The "Bond God" loves to make predictions...

Jeffrey Gundlach, founder of the $120 billion-plus investment firm DoubleLine Capital, is one of Wall Street's biggest winners. Over the past 20 years, he has specialized in fixed-income investments... which earned him the nickname the "Bond God." (He got the name to distinguish him from the equally renowned "Bond King," Bill Gross.)

But what keeps his name in the press as much as anything are his regular predictions about the direction of stocks and interest rates.

Last week, he advised people to get out of a trade that he had recommended a month prior. The return totaled 22%. If you could do that every month, you'd earn 264% a year.

How could you earn that sort of return in bonds? Even the Bond God needed a little help.

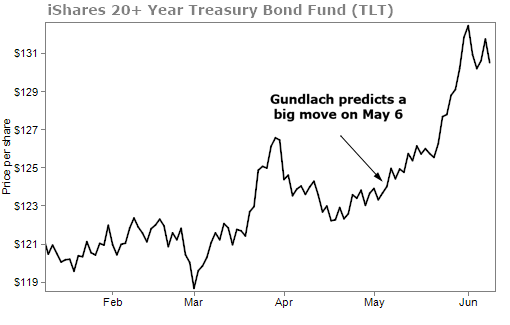

Back in May, Gundlach spoke at the Sohn Investment Conference in New York... an annual forum where well-known Wall Street investors to talk about their top ideas.

While Gundlach generally makes good predictions on interest rates (a major factor in the value of bonds), this time he admitted that he couldn't figure out which way they were going to go.

Gundlach knew that interest rates were set to explode – but he didn't know which direction.

"The problem is that policy fluidity suggests pretty much anything can happen almost without notice," he said, referring to the fuzzy nature of the Federal Reserve's current outlook.

The trick here is that smart investors have a way to make such a bet. While most individual investors have to get the direction of investments – either up or down – correct... Those with more tools can do more.

Gundlach recommended an option strategy called a "straddle." He placed a small bet that the iShares 20+ Year Treasury Bond Fund (TLT) would fall. And he placed another small bet that the same fund would rise. If the fund made a big enough move, the winning bet would pay for the losing bet and then some.

Interest rates did go wild. They headed straight down (and therefore the price of the bonds went up).

Gundlach took to Twitter to announce he thought anyone listening to him should close the trade, calling the one-month 22% return a "rare instant gratification."

That kind of trade is fun... and options let him do it. Most investors must take what the market gives them. They buy a stock and hope it goes up 10%. It's better than a savings account, I suppose, but it's still quite passive.

Smarter options strategies allow you to tailor trades to however you think the market (or individual stocks) may move. You can take the same fund or stock that everyone else sees and turn it into whatever kind of investment you want. Do you want to bet on a fast gain? Or a slow-but-steady climb? Would you like a high-risk/high-reward scenario? Or would you prefer to earn low-risk returns? Do you want to profit if the market declines... or goes nowhere for six months?

And for an option trader, 22% in a month doesn't sound all that surprising. We've been using similar strategies to make returns of 60% in 21 days, 71% in 25 days, 77% in 14 days, and more. Those are real gains we've delivered to readers in the last six months.

This is all to say that finance is a rich subject area, and there is always something to learn. Most folks who heard of Gundlach's idea didn't put the trade on, to be sure. They didn't quite understand the option strategy or didn't have the right account. That's a shame. If you come across a good moneymaking idea in the market, you should have the tools to take advantage.

That's why we've recently expanded our options education and research coverage. Now, we're hosting a special education session on Wednesday, June 19, at 8 p.m. Eastern time to prove that anyone can use these tools. We'll teach a small class of amateur investors how to perform these trades right before your eyes.

You're invited to join, follow along, and learn what options can do for you.

Just click here to RSVP to my special event.

Q: You recommend never investing more than 4-5% of your portfolio in a single stock or bond position. Understood. What about the percentage maximum of a portfolio to invest in a diversified muni bond fund that hold hundreds of different issues of bonds, say IIM for example? My question would be regarding a retiree seeking the tax free income that munis offer. – M.C.

A: In investments like mutual funds, sector exchange-traded funds (ETFs), and muni

funds, you can put 10%-12% of your portfolio into that choice. That's because the funds hold enough securities to be instantly diversified. But don't forget to follow your stop loss.

Q: To what degree have virtual colonoscopies replaced the more invasive traditional procedure? – B.H.

A: We received several great questions about colonoscopies, including some about the newer "take-home" options out there.

Stool-based tests require you to provide a stool sample, which you can do at home. These tests include the fecal immunochemical test (FIT) and the guaiac-based fecal occult blood test (gFOBT). These two tests look for blood in your stool that could come from a polyp growth or other cancer cells. Folks need to take these tests every year. There's also a DNA-based test that requires stool collection at home called MT-sDNA and a newer option called Cologuard. These tests have higher sensitivity and only need to be done every three years. However, there's some concern over a higher false-positive rate.

Compare that with the traditional colonoscopy that looks at the whole colon or a sigmoidoscopy that looks at just the lower colon. These procedures require unpleasant preparation drinks and an actual surgical procedure to insert a camera into your body. That brings risks (though rare) for perforation and problems with anesthesia. So it might be worth it to try the at-home test first if it's a good option for you.

Despite the easier process of these take-home options, not many folks have made the switch. According to the National Cancer Institute, from 2000 to 2015, 60% of Americans received a traditional screening. But only 2.7% did a blood test at home.

At-home tests – with the blood or DNA tests– hold a lot of promise for folks who have an average risk. That means people with higher risk – like those with inflammatory bowel disease or a family history of colon cancer – would still need the traditional screening.

Talk to your doctor to see if you're eligible for a take-home version... And call your insurance company. Most should cover the cost, but not all of them do. In fact, I'm planning on looking into this myself. Look for a future essay about my experience and what I'd recommend.

Q: I am interested in your options trading strategy, but I will be traveling from July 17 through the 22nd and unable to join your Master Class in real time. If I register, would I be able to view it when I return home, the 23rd or 24th? – M.H.

A: We've heard from many readers who won't be able to watch my Master Class next Wednesday night. We will have a replay of the class available. Keep an eye out in next week's Health & Wealth Bulletin, and we'll tell you how to watch.

Keep sending your questions, comments, and criticisms to [email protected]. We read every e-mail.

What We're Reading...

- Did you miss it? The biggest mistake traders make.

- Something different: An oldie but a goodie... How to vanish.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

June 14, 2019