During my time trading for Goldman Sachs, I stumbled upon a strategy that would forever change my life.

This strategy has allowed me collect hundreds and thousands of dollars each and every month. And it has helped me make my mark after I joined Stansberry Research more than a decade ago.

Until recently, though, the masses didn't seem to pay it much attention.

That has been changing...

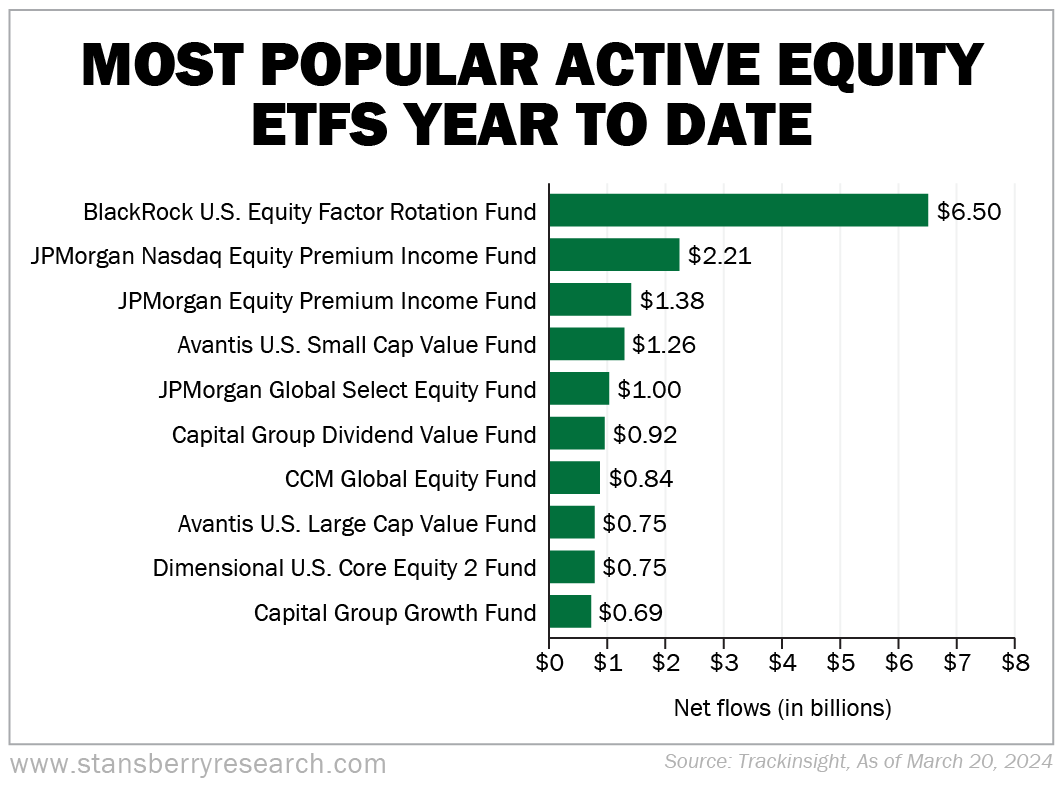

The chart below looks at the biggest net flows into active equity exchange-traded funds ("ETFs"). By far, folks have been piling into the BlackRock U.S. Equity Factor Rotation Fund (DYNF) the most. (We won't get into all the details today, but factor investing is a form of quantitative investing, which has been all the rage recently.)

What may surprise you is the second and third ETF on this list. Take a look...

The JPMorgan Nasdaq Equity Premium Income Fund (JEPQ) and the JPMorgan Equity Premium Income Fund (JEPI) are both covered-call funds. They buy stock and sell options to help generate income. Both funds boast yields much higher than a traditional Nasdaq or S&P 500 fund.

A decade and a half ago, it was hard to convince even my closest friends and family to sell options. As you may imagine, options get a bad reputation. But today, we're seeing billions of dollars dumped into these option-selling ETFs.

And it's not just JPMorgan's option-selling funds... According to a Financial Times article, ETFs dedicated to selling covered calls have surged from just $3 billion in total assets in 2020 to nearly $60 billion in December 2023.

Think about that... In just three years, investors have put nearly 20 times as much money into ETFs dedicated to one of my favorite strategies... selling covered calls. There are now 60 covered-call ETFs to choose from, triple the selection that folks had three years ago.

If you've been following me for long, you'll know that I launched my own option-selling service, Retirement Trader, in 2010. It was a hard sell at the time, even with my background in derivatives... But I was adamant that option selling was the ultimate tool for safe income.

Now, the rest of the investing world has caught on.

Even though all this money is flowing into option-selling funds, I don't think they can compete with what we do in Retirement Trader.

Consider the Invesco S&P 500 BuyWrite Fund (PBP), which has been around longer than most covered-call funds.

I wrote about PBP in 2013. Specifically, I said...

In particular, [PBP] tends to underperform the S&P 500 during rising stock markets. But it makes up for that by consistently outperforming the market during falling periods.

Without getting too into the weeds, this is to be expected for most covered-call trading. If stocks are soaring, a covered-call strategy will lag because your upside is capped in each trade... But because option sellers collect premium – and the premium payment gets larger when stocks fall – you can lose less in down markets.

Basically, the covered-call ETF strategy is to take the market's return and smooth its volatility. With that in mind, PBP lived up to that description...

In 2022, the S&P 500 fell nearly 20%. PBP was only down 11.7% for the year.

In 2023, stocks surged nearly 25%. PBP was also up, but only by 11.4%.

For PBP and most covered-call traders, these results are fine. They're expected.

In Retirement Trader, we're not doing the same thing as these covered-call funds... And we are certainly not satisfied just keeping up with PBP or any of the growing number of funds. After all, even if PBP fell by barely half the amount of the S&P 500, it still faced a double-digit decline.

You see, my Retirement Trader team and I are currently on a 211-position winning streak. We have not booked a loss since March 2020. And we have averaged double-digit annualized returns since our inception in 2010 on closed trades.

Here's how we're different... Unlike most of these funds, we don't just sell options on the S&P 500 or Nasdaq indexes. We handpick each option trade based on market conditions.

Our goal is to not only outperform in down markets, but to deliver positive returns and significantly outperform the market. And our goal in up markets is to, at the very least, keep pace.

We've done just that over the past few years... In 2022, when the market was crushed, we averaged annualized gains of 20.4% on our closed trades. In 2023, when markets were ripping higher, we kept pace and once again averaged about 20% annualized gains on closed trades.

We've certainly proven that our conservative trading-for-income strategy can work in nearly any market environment... And it does much better than any covered-call ETF you will find in the market.

If you have any interest in what I believe to be the best income-collecting strategy ever created, I suggest you learn to trade options for yourself rather than be disappointed in any of the funds available today.

Since my team and I are on a historic winning streak, we want to offer you one of our best deals ever to become a subscriber. You can learn more by clicking here.

(By the way, if you are hesitant to learn about options, I have created a Master Class that is designed to take anyone, regardless of experience, and turn them into an option pro in no time at all. Everything you need will be available to you when you become a subscriber.)

What We're Reading...

- Something different: Oracle met with Senate aides about TikTok data storage after ban passed the House.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

April 24, 2024