The bears are getting harder and harder to find...

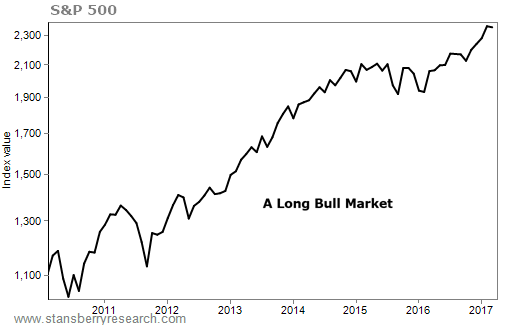

For the past seven years, we've been arguing that the economy has been slowly grinding higher... And we've been riding the bull market that grew out of it.

It's gone well...

But while we've enjoyed these steady gains, lots of investors simply left the market after the financial crisis. Many never came back.

A recent study from BlackRock shows that Baby Boomers hold 60% of their assets in cash and only 20% in stocks.

This is a massive mistake...

You'll face a long road to retirement if you're earning 0.1% in a bank account. After inflation, all that cash is worth even less today than it was in 2010.

On the other hand, those who simply bought an S&P 500 index fund have more than doubled their money.

And one key factor told us the market would keep rising – the lack of extreme optimism and speculation about the future of the market.

Even when stocks rose 50%... 100%... or 200% from their 2009 lows, we saw lots of pessimism and negativity in the markets. Investors were piling into super-safe bonds and driving interest rates to new lows. Financial-news network CNBC had one hedge-fund manager after another on camera nearly every day calling for a "crash."

But markets don't get too hot until the crowd works itself into a frenzy. For the entirety of this bull market, we haven't seen a frenzy. At most, we've seen a grudging acceptance that the economy was doing OK.

Now, the pessimism is fading.

But we haven't yet ventured into the area of irrational exuberance. Folks aren't borrowing money to buy stocks. Cocktail parties haven't turned into stock-tip swap meets. Those are the things we expect to see at a top.

But the bears are slowly starting to change their message. Money is moving from bonds to stocks. Growth estimates are climbing.

As the market rises, we're getting more skeptical that some of its moves can be sustained.

That doesn't mean we're calling for a crash. We're not... yet.

We're still bullish overall. Remember, market peaks lead to market peaks. When the market hit new highs last summer, we pointed out:

If you buy the market when it hits new highs and hold for a month, you have a 91% chance of seeing it go up from there.

If you hold for three months, the chance of a new high rises to 97%. If you buy at market highs, your typical one-year return would be a healthy 7.9%. (All these numbers are based on the S&P 500 from 1928 to 2015.)

The market is up almost 10% since then, hitting multiple new highs along the way.

Over the long term, we think that stocks will do just fine. But for the short term... the potential for a pullback is getting more and more likely.

That means it's more important than ever to make sure your portfolio is made up of what I call Sleep Well at Night ("SWAN") stocks.

I'm talking about opportunities that can pay you regular income – dividend stocks, master limited partnerships (MLPs), real estate investment trusts (REITs), utilities, preferred shares, corporate bonds and municipal bonds...

Again, these SWANs are investments that incredibly safe... but still produce way more income than you can get in a savings account, certificate of deposit, or Treasury bond.

The best part about these types of investments is that when you get the timing just right, you can find rare opportunities to "lock in" much higher yields than other, average investors.

That means that while other folks are making 3%... you could be making double or even triple that every year. More important, it's safe. If you know anything about investing, you know timing the market isn't easy to do on your own.

That's why I write Income Intelligence.

I know I'm biased... I think Income Intelligence is the best kept secret at Stansberry Research.

Every month, my lead analyst Matthew Weinschenk and I go through every single sector of the market that can pay you regular income.

We give you a "big picture" look at the entire income landscape, tell you which of these investment classes is the best buy with the most upside, and detail which specific sector has the safest yield.

In every issue, we show which types of income investments are currently a BUY... which ones we recommend you HOLD... and which ones to SELL immediately. You'll never have to wonder where to put your money again.

For the last several years, we've built an incredible track record of showing folks amazing ways to safely get more income than they're used to getting.

We rarely invite new folks to join, but consider this your personal invitation...

Right now, I've found a little-known way to not only stick it to Wall Street... but also to get paid THREE times more than regular stocks.

See, while Wall Street usually doesn't have your best interests at heart... they're great at making money for themselves.

One study looked at hedge funds between 1998 to 2010... In that time, hedge-fund investors gained some $70 billion. But the managers of those hedge funds pocketed almost $379 billion in fees.

In other words, hedge funds made more than five times more money for themselves than for the folks who entrusted them with their money.

The sad, cold reality is that most investors underperform the market. And you won't do better by trusting a money manager or a hedge fund to invest your money for you.

But what if there was a way you could partner with Wall Street... with a little-known strategy to get paid like a Wall Street insider... and get your share of these billions in earnings?

There is...

This Thursday, April 20, I'm releasing the details of an income investment that essentially allows you to become a partner in a Wall Street firm without having to work around the clock for years and years.

Its interests are aligned with yours. And by becoming a "partner" in this business, you're entitled to a share of the earnings. No matter how much you plan to invest, you'll start getting paid "Wall Street partnership fees" within a few weeks.

Better yet, you'll get the "good" investments that are inaccessible to most individual investors. Click here for the details... as well as how to get access for more than 50% off. (This link does not go to a long video.)

- Panera Bread's acquisition this month is simply the latest in the "incredible shrinking stock market" trend...

- Something different: How to make your own sausage.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Retirement Millionaire Daily Research Team

April 17, 2017