what everything in his Red Cross parcel was worth. One of the prisoners, R.A. Radford – who studied economics before enlisting in the British Army – described the dynamic in his 1945 paper, "The Economic Organisation of a P.O.W. Camp."

Within a week or two, trade grew, rough scales of exchange values came into existence...

It was realized that a tin of jam was worth one-half pound of margarine plus something else; that a cigarette issue was worth several chocolate issues, and a tin of diced carrots was worth practically nothing.

By the time Radford settled into a permanent POW camp in Germany, the values were so firmly established that the prisoners posted signs announcing each item's going rate. Cigarettes were the currency.

A stable, predictable market ensures that each participant gets a fair deal. But savvy investors see their biggest gains in times of chaos. Radford cites this example...

Stories circulated of a padre who started off round the camp with a tin of cheese and five cigarettes and returned to his bed with a complete parcel in addition to his original cheese and cigarettes.

It's one of the deepest truths about markets... Uncertainty leads to disagreement, and disagreement leads to varied prices. If you know what you're looking for, that gives you an opportunity to make outsized gains.

That's what the priest exploited in the POW camp. And if you are looking for uncertainty, look no further than the world today...

Investors don't know what's going to happen with the coronavirus. They don't know what's going to happen with the economy. And they don't know what the government will do about it.

In response, investors are clamoring to buy one particular thing right now. And you can make a lot of money selling it to them...

I'm talking about portfolio protection.

Selling portfolio protection can be profitable in any market, but in the fog of a pandemic, the opportunities are greater. Just like the first days in a POW camp, we can see that current prices aren't where they are supposed to be... and that means there's a tremendous opportunity to make money.

Specifically, I'm talking about selling put options.

Let me be clear: This strategy is not taking advantage of anyone. We are going to give them exactly what they want... and at the price they want. And we will end up richer because of it.

Let me show you how...

At any time, there are hundreds of thousands of options available to sell. With such a vast market, you can always find a deal somewhere.

And with the markets in such a strange state, many option buyers are in a frenzy, leading to a surge in prices. That allows option sellers to earn more income or secure even bigger downside protection.

You can think about options in a lot of different ways. I find it particularly helpful to think about them as insurance or portfolio protection.

When you buy home insurance, you are paying for protection against loss of value to your home. If your home is destroyed by a fire, its value goes to zero. And your insurance company will make you whole.

In exchange, the insurance customer pays money each and every year. Most years, the house doesn't burn down. Most likely, it never will.

The customer is happy to pay for peace of mind, and the insurance company is happy to earn healthy profits.

But how much does the insurance cost each year?

Well, that depends on the likelihood of a fire...

If you have a home in a safe area, it may cost $500 per year. If there's an arsonist school nearby, maybe rates will double to $1,000. And if you build it near the base of an active volcano, maybe the rate jumps to $5,000.

In this example, the price rose because risk increased. The insurance company is raising its rates to protect its bottom line. And the customer is willing to pay more because he wants additional protection against a potential disaster.

Well, today, investors want extra protection in the stock market.

Between the coronavirus, the looming election, protests in the streets, and the economy in recession, people want insurance against stocks falling... and they will pay for it.

That's leading to a surge in income for option sellers.

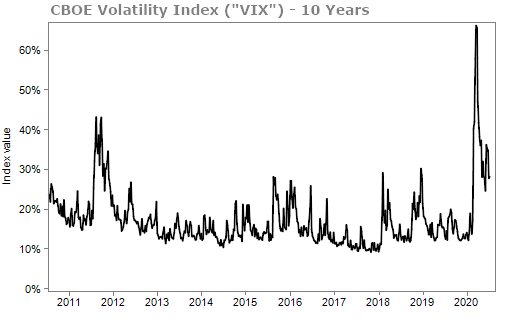

There's an index that essentially measures the price of this insurance. It's called the CBOE Volatility Index ("VIX"). The VIX takes the price of options and works backward to see how volatile option buyers think stocks will be in the future (what's called "implied volatility").

In other words, it's looking at insurance prices and figuring out whether customers are currently scared of a volcano.

For the last 10 years, the VIX – or the expected volatility of the market – was roughly 15%, sometimes getting as low as 9%. During the worst of the coronavirus, expected volatility surged to more than 80%.

But even today, with markets appearing more stable, it still hovers around 25%. That's nearly twice the level it sat at for most of the last decade.

So just how much more can we make?

Let's say you wanted to sell insurance on a stock like Berkshire Hathaway (BRK-B). Berkshire is a big, sturdy company led by one of the greatest investors of all time. It's a stock that should be a staple in any serious portfolio.

Even though Berkshire is a stock most of us would love to own at today's prices (it's down 16% since February), there are still nervous investors who want to buy insurance in the event that Berkshire falls more.

In a normal market, like what it was a year ago, an option seller could make $555 by selling Berkshire insurance. Not bad.

But today, because of the fear in the market, the price of that insurance has shot up to $1,050.

So that's an 89% increase for a nearly identical put option... The only thing that has changed is the level of fear in the market.

This window of uncertainty and fear is not going to last forever. But I believe that it will remain at least until the presidential election... and perhaps much longer than that.

You can make a small fortune by selling options over the next few months. I truly believe there has never been a better time to learn how to do so...

I've recently put together a presentation that goes into detail about the strategy I've been talking about today. You have the chance to make hundreds, even thousands in extra income per month using it.

Click here for all of the details.

What We're Reading...

- Wealthy Americans have less doubt about market rally, economy, but still fear stock investing.

- Risks are mounting for U.S. stocks. Here's where BlackRock says investors should look instead.

- Something different: St. Louis couple charged for pointing guns at protesters.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

July 22, 2020