Editor's note: Today, we want to introduce you to Berna Barshay. Berna is a Harvard-educated, 25-year Wall Street veteran who worked for financial titans like Swiss Re, Sanford Bernstein, and Goldman Sachs. Nowadays, she shares her investing wisdom and advice with readers at our corporate affiliate Empire Financial Research.

And in today's issue of Health & Wealth Bulletin, Berna explains an investing superpower we all have, but most of us don't use, and how it can lead to great investments...

Practically everyone has a secret superpower when it comes to investing...

One valuable asset that every retail investor has when picking stocks is his or her own unique life experience.

It's the knowledge you accumulate through school, work, reading, meeting people, and traveling.

The legendary mutual fund manager Peter Lynch ran the Fidelity Magellan mutual fund from 1977 to 1990, returning a staggering 29% per year during his tenure – more than double the return of the benchmark S&P 500 Index during that period. When asked for advice on how to become a great investor, he responded with the now-famous phrase, "Invest in what you know."

Most of us know lots of things, so we just need to tap into that knowledge and channel it in ways that will generate great investment ideas.

The most obvious place you might get expertise is through your work...

As Lynch once said, "If you're in the steel industry and it ever turns around, you'll see it before I do."

Plenty of investors missed the recent sharp moves up in commodities. But you know who probably did see a tripling in lumber prices coming? People who work in forestry or for homebuilders that use a lot of lumber. I bet even the average sales associate at home-improvement retailer Home Depot (HD) had a decent head start in seeing the big move that was coming.

And it's not just with lumber or other commodities where an ear to the ground in professional circles could offer a heads-up on great investments...

People who work in retail know what brands are hot. Your average shoe salesman at Foot Locker (FL) can not only tell you whether Nike (NKE) or Adidas (ADS.DE) has better momentum at any given moment. He can also probably tell you how the pipeline of new products is looking for both companies.

Real estate brokers saw how tech companies Zillow (Z) and Redfin (RDFN) were changing their business, probably well before most of Wall Street woke up to the transformation.

Perhaps there's no bigger professional advantage in stock picking than being a research-oriented doctor or scientist. Understanding the prospects for U.S. Food and Drug Administration ("FDA") approval for a new drug is so crucial to biotech investing that most health care funds employ a crew of MD-PhDs.

But it isn't just your professional life that may offer clues to finding your next great investment...

You have opportunities to notice things all around you. For me, in New York, I'm in a great physical location to witness emerging fashion trends, and I love keeping up with what's in and what's out.

I remember around 20 years ago, I started seeing Puma (PUM.DE) sneakers everywhere in the city. Suddenly, the Puma Mostro, a Velcro-strapped low-profile sneaker, appeared to be the official shoe of anyone under 40 in SoHo. That observation led me to perform some diligence on the company, which turned into a multibagger investment.

Around the same time, I had an analyst who was in her early 20s and an engineer by training. She loved all things tech before it was cool to be a tech geek. One day, she insisted that we look at Apple (AAPL) because its recently released product – the iPod – would be a game changer.

At the time, I didn't have the vision she did... I didn't see that it was going to be the hit that it was, that digital music would supplant CDs, and that eventually the iPod would morph into the iPhone and change the world.

But my analyst was an early adopter of digital music and really believed in a future for it, as she sat in her office listening to that iPod all day long while working.

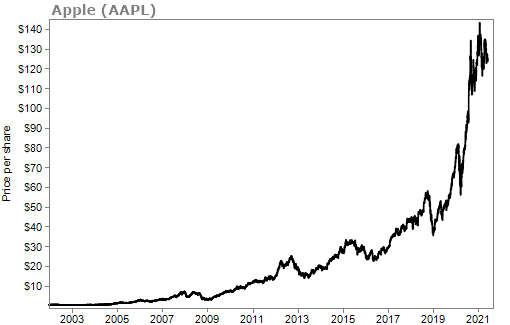

When she convinced me to buy AAPL shares in the fund, they were trading somewhere in the single digits. I can't remember the exact price... but a long-term chart of Apple tells me that on a split-adjusted basis, it would have been somewhere under $0.50 per share in today's prices.

My former analyst converted her passion for tech gadgets into an actionable investment idea – one that, if held, would have been one of the greatest trades in the history of investing...

Lynch encouraged aspiring investors to use specialized knowledge they already had to focus in on groups of stocks to research...

It's important to distinguish between what you know that everyone else also knows and what you know that's relatively rarified knowledge.

You can enjoy a Starbucks (SBUX) coffee every day, but not really know anything about retail businesses or commodity coffee prices. You don't have any edge in trading SBUX shares.

But if you grab that coffee every day on the way to go work at an auto dealer, I'm betting you might have some insights that I don't have about online car dealers like Carvana (CVNA) and Vroom (VRM).

Investing in what you know is about using your unique perspective to identify the idea. But after finding it, you still have to do the hard work.

Your professional career is probably the best place to find some investing inspiration. Think about the services your company uses... Are there new vendors you're ramping up spending with? Which input costs are rising or falling? Which customers are increasing their orders, and which seem to be in trouble and are cutting back?

If you do a 360-degree analysis of what you see in your professional life, you might occasionally have one of those great opportunities to invest in what you know.

And don't discount your experiences out in the world living your life either. There were a few years around the early '00s when I wore Pumas all weekend, because it was the "in" thing to do. Around the same time, my analyst seemed to be surgically connected to her iPod during all waking hours.

Those personal preferences helped us sniff out two great investments. Puma and Apple were great examples of "invest in what you know." I hope Mr. Lynch would approve.

Regards,

Berna Barshay

Editor's note: This Thursday, June 10, Berna will reveal how a "hidden" corner of the market could hand you a long string of double- and triple-digit gains. She'll also release critical details on three stocks you should consider buying immediately thanks to a powerful stock market situation that's unfolding right now.