Doc's note: Today, I'm sharing an essay from TradeStops founder Dr. Richard Smith. In it, he shares a powerful tool that can take all of the emotions out of investing and help you sleep well at night...

For more advice to help you sleep well, don't miss this Wednesday's Bull vs. Bear Summit. If you want to hear the investing story nobody else is telling – and receive all of the information you need to make an informed decision on what you should be doing in your portfolio right now – make sure to tune in at 8 p.m. Eastern time.

Click here to reserve your spot.

Buying stocks is easy.

Stock screeners, news reports, and great newsletters like True Wealth and Stansberry's Investment Advisory provide endless sources of stimulating ideas. As investors, we're drawn to stocks that have great stories. We spend vast amounts of time, energy, and effort figuring out the best stocks to buy.

But selling? Selling our stocks is hard. Really hard. How can you know when it's the right time to get out of a position? Unfortunately, for most people, it boils down to guesswork. For instance, have you ever...

- Put too much money into a stock you were excited about it, only to have it move against you, leaving you stuck?

- Tried to salvage a losing investment by doubling down on a stock?

- Told yourself that you'll wait for the stock to get back to even before selling?

- Ended up riding what should have been a small loss and turning it into a big loss that damaged your portfolio, or even wiped you out?

Sound familiar? It should. It has happened to everyone who wanted to become a successful investor. It happened to me when I began investing during the tail end of the dot-com bubble.

It happens to seasoned investors, too. Take Bill Ackman, for instance. To call Ackman a "seasoned" investor is an understatement. The man is a legend... Yet even he isn't immune from the mistakes we all make.

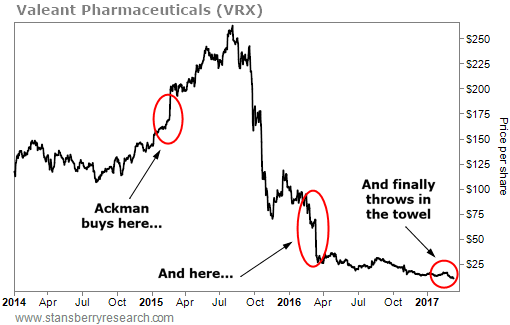

It's a good bet you know the story of Ackman's epic fail with the controversial Valeant Pharmaceuticals. But this chart still shocks me every time I see it...

Ackman made almost every mistake in the book. Buy too much of a stock you're excited about? Check. Desperately try to salvage the position by buying more? Check. Refuse to cut losses, riding the stock all the way to the bottom? Check.

I created TradeStops to help investors avoid just that kind of nightmare scenario. After years of intensive research, I've developed a set of tools that any investor can use to pinpoint exactly the right time to sell their stocks AND to know exactly how much to invest... so you can be invested while still being able to sleep easy at night.

What I discovered is that each stock has its own unique volatility profile that can be quantified – think of it as a stock's volatility DNA. I call this the Volatility Quotient ("VQ"). This tool can help you know when to sell, as well as help you decide how much money you can comfortably invest.

Because more conservative stocks are more stable in the movement of their share prices, they tend to have lower VQs. Higher VQ percentages indicate that a stock is prone to higher levels of volatility.

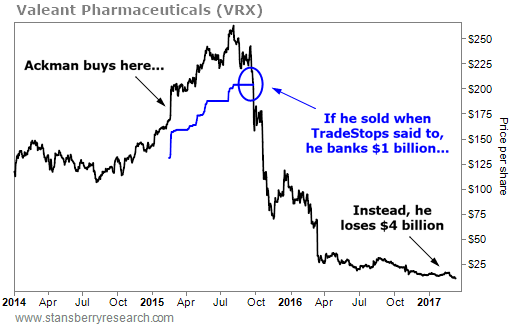

When Ackman first acquired his 5% stake in Valeant, the stock's VQ was 22.4%. Shares peaked at about $262 in August 2015. Had Ackman been using TradeStops, he would have known to sell when VRX fell 22.4% from its high of $262. He would have pocketed a $1 billion gain instead of losing billions of dollars of his investors' money...

The VQ helps you know exactly when to sell your stocks. It tells you how much room you should give each stock to either prove itself worthy of your hard-earned investing capital or to signal that it's time to move on to greener pastures.

Finally, I want to show you how the VQ can tell you exactly how much money to invest. The idea is simple. I call it "equal-risk investing." (Hedge funds call it "risk parity.")

Here's how it works: Let's say you're willing to risk $1,000 on each of your investments. Does that mean you always invest $1,000? No. It means that if you turn out to be wrong (or too early) about this investment, the most you're willing to lose is $1,000.

Make sense? If a stock is low-risk and has a VQ of 10%, then how much can you invest if you're willing to risk $1,000? You can invest $10,000. (If your $10,000 investment falls 10%, then you'll be down $1,000.) On the other hand, if you have a high-risk stock with a VQ of 50% and you're willing to risk $1,000 on this investment idea, you can invest $2,000. (If your $2,000 investment falls 50%, you're down $1,000.)

Can you see how powerful this is? The VQ helps you invest more money into your conservative investments and just the right amount of money into your more aggressive and speculative investments so you can still sleep at night.

This is the single most powerful way to boost the performance of individual investors I've ever seen.

Regards,

Dr. Richard Smith

Editor's note: Richard's TradeStops software has helped tens of thousands of individual investors successfully navigate the markets for years. This Wednesday, February 13, at 8 p.m. Eastern time, Richard will host our first ever Bull vs. Bear Summit.

Richard is joining a panel of experts for our event. You'll likely recognize their names from CNBC... Barron's... and the Wall Street Journal. And they've agreed to sit down together and publicly share what you should be doing with your money right now.