Michael Hutchings bought at the wrong time... Now, he keeps a shotgun in the bedroom closet and a handgun in the kitchen cabinet.

While the entire country suffered during the 2008 mortgage meltdown, few communities saw a bigger blowup than Las Vegas.

It was there that Hutchings – a homebuilder – decided to construct his own dream home in 2006, complete with a guesthouse and swimming pool.

Of course, the bubble popped. As of 2016, when Hutchings told his story to the New York Times, he still owed $800,000 on the house he built in the upper-middle class Sunrise Mountain neighborhood about 10 miles from the Vegas Strip... He couldn't sell it for enough to pay that off. Plus, he had poured another $580,000 into it already.

But of course, his home wasn't the only one to fall in value. The entire neighborhood collapsed. Now, he hears gunshots and sees stray dogs roaming around.

He keeps the guns for protection from anyone out there more desperate than he is.

Buying at the top can destroy your financial world.

The trouble with the housing market is that it's such a single outsized bet... And many people buy a home without realizing the full range of potential financial outcomes. When you want to get out... sometimes you simply can't.

The stock market is the same way. It can hurt. And by the time you "give up" and try to sell, it's often too late. In fact, if you get out at the wrong time, you can still get burned.

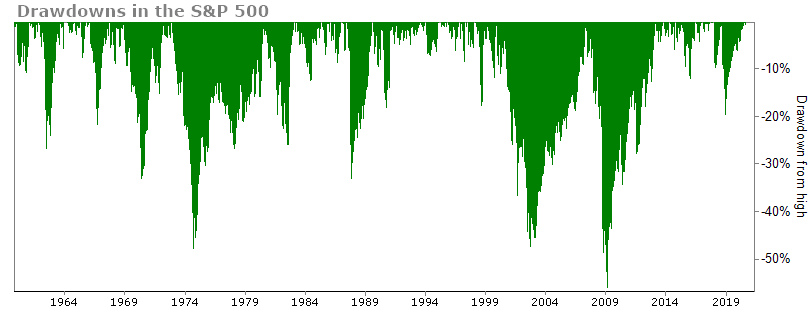

This chart shows the drawdowns in the S&P 500 from its peaks.

If you were "all in" on stocks in late 2008, you saw your wealth plummet by nearly 60%.

And here's the worst part... If you're holding too much in stocks after the crash comes, you can't do much except stay the course and wait for the market to rise. We know that stocks are a wonderful tool for creating wealth. If you sell when they're down, you lose your wealth and you don't have an easy way to get it back.

So even if you were emotionally strong enough to do the right thing and stand your ground in the face of a full-fledged beating from the bear market, it would have taken you nearly five years just to just get back to Square One.

That's the biggest fear of every investor. It can feel like we are at the mercy of the market. Most of the time, it's our friend. But when it turns its back on you, it can seem like there's nothing to do but bear down and ride it out.

But while many investors think this way, it's not true at all...

We are fortunate enough to have a robust financial system that offers all sorts of tools and products that help protect your downside. And many of those – like annuities or structured notes – do work. But usually, the greater benefits go to the banks and insurance companies that sell them and charge fees for putting them together.

Intelligent investors know there are several ways to shore up their accounts against potential bear markets, crashes, and collapses.

Now, it's not a free lunch. Usually the cost comes in the form of giving up some potential upside. But if you can keep yourself clear of a half-decade of wealth-reducing worry, you owe it to yourself to learn a few tricks.

I call one strategy I use the "Eifrig Guardrail Trade."

It has two steps...

After determining how much you want to invest in the strategy, you put the bulk of your capital – around 80% – into a completely safe interest-bearing cash account.

You take the remainder – around 20% of your capital – and buy long-dated call options on quality stocks.

If the entire market collapses, you have a huge pile of safe, guaranteed, sleep-well-at-night cash in your mattress. That's a comfort to any investor.

At the same time, if the market keeps roaring and the "Melt Up" continues, your call options will rise in price.

That strategy makes perfect sense to a lot of investors.

It's not without some downside. If the market meanders along and posts a smallish gain, you may end up a little behind. Your call options will lose time value, and you'll trail the market.

That's what happened after I first created the Guardrail Portfolio in August 2017. Two of the stocks in it didn't do well, and those options posted losses. Over the next year, the portfolio earned 6% (plus about 1% interest on your cash) compared with the market's 16.5% gain.

Even so, a 6% to 7% return on a portfolio that was 82% cash isn't bad.

However, that's not the whole story... Far from it.

If you will, for a moment, recall your mental state last December. The market had just endured the worst crash in recent memory. You may not recall now... but to many investors, it felt like "The Big One" was upon us. The market has rallied back, but there was no guarantee it would do so at the time.

At that market bottom – Christmas Eve 2018 – the S&P 500 Index was off 17.6% from its level in August when we started this Guardrail Portfolio.

In that same period, our Guardrail Portfolio was down just 10%.

In other words, we have bettered the market... while keeping 80% of our money in cash and cutting our worst drawdown almost in half.

That's nearly magical.

A year from now, you may be at a cocktail party. One guy there will have been scared out of the market. One guy will have held all the way through.

Today, we don't know which one of them will have been right. But when they turn to you and ask, "What did you do? Did you play it safe or go for big gains?" you'll be able to say...

"I did both."

In my Retirement Trader newsletter, I showed readers exactly how to build their own Guardrail Portfolio on a selection of stocks. You can still apply that formula to the market today.

Click here to learn more about Retirement Trader and take the first step toward building your Guardrail Portfolio.

What We're Reading...

- Something different: Here are some cool ways to celebrate the Apollo 11 moon landing's 50th anniversary.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

July 17, 2019