There are two types of investors...

The first investor is one that gives into fear and tends to do what the "herd" does. The other investor is one who not only ignores the herd, but takes advantage of others' fears in order to gain profits.

We all like to think we're the second type of investor. But in reality, few of us are. Most investors fall into the first category.

Think about it... After the housing bubble burst in 2008 and 2009, were you willing to buy stocks? They were trading for a mere 12 times earnings in 2009 when the economy started showing signs of life.

My guess is that there were few folks who had the courage to buy. That would have certainly been going against the herd.

All the media could talk about was how our financial system was going to collapse (and, truthfully, it was close). So the majority of investors had no money invested. Most were too scared to do anything besides quiver under their sheets.

But for some brave investors, legendary investor Warren Buffett for example, took advantage of the massive opportunity of buying quality stocks at huge discounts. They were buyers during that time of fear.

For the smart investor, this led to life-altering returns.

Today, we're faced with a similar situation.

Although the markets have regained much of their losses since March, investor fear still reigns.

Coronavirus cases have been spiking in recent weeks. That's caused folks to worry about another economic shutdown... And another shutdown would truly be devastating for our economy. (Though for the record, I don't think that's likely.)

There's also fear of stocks. They're not the bargain they were back in March and April. If you look at valuation metrics like price to earnings or price to sales, stocks actually seem expensive at the moment. And this is at a time when millions of Americans are still struggling to get back to work.

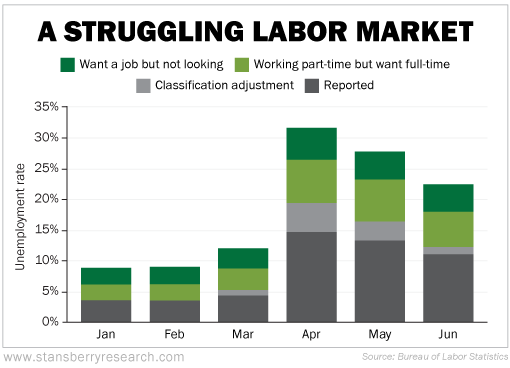

As you can see, the unemployment picture is not looking great...

So while the stock market is close to all-time highs, the economy is only just beginning its recovery. That's leading to a lot of nervous investors.

Piling onto the uncertainty and widespread fear, there are protests all throughout the country and a presidential election looming ahead in November. With our country so divided, the election is sure to bring a lot of emotions and rash behavior.

There's so much to be uncertain about today. And that uncertainty of the future means fear.

Today, fearful investors are buying portfolio protection.

They worry about everything that can go wrong over the next several months and they want to be protected. That's what the herd is doing.

But I'm here to tell you that's not what you should be doing.

Now is the time to find the courage to be the second type of investor. It's time to profit from other investors' fears.

Today, you should take the other side of their bet... You should be the one selling folks portfolio protection.

Fear lets your emotions get the best of you. You do things you wouldn't normally do... things that don't make much sense.

For example, because there are so many people buying portfolio protection, the surge in demand has caused prices on that protection to skyrocket. And investors are happy to pay these hefty prices.

Some investors are even buying protection or insurance on stocks that they'll likely never have to actually use. But it brings them peace of mind.

It's a wildly profitable strategy if you're the one selling them that insurance policy. The prices that investors are willing to pay today are much more than they were anytime over the past few years. And that leads to a once-in-a-decade income opportunity...

I'll give you an example.

Let's say you've long been bullish on housing. You own a few hundred shares of a popular housing fund like iShares U.S. Home Construction Fund (ITB). But you're like most investors today and you're nervous. You're fearful that we could see a second wave of the virus and that could crush the housing market.

So you decide to buy insurance on ITB, which allows you to sell your shares of ITB for a specified price in the event ITB crashes over the next few months. It will allow you to limit your losses if things take a turn for the worse.

The cost of that insurance policy was recently $625.

Now let's rewind a few months back to December 2019...

If you wanted to buy the exact same insurance policy on ITB with the exact same terms, it would have only cost you $115 in December.

That's a 443% increase in price.

And remember, these are the exact same terms... The only thing that has changed is that investors are terrified today. As a result, they're willing to pay much more today versus a few months ago.

Another example... fearful investors are paying nearly 200% more for protection on retail giant Target (TGT) today than they were back in July of last year.

And it's not just housing and retail... The list of examples can go on and on in nearly every sector of the market...

Fear was just at an extreme in the markets. And it's still historically high today.

In fact, fear levels haven't been this high since the financial crisis over a decade ago. Instead of talking about how you're the type of investor who profits from others' fear, now is the time to actually do it.

This opportunity of panic in the market won't last forever. And these windows only come around about once in a decade.

I've recently put together a presentation that goes into detail about the strategy I've been talking about today. Trust me, if there was ever a time to learn this strategy, it's today.

You have the chance to make hundreds, even thousands of extra incomes a month using it...

Click here for all of the details.

What We're Reading...

- Coronavirus fear factor may weigh on nation for years.

- Ending extra $600 in unemployment benefits will impact 20 million Americans, says government agency.

- Something different: Foreign students fret over being sent home after U.S. visa rule.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

July 8, 2020