Back in August, everyone expected we were headed for a full-blown recession.

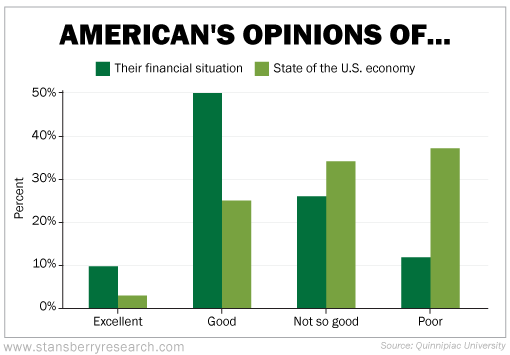

At the time, Quinnipiac University ran a poll asking how people felt about the state of our nation's economy... Not surprisingly, 71% of Americans described it as either "not so good" or "poor." And 51% thought the economy was getting worse.

Delving into the details reveals a more nuanced take...

The pessimism about the economy broke down along political lines, with 77% of Republicans saying the economy was worsening versus 20% of Democrats (even though the disparity in their own situations was quite small). So perhaps some of these attitudes are skewed by mistrust of the other party's president.

Moreover, when asked about their own financial situations, most Americans actually said they were doing well – 10% said they were "excellent," and 50% said things were "good."

In other words, while the news might make it seem like the U.S. economy is in dire straits, American households are in pretty OK shape.

And the market is now reacting to the strength of our economy and the fact that we may dodge a recession. We don't think extreme inflation is an immediate threat, and we didn't have a painful recession last year. Now, asset prices are rising.

Sometimes, you need to trust what's right in front of you...

If you're planning to put your money to work in the markets this year, Americans' household finances paint an encouraging economic picture.

But according to my colleague Eric Wade, the most powerful investment opportunity right now doesn't hinge on consumer sentiment, consumer spending, or even the overall economy.

Eric believes we're on the verge of a pivotal make-or-break moment for investors... and it could literally begin as early as this week.

If you're serious about jumping in early on an opportunity that could transform your financial future forever... then you'll want to watch Stansberry Research's first emergency briefing of the year.

If you missed it, click here to catch up on all the details.

Now, let's dig into some questions... As always, keep sending your comments, questions, and topic suggestions to [email protected]. My team and I really do read every e-mail.

Q: I recall reading something about what to do with gift cards you don't use. Can you share that again? I don't want to get scammed. Thanks. – G.K.

A: Here's how to cash in your unwanted gift cards...

Another gift-giving season has come and gone, and you may have received some gift cards you're not likely to use. Or maybe you have some with just a few dollars left. Don't write them off as a loss this year. You can sell them online for close to their dollar value.

Many websites provide this service. Our favorite is called CardCash... It will buy and sell your used gift cards through third-party gift-card-exchange organizations. We like CardCash because it offers up to 92% back on the value of your card, depending on the retailer. For example, we found an offer to pay $42.50 for a $50 Best Buy gift card (85% of the value).

You can choose to either get cash for your card or trade it in for another gift card that you'll actually use. CardCash also takes steps – like verifying your identity – to make sure no one gets scammed.

Q: Any tips to keep my car running this winter? A few times each winter, my battery dies. – B.E.

A: Wintry temperatures are tough on car batteries. The colder the air, the more life your battery loses. At 32 degrees Fahrenheit, a battery loses 35% of its life. Especially if your battery is more than a few years old, it's less likely to start your car when you finally need it to.

A few steps can help you avoid the unpleasant surprise of a dead battery...

First, get your car battery's life tested. For example, you can take your car to AutoZone, which offers free battery testing and charging. The whole process takes about 30 minutes. A battery test can tell you whether it's time to buy a new battery, and a recharge can even stretch some additional life out of your old battery – especially if you take mostly short trips.

Second, don't ditch your car forever. The best way to maintain your battery life is to drive it for at least 10 to 20 minutes a few times a week. This will give enough time for your engine to warm up and recharge the battery, get its battery acid moving (to maintain a charge), and help it withstand damage from the cold.

Lastly, you can keep a fully charged portable battery charger in your car in case you ever do get a dead battery. That's much easier than finding someone to give you a jump start. We recommended a Viking charger like this one a couple years back in our annual holiday gift guide.

What We're Reading...

- Did you miss it? Overcome this investing trap to start the new year.

- Something different: If you visit med spas... beware.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

January 5, 2024