If you want to know what a bubble looks like, it looks like Flooz or Beenz...

For those who may not remember, these were new, "online currencies" that attempted to become an alternative to credit cards for spending money on the Internet.

They weren't backed by a government or any underlying asset. Instead, they relied on high-profile ad campaigns... Flooz chose Whoopi Goldberg, while Beenz hired "reverse pickpockets" to slip promotional flyers into folks' pockets. Of course, anyone who held on to their Floozes or Beenz for long found out they were worthless...

Flooz.com even raised $35 million from investors, while Beenz raised nearly $100 million. That may not be a huge sum of money... But it's still a bad joke for those who invested. They didn't have any earnings or really even a product, just the hope that people would let them handle their transactions rather than use their credit cards.

The Internet boom that ended in 2000 offers a litany of stories like that. At the time, investors piled into anything with a ".com" at the end of the company name, with no regard for profits. Of course, many of these companies evaporated into bankruptcy.

That's what a bubble looks like.

At first glance, both the fascination with new online currencies and technology stocks might sound familiar to investors who have watched the recent headlines. One investment theme has dominated 2017...

Turn on CNBC and you're likely to see a story about Twitter's (TWTR) earnings, Snap's (SNAP) user growth, Facebook's (FB) controversial Russian ad connections, Apple's (AAPL) new headquarters, or the latest price action in the electronic cryptocurrency known as bitcoin.

Technology is the biggest topic in business and in our daily lives.

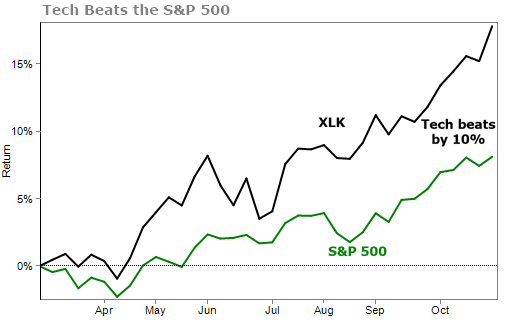

Of course, the performance of tech stocks reflects our fascination. For most of the year, they've outpaced the broader markets... as you can see in this chart that compares the recent performance of the Technology Select Sector SPDR Fund (XLK) with the benchmark S&P 500 Index...

And if you narrow your focus to the "FANG" stocks – Facebook, Amazon, Netflix (NFLX), and Google/Alphabet (GOOG) – the difference becomes greater...

Whenever something runs this fast and high, folks start breaking out the "B" word. So are these FANG stocks and other publicly traded technology companies in a bubble?

Not even close.

First, a bubble means that people are in such a buying frenzy that they have no regard for true value. Instead, their main goal is for prices to keep going up so that they can sell to another speculator down the road. (Think Dutch tulips in the 1630s, dot-com companies in 2000, or maybe bitcoin today – the verdict is still out.)

This tech rally is not that. Companies like Amazon and Google have real businesses, generating huge revenues. You can come up with cogent, reasoned explanations for why some of these tech companies could become some of the most valuable companies of all time.

Some have the potential to capture such monstrous market share that their upside is massive.

Amazon has its sights set on being the engine for all e-commerce and potentially in-store transactions as well. Oh, and it will serve up a major portion of the globe's computing power through its cloud-computing division.

Just think, Amazon originally started off selling books... Today, there's practically no limit to its potential. Just the other day, I ordered dental floss, cinnamon, and dried porcini mushrooms – delivered two days later, in time for the dinner party I was hosting (well, not the floss).

Facebook intends to capture hours of your attention each day. Google plans to index all the world's information and use it to tailor all sorts of services and advertising.

The scale these companies have already achieved make it extraordinarily hard for competition to step in. You can't build a better search engine without the mountains of data that only Google has. You can't spend enough to compete with Amazon's logistics.

If these companies reach their potential heights, their market caps will reach many multiples of where they are today.

Today's tech companies already have extraordinary profitability and real cash flows. That sets them aside from most companies in the dot-com boom.

Take Alphabet – the parent company of Google. The company boasts 22% profit margins, $25 billion in annual free cash flow, and it is growing revenue at 22% a year. To put that in perspective, the average company in the S&P 500 only has a profit margin of 9%. And only four companies in the S&P 500 have greater free cash flow – Apple, Microsoft (MSFT), Berkshire Hathaway (BRK-B), and JPMorgan Chase (JPM).

I don't know if we've ever seen a business like Alphabet that combines that sort of growth, scale, and profitability. It's historically one of a kind. Facebook's a close competitor, though. It has a profit margin of 38%, takes in $13 billion in free cash flow, and is growing revenues at 50% a year. Today's tech giants make real money.

It's clearer than ever that technology is our future... And investing in these ideas may pay off in a big way.

In my latest issue of Retirement Trader, out today, I explain what to do with your money even when stocks look expensive, like tech stocks do now. And I tell you how to instantly diversify your portfolio with just one stock.

If you're not already a Retirement Trader subscriber, click here to get started.

[optin_form id="73"]

What We're Reading...

- Read this throwback article from the beginning of the dot-com crash.

- Use the 'Warren Buffett Approach' to safely grow your wealth.

- Something different: Don't miss this weekend's supermoon.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Retirement Millionaire Daily Research Team

November 29, 2017