The education of new investors often follows a similar path...

New investors get interested in the stock market. They think it's just a matter of time before they find some small, unheard-of company that will grow 100 times over, making them rich.

Before long, the investor realizes that investing in small companies is harder than it looks.

Yes, occasionally a tiny stock blossoms into a big winner.

But if you don't have a strategy for choosing the right small companies, it won't be enough to offset all the other duds.

Eventually, investors usually learn that the "easy way" to succeed in investing is to buy established quality companies and hold them for extended periods.

This method of investing is near and dear to me. In my Retirement Millionaire flagship letter, we focus mostly on blue-chip dividend-payers... well-known brand names... and funds with plenty of liquidity.

We love their safety and ability to compound wealth over time. We were among the first to talk about this trend years ago... We built our portfolio around them.

Recommending these large companies and funds are the best way that I can serve my 100,000 subscribers. It's how we ensure that everyone can buy in at a good price.

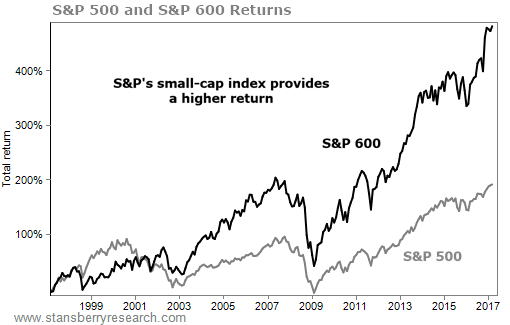

And yet... small-cap stocks consistently outperform large caps over time.

[optin_form id="73"]

It makes sense that small and growing companies can be spectacular investments. It's much easier for a company with $10 million in sales to grow sales and profits than it is for a large company that already dominates its market.

When you compare the returns of the S&P 500 (which is all large caps) with the returns of the S&P 600 (a collection of 600 small-cap stocks), you can see that small caps often outperform...

Over the long term, the performance is even more amazing.

If your father (or grandfather, for our younger readers) invested $10 in 1926... it would be worth about $50,000 today if he put it in large caps. But that's just a fraction of what you'd have if he had put the ten dollars into small caps – more than $2 million!

That's according to data from two University of Chicago economists (one of whom won a Nobel Prize).

This long-term outperformance of smaller companies is well known by big investors...

In fact, legendary investor and Berkshire Hathaway CEO Warren Buffett has bemoaned that he simply has too much money to make the kind of 50%-plus returns he enjoyed when he got his start investing less than $1 million.

This type of "going small" strategy is a huge advantage that you have as an individual investor... if you're willing to do the work.

It's not easy to find small companies with strong growth prospects. You have to uncover their niche... research the management... study the debt structure... weigh competition risks... and identify whether their growth is sustainable.

The simple solution is to invest in a lot of small companies. This diversifies your risk.

For example, in my Retirement Millionaire letter, I recommended buying shares of the iShares Core S&P Small-Cap Fund (NYSE: IJR) in 2014. Since then, we're up 33%... handily beating the 20% gain in the S&P 500 stock index.

Given our focus at Retirement Millionaire on established companies, I'll bet that you don't have enough exposure to small caps in your portfolio. So buying IJR today is a low-cost, one-click way of owning hundreds of small- and mid-cap companies. It's a great way to boost returns over the long term compared with large, blue-chip firms.

Of course, there's a more powerful way of discovering and investing in the "go small" opportunity...

On Wednesday night, Porter unveiled a way to improve your potential returns even more by investing in hand-picked, small companies with massive growth potential. It's a strategy he's calling the "10x Project."

The sort of returns that you can potentially see by investing in small companies can dwarf the returns from index funds and large-cap stocks.

That doesn't mean you should buy into something wildly uneconomic and risky... like action-camera maker GoPro (GPRO) or social-blather site Twitter (TWTR). That's not what the 10x Project is about.

Instead, Porter's research shows how you can make safe double-digit gains, year after year, by focusing on the same industries and types of businesses that he recommends in Stansberry's Investment Advisory and that I focus on in Retirement Millionaire... with one very important adjustment.

Click here for the details behind this adjustment... what Porter calls the "D-Factor."

What We're Reading (and Watching)...

- If you subscribe to HBO, the documentary Becoming Warren Buffett recently premiered. Worth watching!

- Something different: These 80-year-old athletes are inspiring.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Retirement Millionaire Daily Research Team

February 15, 2017