People have been talking about the death of oil for years... and so far, they've been dead wrong.

Despite advances in alternative energy sources, we still need oil. It heats our homes, it's used to make products like plastics and solvents, and, perhaps most importantly, it fuels our cars.

Of course, electric cars are the future. I'm not here to argue that. They emit fewer greenhouse gases and air pollutants than petrol or diesel cars. Perhaps most importantly, governments around the world are pushing for this switch.

But the truth is that electric vehicles won't replace gas-guzzlers for a long time.

So for all the Tesla (TSLA) bulls that have predicted Teslas would dominate highways around the country... it hasn't happened yet.

The number varies, but the U.S. vehicle fleet turns over about 7% per year. That means it would take about 15 years to replace all the vehicles on the road today. So even if every car owner swapped out his or her gas-burner for an electric model, we've got at least that long.

And electric cars are nowhere close to 100% of new cars sold. Currently, they account for only about 2%. At that rate, it would take about 700 years to replace all gasoline vehicles.

Electric vehicles' market share will increase, of course. One set of projections puts electric vehicle sales at about 50% of the market by 2040. But even at a 50% market share, it would take 30 years to get us off oil. And that's just the usage from passenger cars sold in the U.S.

So for now, we need oil.

And something that I think you should consider today is betting on the price of oil to rise in the months to come.

Right now, demand looks likely to outrun supply... and should lead to higher prices.

If you remember, oil production got rocked during the pandemic shutdown when prices dropped below $40 – and oil futures even briefly went negative.

While we now know the economy bounced back from the pandemic quickly, there was a time when it looked like we were facing a massive global recession. Oil drillers reacted by shutting down everything they could.

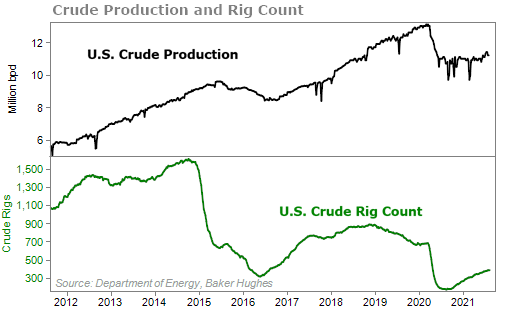

And they've barely started up again... Crude rig counts – the number of drilling rigs in operation – have started to rise, but they have a long way to go to get to pre-pandemic levels. So production is still down from where it was before the pandemic.

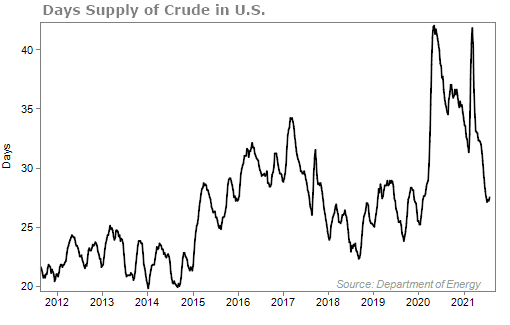

Taken together, inventory is short, and that matches with rising prices. If we stopped producing today, the country would only have 26 days of oil on hand.

With the economy reopening and folks getting out and traveling, demand for oil has made a comeback.

So, in short, simple economics tells us that when demand is greater than supply, it leads to higher prices. That's what we see for oil in the months and years ahead.

My outlook is that over the next two years, oil prices will average around $80 a barrel or even higher. Even though the price of oil has been up recently, that's still roughly a 15% increase from where prices are today. And that means there is money to be made by betting on certain oil stocks.

My team and I have identified one of the largest producers of oil that should see its stock rise significantly. If you are a subscriber to Retirement Millionaire, you can read my write-up and recommendation here.

I recently put together a presentation discussing what worries me about the markets and the four steps you can take today to protect yourself from future chaos.

Click here for all the details.

What We're Reading...

- Oil rises to six-week high as U.S. supply concerns dominate.

- Consumer prices post smaller-than-expected increase in August.

- Something different: World now sees twice as many days.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

September 14, 2021