Growth had its multiyear run... Now it's time for value.

As you know, once the dust settled from the financial crisis, growth was all the market cared about.

Interest rates were near zero. Companies were able to borrow on the cheap to chase sales growth. And it worked... Investors piled into growth names and didn't care much about profits.

But that changed at the end of 2021.

Since borrowing costs have moved higher with interest rates lately, spending has gotten more expensive. That's why every other day, we're hearing news about some technology company cutting jobs.

Alphabet (GOOGL) announced it was laying off about 12,000 employees. Salesforce (CRM) cut roughly 10% of its workforce, about 8,000 jobs. And social media company Snap (SNAP) laid off 20% of its employees last year.

According to Crunchbase News, more than 77,000 workers in U.S.-based tech companies have been laid off so far in 2023.

These companies overhired to pursue growth... When interest rates were low and markets rewarded rising sales, this was the right strategy to drive stock prices. Now, with interest rates at multiyear highs, these companies have to scale back.

The past couple years have taught us that growth does not go up in a straight line forever... and that we need sources of energy... transportation for our supply chain... commodity metals to get pulled out of the ground... and robust utility infrastructure to keep the lights on. We need companies that produce real things.

Of course, investors haven't cared about those kinds of stocks for nearly a decade now. They're too boring.

That has changed.

Growth is now out of favor. Value stocks are in.

Value stocks are defined as stocks with low valuation multiples compared to their historical averages or compared to a broader index. They're often known as companies with slow top-line growth but lots of profit.

Think of stocks like CVS Health (CVS) and Shell (SHEL).

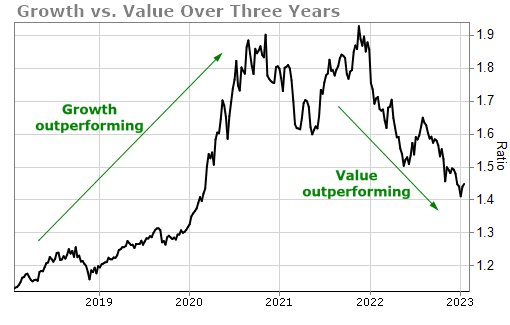

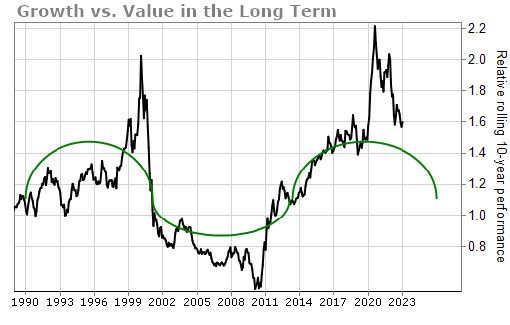

You can see the shift in the market's appetite in the two charts below...

The first chart tracks the ratio between growth and value stocks. While growth ran ahead in 2019 and 2020, value has started to creep back...

The second chart looks at a longer time horizon. If you compare the 10-year returns of value and growth, you see a bit of a cycle through history. And you also see we are dramatically low on the cycle right now...

Also, given the possibility of recession, investors will want to own value stocks because there is safety in cash flows.

We think value should continue to outperform growth... not only in the short run, but for many years to come.

Recently, our colleague Joel Litman teamed up with Chaikin Analytics founder Marc Chaikin to share their investment "playbook" for how to protect and grow your wealth today.

During the presentation, they shared all the details on how to navigate today's rocky market.

What We're Reading...

- Something different: Tesla board member says Elon Musk doesn't mind bankruptcy if a rival builds a better car.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

February 15, 2023