We recently heard from a very nervous subscriber...

"What is happening with Invesco Value Municipal Trust (IIM)?" he wrote in an e-mail. "Doc Eifrig has been a proponent of this fund for several years. Since the first of November, the price has been rapidly sinking."

IIM is a fund that holds a portfolio of municipal bonds, an extremely safe income-generating investment. If you subscribe to our Retirement Millionaire or Income Intelligence advisory services, you'll recognize it immediately. It's been one of our favorite vehicles for safe, steady income.

And for the last few years, it's been a wildly successful investment, especially considering how safe it is. Earlier this month, the Wall Street Journal published a piece called, "Municipal Bonds Shine in Bleak Landscape." The paper noted...

Municipal bonds sold by U.S. state and local governments are returning about 2% this year, according to Barclays PLC data, beating corporate bonds and many other supposedly higher-performing asset classes.

It is the second year of near market-leading returns from a sector typically prized for its low, steady performance. Muni bonds last year posted a total return of 9%, which comprises price appreciation and interest payments, approaching the S&P 500's total return of 14%.

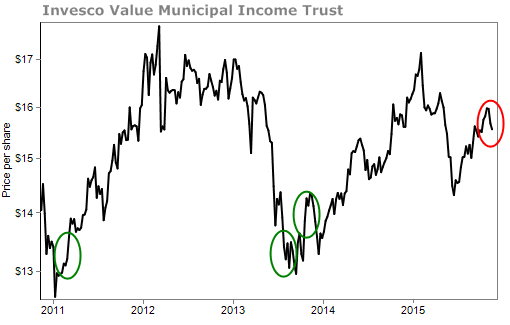

Take a look at how this fund has been performing. The green circles represent specific times I've recommended the fund to subscribers. The red circle represents the decline that our reader is worried about...

A quick look at this chart should tell you that this decline is nothing to be concerned about.

If you are worried about it, I've got a simple way for you to become a more successful investor. It's one asset every great investor has, and it's nothing you can buy on E-Trade. The asset is this: Reasonable expectations.

You determine what counts as "successful" for your investments. A lot of new investors need to set that bar at a level they can actually reach.

Many investors expect to earn untold riches in the market.

You need to make an honest assessment of what's possible. For instance, from 1926 to 2013, a portfolio that had 60% stocks and 40% bonds returned an average of 8.9% a year.

[optin_form id="73"]

If you are expecting to earn a rate much higher than that... like 50% a year... you've set your sights way too high. In some cases, this can be harmless. But high expectations can lead investors to save too little for their futures. Also, inflated expectations for returns can lead investors to take on too much risk.

Rather than grow their portfolios quickly, they blow them up.

Investors with high expectations also expect every stock they own to rise constantly. That simply doesn't happen.

First, you'll have nearly as many stocks go down as go up. Even top investors would be satisfied with a win rate of 55% or 60% – especially if the gains are bigger than the losses.

Second, even your best bets won't march straight upward.

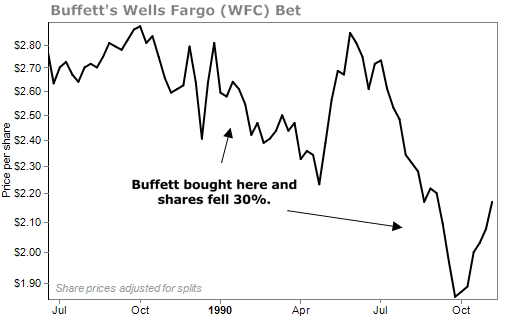

In 1989 and 1990, legendary investor Warren Buffett bought big stakes in Wells Fargo (WFC). Things did not work out well...

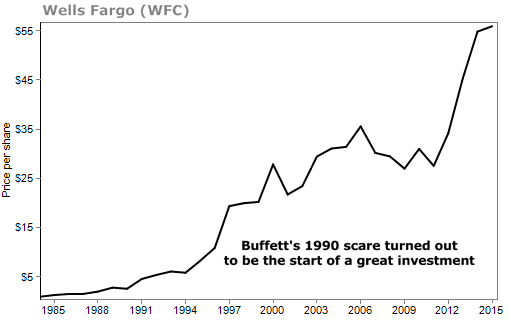

Rather than panic, Buffett held on. Now his shares of Wells Fargo are up about 4,000%.

Or, another example: that 60% stocks/40% bonds portfolio we mentioned lost money in 21 out of 88 years, or 23% of the time.

If you expect your investments to return 20% a year with no losers and no down years, you will never be a successful investor. Your definition of success cannot be achieved.

To become successful, you have to embrace the fact that investments go up and they most certainly go down.

With wise asset allocation and diversification – and an appreciation for the bumps in the road – you can earn returns that can lead to a comfortable retirement over time.

Your success starts with how you define it.