How long can humans live?

A new study published in the leading journal Nature claims that we have a "maximum limit" on our life span...

Researchers analyzed data from around the world and found that survival declined after age 100. Then, using these demographic data, they pinned 115 years as the natural limit of human aging. As they point out, no one has beaten the record the world's longest living person since the 1990s. You may remember the oldest person on record, Jeanne Calment, who celebrated her 122nd birthday in 1997.

Of course, this isn't the first time scientists have made a prediction that humans can't live longer than a certain age...

In 1928, a researcher used U.S. life-table data to predict that humans around the world could only live up to 64.75 years... At the time, U.S. life expectancy was about 57 years. But he didn't realize that this upper limit had already been surpassed – in New Zealand, women already had a life expectancy of about 66 years of age.

Then in 1990... another researcher asserted that life expectancy should not exceed an additional 35 years after turning 50 – capping maximum age at 85. This level was surpassed by Japanese females in 1996.

In fact, according to a research article in Science magazine, the typical maximum life expectancy prediction has been broken, on average, five years after publication.

Today, the fastest-growing segment of the population in developing countries are folks aged 85 or older, according to the National Institutes of Health. Experts project this segment to grow more than 350% between 2010 and 2050.

According to the National Institute on Aging, the number of people who make it past the age of 100 will keep increasing. It expects this number to rise by more than 1,000% from today through 2050.

That's because of advancements in science. Take Valter Longo, a University of Southern California professor of gerontology (the study of the elderly). He has already upped the life spans of yeast and mice. He has increased their lives to the equivalent of 800 and 150 years, respectively, for humans.

As medical advancements continue, that number could grow even more... even faster. Already, life expectancy is increasing by an average of three months every single year.

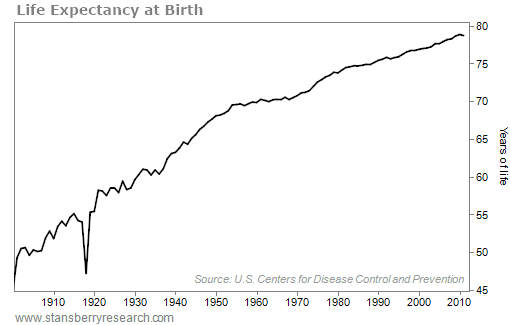

So as you can see in the chart below, every four years, people get another year. (The big drop occurred during the 1918 Flu Pandemic.)

It's clear that improvements in the field of medicine already help us live longer, healthier lives than in decades past. That makes it more important to preserve your nest egg... and make sure we're prepared to make it to 100... 120... or longer.

A longer life means you may need your money to last 40-50 years in retirement, not just 20 more.

And in my newsletter, Retirement Millionaire, I covered a way to guarantee that your nest egg will generate income for the rest of your life – no matter how long you live...

This is a tricky investment to understand at first, and the industry is plagued with high-fee, opaque investments... But once you understand the concept, you can be completely insulated against a decline in the market.

I'm talking about annuities.

Annuities are a financial contract between you and an insurance company. In the simplest terms, you pay a large amount up front, then the company pays you back over the following years... either for a fixed number of years or until you die.

When used properly, annuities provide stable income and remarkable peace of mind.

Annuity structures vary in so many aspects that people find them difficult to understand. Many have poor designs and high fees. And annuity sellers often use aggressive sales tactics because they want a commission.

But when used correctly, annuities are a powerful tool to help ensure a secure, comfortable retirement.

The idea of an annuity is to start off retirement with a piece of your nest egg invested in a guaranteed stream of income.

For example, a 60-year-old man can spend $200,000 today and, in return, receive $900 to $950 a month for life. That becomes a total of almost $290,000 in payments by the age of 85. The longer you live, the bigger the return on your investment principal.

Now, this can get more complex based on how much of a payout you want and over what length of time. In the above example, the 60-year-old man chose what's called a "single premium immediate annuity."

But there are many other variations available...

- You could set an annuity to pay for a certain number of years, rather than base it on your anticipated life span.

- You can buy one today but not start collecting income until decades into the future (called a deferred annuity).

- You can earn a guaranteed return or allow it to fluctuate in the market.

- You can avoid paying taxes on your investments.

By selecting, combining, and adjusting these factors (and more), you can tailor the right annuity to your situation.

Current Retirement Millionaire subscribers should read my full September issue on annuities right here, titled Can You Afford a 200th Birthday?.

We also discussed this issue on our monthly podcast, Retirement Millionaire Uncut. Every month in Uncut, I – along with staff, friends, and business contacts – talk about what's going on in the markets... expand on the ideas we've been writing about... and share some important updates and insights with you.

This feature is available only to lifetime members – folks who want to make sure they receive all of our income and retirement advice for a lifetime.

Lifetime members also receive quarterly recommendations from my options-trading newsletter, Retirement Trader. And, of course, you'll have lifetime access to my flagship newsletter, Retirement Millionaire. Click here to learn more about the benefits of lifetime membership.

What We're Reading...

- Behavioral economist Richard Thaler, author of Nudge and Misbehaving, has found that buyers of annuities are assured more annual income for the rest of their lives versus people who self-manage their portfolios... so why don't more people buy them?

- Something different: Bumblebees can get buzzed on sugar.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Retirement Millionaire Daily Research Team

October 17, 2016