There is nothing more devastating than watching your portfolio get slashed in value.

If you've been around long enough to hold stocks through the dot-com bust and the housing bust, you know the pain I'm talking about.

Folks who are new to investing got a taste of that pain the past couple weeks...

The S&P 500 Index is down about 15% from its recent peak. And it's possible we will enter bear market territory – classically defined as a 20% decline – in the following weeks.

If you've been following the headlines, you've likely been overwhelmed. Of course, there is the coronavirus, which is spreading to more and more countries... And now there is an oil price war to be concerned about.

Over the weekend, Saudi Arabia slashed its crude prices and signaled it would boost output next month. This was sparked because Russia rejected a Saudi-backed plan by the Organization of the Petroleum Exporting Countries ("OPEC") to cut crude output in response to falling demand in China and other countries.

On Monday, the Dow logged its biggest point drop in history, falling over 2,000 points. And then yesterday, the Dow was all over the place... It was up about 1,000 points at one point in the morning before turning negative around noon. It finished the day 25,018.16

While you may have seen other analysts and folks in the media make bold claims about what will happen next in the market... I've been brutally honest with my subscribers.

The truth is, I don't know what will happen tomorrow... or even the next day. The coronavirus is unpredictable... The public's reaction to the virus is unpredictable... And the market's reaction to that reaction is unpredictable.

I'd be doing you a disservice to make a big market call and put your money at risk because of it. It's nearly impossible to know what headlines will pop up in the next week or two.

With that said, do I think this is the start of a once-in-a-decade crash like the dot-com bust or the housing bust?

No.

Given how strong the consumer is currently, we're not likely to see a big 40% or 50% market collapse over the next few months. The economy could eventually take a turn for the worse... But as of now, we're still seeing signs of strength.

My advice is simple, and it's been the same for months now...

Hold plenty of cash. Own quality businesses. Own gold as a chaos hedge. Be conservative with your money... but stay in the game.

Now is the time to keep your money safe and only act if you have a favorable risk and reward setup.

If you do want in on the action and want to trade in this market, I urge you to be careful. You should use small position sizes. And diversification is key.

This is what we like to call a trader's market because of the violent price swings. Bloomberg recently reported on how Wall Street can make a killing...

The historic panic in global stock markets has spawned a fortune for some of the world's biggest investment banks.

JPMorgan Chase & Co. and Citigroup Inc. have added about $500 million in revenue from equity derivatives trading year-to-date compared with the same period in 2019, people familiar with the matter said. Trading surged as investors rushed to bet on stock moves and protect their holdings.

After all this shakes out, there will be stories written about some trading hero who doubled his or her stake after making a big bet today. Think about stories like The Big Short by making bets against the housing.

One way to achieve incredible results from a highly volatile market – like the one we're seeing – is by using options. If you buy options, you can make a very small bet that could pay off 5-to-1, 10-to-1, or even more.

For example, if you bought a put option on Friday that bet against energy, you would have tripled your money... in just one trading day.

A single trade could make up for much of the losses you experience in your investing account.

That's why many professional money managers use options as a hedge against their portfolios. It can offset some of the risk from their stock holdings by buying a few put options. If the market turns, their puts become highly valuable.

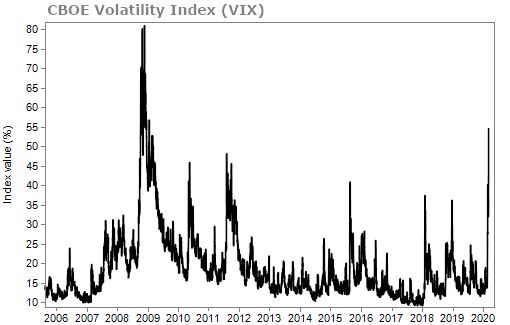

I'll be the first to admit that buying options is a difficult game to win. The win rate is low... But it is a strategy that can make you a small fortune in a volatile market. And there's no doubt we're seeing volatility and fear in the market right now...

If you are interested in trading today's unpredictable market or want to learn about ways to protect yourself from a down market, Stansberry Research is hosting an urgent briefing this Monday at 8 p.m. Eastern time.

One of our very own, Bill McGilton, editor of Stansberry's Big Trade, will show folks how to potentially make a fortune with just a few small bets. Bill will even give away the names of three stocks to target immediately with this strategy, for 500% to 1,000% potential gains.

Click here to reserve your spot.

What We're Reading...

• Oil could plunge another 43% as price war breaks out between global powers.

• Dow sinks 2,000 points in worst day since 2008, S&P 500 drops more than 7%.

• Something different: Trump's coronavirus stimulus is still evolving.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

March 11, 2020