Today, more teenagers are owning stocks than ever before...

If you've struggled with what to get your nephew, your friend's children, or your grandchildren for their birthday or for a holiday, you're not alone.

Most of us buy toys or games. But they eventually get shoved aside by the kid and end up as clutter in their parent's house.

One gift you can give is a financial education. By opening a certain type of account, you can teach your young person about investing and the power of compounding wealth over time.

You can set them up for a lifetime of financial success with a custodial brokerage...

A custodial brokerage account is a brokerage account that you can set up on behalf of a minor, and it can be used to invest in stocks, bonds, cash, and more. The good news is a custodial account can be opened by anyone... parents, grandparents, siblings, aunts, or any other adult.

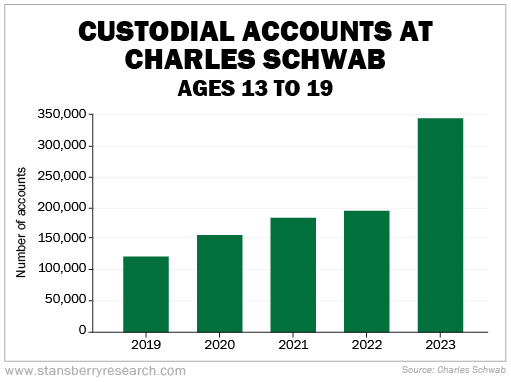

These accounts are becoming more popular.

Custodial accounts at broker Charles Schwab surged last year. Take a look...

Here's how they work...

When you deposit money into a custodial account, it's immediately considered the minor's asset. As the custodian, you can change the investments if you need to, but you can't take the money back... It's an irrevocable transfer.

However, the recipient cannot access the money until they reach the "age of majority." They'll have full control of the account when they reach a certain age, which is typically 18 or 21 depending on which state they live in. This includes both the principal and any investment returns.

When you open a custodial account, it creates what's called a fiduciary relationship between you – the custodian – and the minor. As the custodian, you can invest money on behalf of the beneficiary.

The goal would be to grow the account until the minor turns 18 or 21. Once the beneficiary takes control of the account, he or she can withdraw the money... or even better, continue to hold the stocks in the account and let them grow. (If you do your job teaching them, this is what they'll do.)

The most common types of custodial accounts are known as the Uniform Gifts to Minors Act ("UGMA") or the Uniform Transfer to Minors Act ("UTMA").

The major difference between UGMA and UTMA is that an UGMA is limited to purely financial products such as stocks, mutual funds, and bonds. On the other hand, an UTMA account can hold any form of property, including real property and real estate.

If you want to gift a rare painting, for example, you'd choose an UTMA account. But for the purposes of gifting a stock portfolio, UGMAs are the way to go.

They are simple to open, too. The process is similar to opening up a regular brokerage account...

In the application, you'd have to give personal information for both yourself and the minor. That includes name, physical address, contact information, citizenship, and Social Security number. Because you'll need the minor's Social Security number, you'll likely have to run this gift idea by the parents (probably a good idea anyway).

Setting up and funding an account should take you no more than an hour.

Many brokers have no minimum investment to open an account, or a very low one. And many do not have a maximum contribution limit.

The benefit of custodial brokerage accounts is that they allow you to invest money on behalf of a child without you having to hold legal ownership of those assets. This can be great for tax purposes.

Any investment income, such as dividends or earnings, generated from the account is considered the child's income. Therefore, it's taxed at the child's tax rate once the child reaches the age of majority and takes control of the account.

A custodial account is much more than just gifting money... It creates a bond between you and the recipient. Year after year, you two can track the progress of the portfolio. And the education the young person receives is priceless.

It's a shame they don't teach investing better in school... But you can help someone special in your life learn about investing if you decide to open a custodial account. Give your broker a call and see if opening an account is the right thing for you to do.

And, as we've said recently, even with markets hitting new highs, it's still a good time to invest.

According to my friend Marc Chaikin, a presidential election offers unique moneymaking opportunities (or money pits if you don't know what to invest in).

Last week, he shared all the details of this crucial market cycle and why millions of folks could lose money.

What We're Reading...

- Something different: JetBlue and Spirit end $3.8 billion merger agreement after losing antitrust suit.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

March 6, 2024