To say the housing market is in a full-blown bubble might be a bit of a stretch...

But there's no denying that home prices have gotten out of control.

Since the beginning of 2020, the median house price has soared more than 25%. Now, whether this is a good or bad thing is all a matter of perspective...

If you've happily owned the same house for more than a few years, you're probably thrilled that your asset has appreciated in value. After all, your net worth has increased without you having to do anything. You've benefited greatly.

On the other hand, if you've been searching for an affordable home lately, you're probably not having much luck. Competition is fierce, supply is low, and almost everything may be out of your budget.

Unfortunately, the latter scenario is one that millions of everyday Americans are currently struggling with. And the sad reality is, owning a home has become a pipe dream for many...

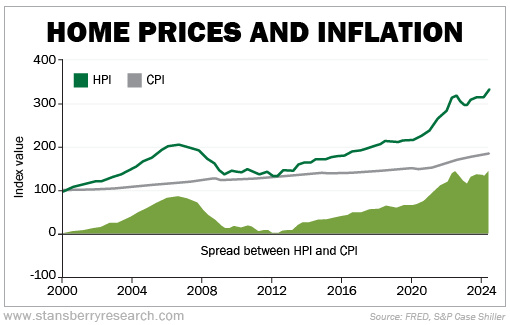

To see just how bad things have gotten, take a look at this chart below comparing the home price index ("HPI") with the consumer price index ("CPI"). Pay close attention to the bottom section, which shows the difference between the two metrics...

While overall inflation has greatly increased over the past few years, you can see that the cost to own a home has increased even more. And notably, the spread between the indexes is the widest it has been in more than two decades.

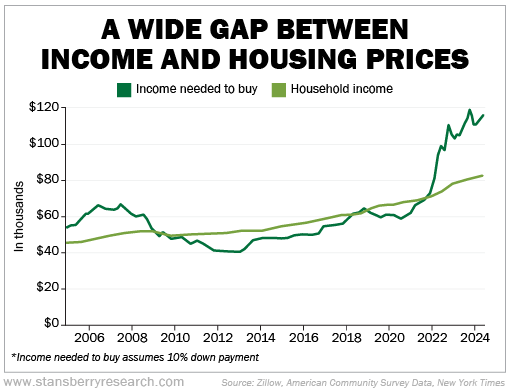

It's not just inflation, either. Home prices are far outpacing wage growth, too...

Now, if you're an aspiring homeowner, there's good news. Multiple macroeconomic factors are signaling a cooling of home prices in the short term...

First, mortgage rates are moving lower. Average rates have fallen from nearly 8% to around 6% today.

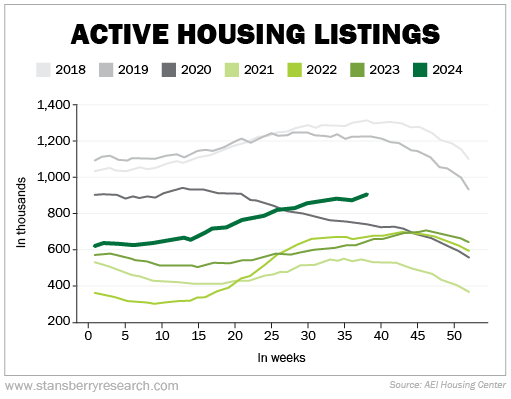

Many homeowners have basically been stuck with their current houses, as they don't want to give up their locked-in lower mortgage rates. As these rates trend lower, more homeowners will be willing to move. This means there will be a greater supply of homes hitting the market.

In fact, we're already starting to see supply increase. The chart below looks at the number of home listings by year. Clearly, inventory is in an uptrend...

When you want to forecast what home prices will do in response, just follow Economics 101: Look at supply and demand.

Prices were rising for the past few years because the supply of homes on the market was so low while demand was consistently high – thanks to a strong economy and labor market.

With more supply coming on line, house prices should fall.

Plus, if we see demand start to cool because of a softening economy, then home prices will fall even further. As we talked about last Wednesday, it's very possible that a recession is closer than you think.

Federal Reserve Chair Jerome Powell recently stated that more interest-rate cuts may be coming, though they won't be as aggressive as the recent half-percentage-point cut. Still, any rate cuts will be a boon for homebuyers.

We'll be keeping an eye on the housing market in the months to come. For the time being, everything is pointing to lower prices. And at the very least, we should finally see a breather in home-price growth for the first time in years.

What We're Reading...

- Something different: How fentanyl traffickers are exploiting a U.S. trade law to kill Americans.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

October 2, 2024