Doc's note: Some of the biggest market gains throughout history are a result of using this buying mindset when there's investor fear. Now could be one of those times.

In today's essay, my colleague and DailyWealth editor Dr. Steve Sjuggerud explains how extreme pessimism in precious metals is creating a huge opportunity... even a chance at seeing triple-digit upside.

I've made my career on finding setups like we are seeing today...

It's a simple idea. When an asset falls further than people expect – for longer than people think is possible – they give up on it.

It becomes a "left for dead" asset. And investors want nothing to do with it.

That's when the greatest opportunities present themselves – as I've found many times before...

For example, I urged readers to buy stocks in March 2009, when nobody wanted to be in the markets.

Buying stocks at that moment of extreme pessimism was the right call... The stock market is up more than 300% since then.

The same story was true for real estate in 2011...

The market peaked a few years earlier and had fallen – fast. We reached the moment of extreme pessimism in housing. But in hindsight, that moment was a perfect opportunity to buy.

Recently, we had another extreme in pessimism... This time, it's in precious metals. And it could mean we have triple-digit upside ahead of us.

The story is the same as it always is... Precious metals have fallen further than people expected, over a longer period of time than they expected.

Silver is just one example of what we're seeing in the sector...

Silver hit $35 an ounce a few times in 2012. Today, as I write, it's under $15 an ounce. As you might guess, after such a big fall and so much time, investors have completely given up on silver.

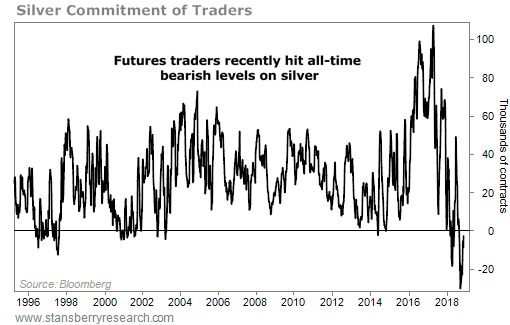

Futures traders are now the most bearish they've ever been on silver. That's why today's opportunity could mean triple-digit upside once this extreme reverses.

Here are the details...

If you're familiar with my work on sentiment indicators, you know we often look at the Commitment of Traders (COT) report.

It's a weekly report that tells us exactly what futures traders are doing with REAL money. It's not a survey... It doesn't focus on opinions, which can be biased or unreliable. These traders are putting actual money to work.

The simple story is that futures traders often get it wrong at extremes. When traders all bet in one direction, the opposite is likely to occur.

As I said before, futures traders recently hit their most bearish level on silver prices in history. Take a look...

You can see this moment of extreme pessimism. Futures traders are all betting on lower silver prices.

Sentiment has only been close to today's level a handful of times. We saw similar bearish levels in 1997, 2002, and 2014. Each sentiment extreme led to major rallies in silver...

Specifically, silver soared more than 70% from mid-1997 to early 1998. After hitting another negative sentiment reading in 2002, the metal soared more than 250% by 2008. And it rallied more than 30% after a similar case in late 2014.

Those are eye-opening returns.

The problem for me is the uptrend... We don't have one.

Hated markets like silver can still get more hated. You don't want to try to catch a falling knife.

It's not time to buy – yet. But I believe the time is coming soon.

Not only that, but we're starting from a point of extreme pessimism. That means triple-digit gains are possible in silver when the bull market in precious metals finally kicks in.

We are getting close. When the time comes, you want to take advantage of it.

Good investing,

Steve

P.S. Just the other week, I told DailyWealth readers one of the easiest ways to invest in gold. If you want to stay up-to-date on this trend, click here to start receiving DailyWealth – it's free!